A comprehensive guide to quickly cashing your check in the absence of proper identification

While many banks typically demand an ID for check cashing, there exist simple methods to access your funds if your ID is misplaced or unavailable. Options include utilizing your bank’s mobile application, an ATM, or endorsing the check to a trusted individual. Continue reading to discover techniques for cashing a check without an ID and the types of identification most banks accept. Additionally, we will provide guidance on depositing your check if you lack a bank account!

Key Points to Remember

- Utilize your bank’s mobile app or an ATM within your bank’s network to deposit the check without an ID. Alternatively, consider using the mobile app of a prepaid debit card or endorsing the check to a trusted person for cashing.

- If you are unbanked, visit the issuing bank with your ID and the check. Alternatively, cash the check at retailers like Walmart.

Step-by-Step Guide

Methods to Cash a Check without an ID

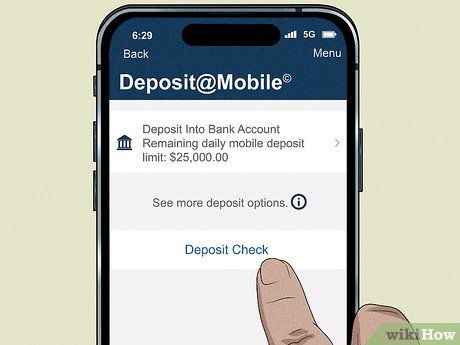

Utilize your bank’s mobile app to deposit the check. If you hold a bank account, most banks offer a mobile app enabling check deposits without requiring an ID. Simply download your bank’s app, sign in with your account details, and proceed to deposit the check. Remember to endorse the back and capture images of both sides of the check.

- Adhere to your bank’s endorsement guidelines, which may include adding your bank account number or other specifications.

- Alternatively, cash the check online via your bank’s website.

Cash the check using your bank’s ATM. Many ATMs facilitate check deposits without requiring an ID for account holders. Visit an ATM within your bank’s network, insert your debit card, enter your PIN, select “Deposit,” insert the check, and verify the amount.

- Funds from your check are typically accessible within 2 days.

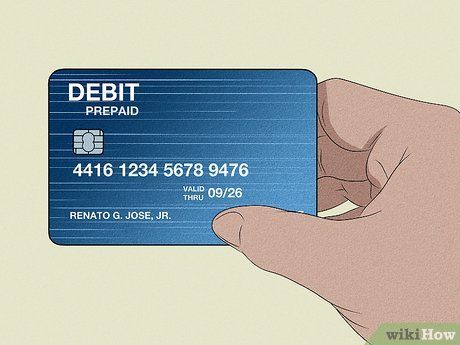

Employ a prepaid debit card to cash the check. Most prepaid debit cards, such as Visa Prepaid Cards, offer mobile apps for managing finances, including check deposits. Obtain a prepaid debit card, download the mobile app, and register your card. Then, photograph your check to deposit it onto the card.

- Some prepaid cards impose a fee for check deposits.

Deposit the check via a mobile payment service like PayPal. Numerous mobile payment services like PayPal, Venmo, and Cash App offer check deposit features that add funds to your online account without necessitating an ID. Simply download the preferred app, create an account, link your bank account, and utilize the app’s check deposit feature to capture images of both sides of the check.

- Most apps levy a fee for check deposits, and there are typically deposit limits.

- Additional mobile payment service apps like Current, Ingo Money, and GO2bank support check deposits.

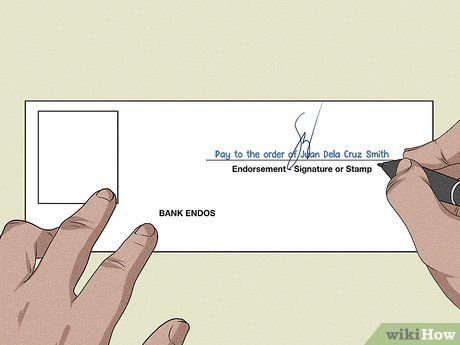

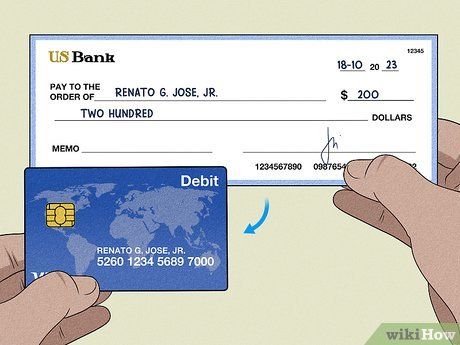

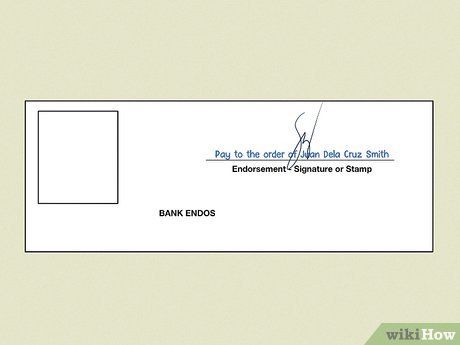

Transfer the check endorsement to a trusted friend or family member holding an ID. Certain banks permit endorsing your check to another individual, granting them the authority to cash it. To endorse a check over, ensure your bank allows third-party endorsements, then sign the check. Below your signature, write “Pay to the order of” followed by the name of your trusted associate. Finally, hand over the check for them to cash and reimburse you.

- Note: Some banks may mandate your presence and ID presentation when your associate deposits the endorsed check. Verify your bank’s third-party check policies before endorsing your check.

