While some may adhere to the notion of avoiding lending altogether, others see it as an opportunity for profit. Witnessing the substantial earnings banks and major lenders derive from loans prompts certain individuals with surplus capital to explore lending opportunities. With a blend of economic incentives and innovative technology, more people can effectively step into the role of a lender and potentially secure significant returns on their idle funds.

Essential Steps

Understanding the Lending Landscape

Aggregate your funds. To optimize your lending endeavors, consolidate all your available capital into a single account or fund. This approach facilitates a clearer assessment of your lending capacity while ensuring minimal disruption to your personal financial stability.

- It's prudent to prepare for unforeseen circumstances by only lending funds that you can afford to forego, safeguarding your financial well-being in case of default.

Define your lending objectives. Prior to engaging in lending activities, it's crucial to establish clear goals. Consider factors such as the duration of investment and the desired returns. This initial assessment will streamline your lending decisions later in the process.

Assess the tax implications. It's essential to acknowledge that every investment carries a tax burden, and lending is no exception. As a lender, you'll be subject to taxes on interest income, impacting your overall returns. It's imperative to anticipate and understand how this tax obligation will influence your financial position in the future.

Exploring Micro Lending Opportunities

Familiarize yourself with micro lending platforms. For individuals venturing into lending, online micro lending services, also known as peer-to-peer lending, offer promising avenues. These platforms facilitate connections between small-scale lenders and potential borrowers, providing a comprehensive understanding of the associated regulations is essential to avoid potential complications later on.

- Popular micro lending platforms include Kiva, Prosper, and Lending Club.

- Micro loans cater to various needs, including:

- Consolidating credit card debt at a lower interest rate

- Launching or expanding small businesses

- Funding creative endeavors such as films, music, or artwork

- Addressing personal financial needs like weddings or car repairs

Assess the borrower rating systems on micro lending platforms. Similar to traditional lenders, micro lending platforms employ rating systems to evaluate borrowers based on predefined criteria. By understanding these rating mechanisms, lenders can mitigate risks and make informed decisions when selecting loans. Typically, lenders diversify their portfolio by selecting a range of loans, thereby minimizing the impact of potential defaults.

- Riskier borrowers are typically offered loans at higher interest rates.

Finalize the agreement. Once you've selected your preferred loan recipients, you can complete the transaction on micro lending platforms using their provided tools and documentation. Upon completion, you officially become a lender, eligible to receive income payments that enhance your investment portfolio.

Explore the concept of a lending club. Instead of lending funds to a single borrower, consider investing in notes or $25 increments within a lending club. This strategy diversifies your investment across numerous loans, with each borrower's loan being funded by multiple investors.

Exploring the Pros and Cons of Micro Lending

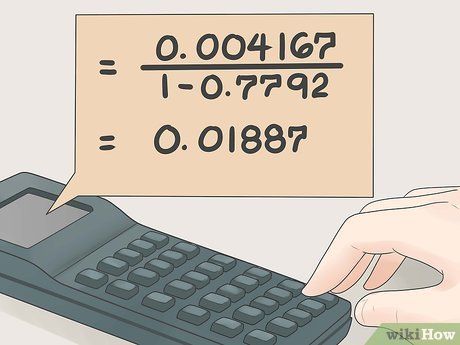

Assess the advantages of micro lending. Micro lending offers the potential for returns on investments ranging from 5-9%, significantly higher than those of savings or money market accounts. Despite a 4-5% default rate and 1% fees charged by micro lending companies, these returns remain attractive.

- Micro loans are insulated from stock market fluctuations, ensuring steady returns even during market downturns.

Evaluate the risks associated with micro lending. One notable risk is borrower default, as micro loans lack the collateral typically required by banks. Additionally, borrowers may declare bankruptcy, resulting in the loss of your investment.

Explore automated investment tools. Instead of manually selecting individual borrowers, which can be time-consuming, consider utilizing automated investing. You can choose a combination of loan grades based on borrower risk and specify the amount for each loan. The tool will then automatically invest in loans on your behalf and provide daily reports online.