Credit cards are among the leading payment methods today, leading to an increasing demand for credit card applications. Banks continuously offer promotions and the best credit card application conditions, leaving many people unsure which bank's credit card to choose.

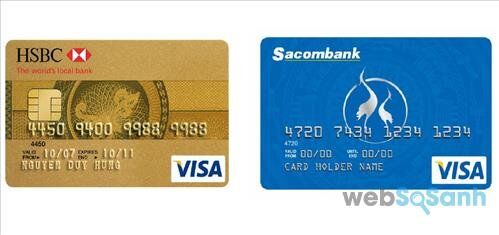

Among these banks, Sacombank and HSBC are two names that often leave people undecided. Should they get a credit card from Sacombank or HSBC?

Let's explore the credit cards of both banks with Mytour, comparing HSBC and Sacombank credit cards to find the best bank for your credit card.

Deciding Between HSBC and Sacombank Credit Cards

Comparison of Credit Card Application Requirements: HSBC vs. Sacombank

To apply for a credit card at both HSBC and Sacombank, the primary cardholder needs to meet the conditions of being a Vietnamese citizen or a foreigner residing and working in Vietnam, and be at least 18 years old.

However, concerning income requirements, HSBC imposes higher conditions, with a minimum income starting from over 6 million dong per month for standard credit cardholders, whereas Sacombank only requires cardholders to have an income of over 5 million dong.

Therefore, to find a bank with easier credit card application conditions, it is advisable to choose Sacombank.

Learn more about How to apply for a Sacombank credit card

Comparison of Credit Limits: HSBC vs. Sacombank

Understanding Credit Limits: HSBC vs. Sacombank

Both banks offer appealing credit limits to users. However, delving into the details, HSBC credit cards are much more generous to their users. For instance, the standard HSBC Visa international credit card has a limit of 60 million dong, whereas Sacmbank's is only 50 million dong.

Therefore, to choose a bank with a higher credit limit, you should opt for HSBC.

Comparison of Usage Fees: HSBC vs. Sacombank

The annual fee for Sacombank credit cards is slightly lower than that of HSBC credit cards. Additionally, Sacombank also offers free issuance of cards except for the Visa Platinum card with an issuance fee of 299,000 dong, whereas you still incur regular fees when using HSBC credit cards.

Moreover, the cash withdrawal fee at ATMs for both HSBC credit cards and Sacombank is 4% of the withdrawal amount.

HSBC Credit Cards: High Fees but More Benefits

HSBC credit cardholders enjoy more benefits compared to Sacombank credit cardholders, such as shopping discounts, flight perks, insurance, while Sacombank excels in domestic shopping support.

Conclusion: To choose a bank for a credit card with more benefits and a better credit limit, you should opt for HSBC. On the other hand, Sacombank credit cards are indispensable for those seeking low fees and extensive domestic shopping support.

View more HSBC credit card types

Mytour.vn - The first price comparison website in Vietnam

Find the cheapest products in Vietnam