(Homeland) - One of the most significant benefits of Apple Pay, as well as other mobile payment services, is the effective limitation of risks associated with users' card information exposure.

On August 8th, the mobile payment service Apple Pay was officially supported in the Vietnamese market. Prior to this official support, Apple had silently tested its payment service multiple times, but only a limited number of users had the chance to experience it. In this official support, users can add multiple debit or credit cards from popular banks in Vietnam, such as Techcombank, VietcomBank, VPBank, TPBank, etc. The supported card formats include Visa, MasterCard, JCB, and American Express.

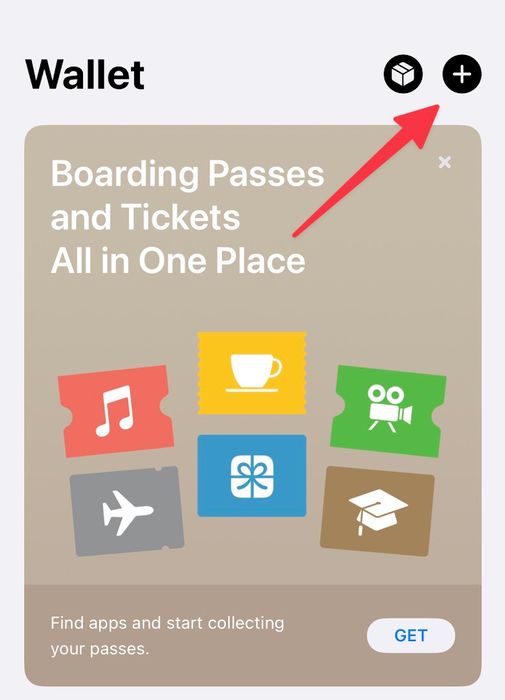

To use Apple Pay, users need to locate the 'Wallet' app on their iPhone, then press the '+' icon in the top right corner of the app screen. An option to add a debit or credit card will then appear.

Open the 'Wallet' app and find the '+' icon as shown.

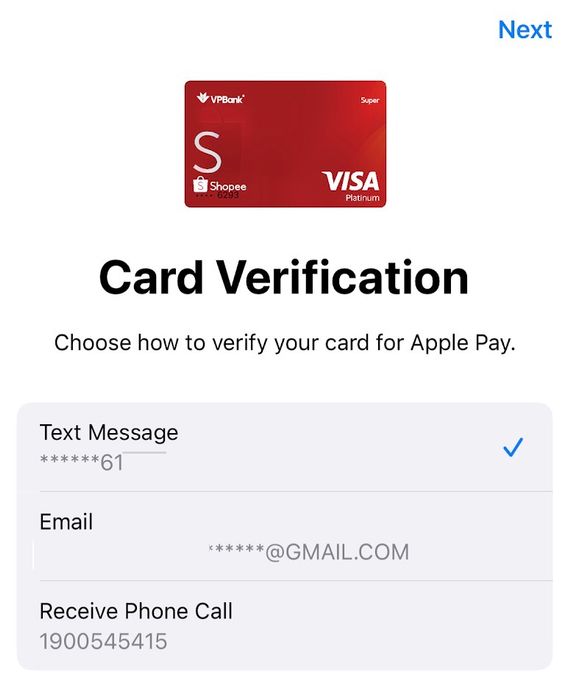

Open the 'Wallet' app and find the '+' icon as shown.At this point, users can scan the card information using the iPhone camera or manually enter the card number and necessary details. Apple Pay will then verify the cardholder by sending an OTP code to the registered phone/email or by calling the bank's hotline for assistance (depending on the bank).

In the coming time, Vietnamese banks will update their apps to allow users to add cards directly from the banking app without manually entering card numbers.

Immediately after successfully adding the card, users can use it instantly by tapping their iPhone or Apple Watch on card-accepting machines (POS machines). The operation mechanism of Apple Pay and similar services involves utilizing Near Field Communication (NFC) to exchange information with POS machines.

Apple Pay will utilize the iPhone's NFC to perform touch payments with POS machines.

Apple Pay will utilize the iPhone's NFC to perform touch payments with POS machines.Minimizing the risk of card information exposure.

As mentioned, by using NFC to communicate with POS machines and only activating when users open the 'Wallet' app and choose the payment card, Apple Pay and similar mobile payment services help users limit information leaks and prevent hackers from exploiting NFC to withdraw money from the card. The 'Wallet' app itself does not display the full card details, showing only the last 4 digits for user recognition.

There have been numerous cases where users lost money from debit and credit cards due to unintentionally exposing card information during direct payments, such as at restaurants, supermarkets, cafes, etc. Many people have the habit of handing over their cards to staff for payments, which can unintentionally expose card information, allowing criminals to withdraw money without the cardholder's consent.

The practice of handing over cards to staff for payments poses various risks of card information exposure.

The practice of handing over cards to staff for payments poses various risks of card information exposure.Mr. Pham Ha, a long-time Apple user, shared: 'Linking credit or debit cards with Apple Pay is quite easy and quick. I no longer need to carry cash or bank cards every time I go out. This makes me feel more comfortable and secure about the security of my account information.'

Overall, Apple Pay is highly regarded for its convenience, smart integration, and high level of security in goods and services payment. With Apple Pay, users can store credit and debit card information on their devices, from iPhone to Apple Watch, enabling them to make quick and easy payments.

The intelligent integration of Apple Pay allows users to make payments not only at traditional stores but also online and within mobile apps. This provides a seamless and uninterrupted shopping experience, from product selection to transaction completion.

Beyond its convenient features, Apple Pay prioritizes the security of users' personal information and accounts. Instead of using real card numbers, Apple Pay employs one-time-use token codes and authentication through fingerprints, facial recognition, or PIN, helping to mitigate the risk of credit card information loss and account fraud.