Is ID necessary for check cashing?

Presenting an ID is typically mandatory for check cashing at most banks. Banks enforce ID requirements during check deposits and other transactions to safeguard against fraud. Your ID serves to confirm your identity with the bank, offering protection to your account against fraudulent activities.

Which IDs are valid for check cashing?

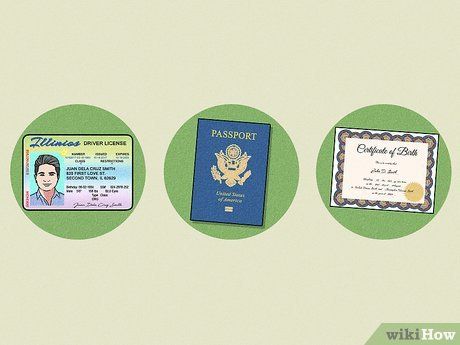

Driver’s licenses, passports, and state ID cards are widely accepted by most banks. Most banks require a government-issued primary ID with your photo for identity verification. Common primary IDs include:

- Driver’s license

- Passport

- State-issued ID card

- Birth certificate (for minors)

- Social Security card (for minors or seniors)

- US Military or Veteran ID

- Permanent Resident Card (Green Card or Resident Alien Card)

- US Employment Authorization Card

- Matrícula Consular Card

Some banks may consider secondary forms of identification, such as an employer ID. In case you lack one of the primary IDs mentioned earlier, certain banks may validate your identity with a secondary ID, especially if you're a familiar customer. Accepted secondary IDs comprise:

- A bank statement

- A bank-issued credit, debit, or ATM card

- Employer ID Card

- Employer pay stub

- Social Security Card

- Student ID

- A utility bill

- Foreign National ID

- Contact your bank to inquire about their ID requirements for check cashing.

How to Cash a Check as a Minor without an ID

Accompany your parent or guardian to your bank to cash the check. If you possess a check for deposit but lack your own ID due to being underage, request your parent or guardian to endorse the check on your behalf. Subsequently, accompany them to the bank for cashing the check and ensure they carry their ID, as it will be requested by the teller.

- To endorse the check, ask your parent or guardian to inscribe your name followed by “Minor.” Then, have them sign their name and indicate their relationship to you (e.g., Mother, Guardian, etc.).

Deposit the check into a joint or minor bank account. If you hold a joint account with your parent or guardian, you can effortlessly deposit the check into your account either online or by visiting the bank accompanied by your parents. In case you don’t possess a joint account, discuss with your parent or guardian about establishing an account for you.

- Several banks provide specialized accounts for children and adolescents, supervised by your parent or guardian.

Utilize a prepaid debit card to cash the check. Most prepaid debit cards enable check deposits via their mobile app without requiring an ID. Seek approval from your parent or guardian before acquiring a prepaid card. Then, download the card’s app, authenticate the card details, and deposit your check.

- If you encounter difficulties depositing your check, seek assistance from your parent or guardian.

- Some prepaid cards impose charges for check deposits.

Methods for Cashing a Check without a Bank Account

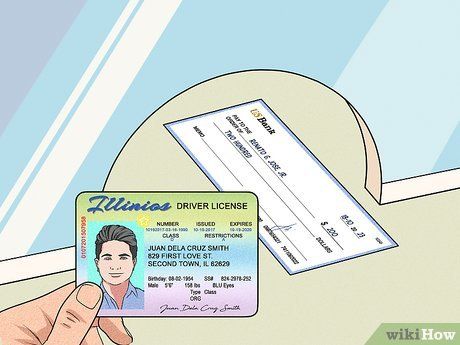

Visit the bank that issued the check. Most banks honor checks they issued, even if you're not a customer. Simply locate the bank's name on the check, endorse it, visit the bank, and bring your ID to cash it.

- Some banks may charge a fee for cashing your check.

Utilize retail or grocery stores like Walmart to cash the check. Certain stores, including Walmart, Kroger, Safeway, and Harris Teeter, provide check cashing services. Present your check and ID at the store to receive cash.

- Most stores charge a fee for check cashing.

- There's typically a limit on the amount you can cash.

Cash the check using a prepaid debit card. If you lack a bank account, purchase a prepaid debit card (not requiring a bank account) and download the card's mobile app. Log in to the app, locate the mobile deposit feature, and capture images of both sides of your check.

- There may be a fee for check deposits.

Endorse your check to a trusted friend or family member. If someone you trust has a bank account, inquire if they'll cash your check. Simply endorse the check and write “Pay to the order of” followed by the friend or family member’s name beneath your signature. After cashing the check, they can give you the money.

- Contact your bank to confirm acceptance of third-party checks.

- Your bank might require you to accompany your friend when they cash the check and provide your ID for third-party check verification.

Utilize a check-cashing store for depositing the check. Many check-cashing establishments accept check deposits without requiring a bank account, although they typically mandate an ID. Simply search for nearby cash-checking stores, opting for one with positive reviews and minimal fees.

- Check-cashing stores often impose higher deposit fees, with some charging fees exceeding 12%.

Guidelines

-

If you encounter difficulties cashing a check without an ID or bank account, explore financial aid programs, organizations, and social services in your locality for assistance.

Cautionary Notes

- If you receive a check from an unfamiliar source or bank, verify its authenticity before cashing it. Search for the bank online and locate their customer service line on their official website. Subsequently, dial the number to authenticate the check’s validity.

- Only endorse a check to individuals you trust.

- Most banks, stores, and check-cashing establishments merely require your ID for check cashing purposes. Refrain from disclosing sensitive information unrelated to check cashing, such as your Social Security Number.