When drafting a guarantor letter, an individual or entity assumes financial liability for another party, should they default on a contractual agreement. These letters are crucial for various financial transactions; for example, landlords might request a guarantor letter if they doubt a potential tenant's ability to afford rent, or a country may mandate one for travel visa applications to ensure travelers won't face financial hardships abroad. It's imperative for guarantors to fully comprehend the terms they're agreeing to and formalize these terms in writing, as issuing a guarantor letter on behalf of another entails a significant financial commitment.

Procedures

Section 1: Assessing the Contract

- Consider having a legal professional review the contract to identify any loopholes.

- If asked to provide a guarantor letter for a travel visa, verify the individual's financial capacity to undertake the planned travel.

- It's also prudent to inquire whether the institution utilizes a standard guarantor form. This form may serve as a substitute for a self-written guarantor letter or, in rare instances, complement your letter. Having a standardized form simplifies the process for you. Examples of such forms include: A promissory note and A parental guarantee

Section 2: Structuring the Letter

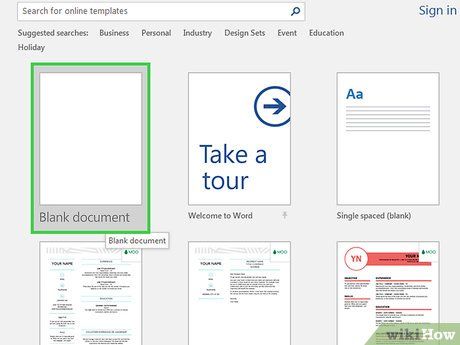

- Many word processing programs offer templates for formatting letters, which significantly simplifies the process, particularly for those with limited experience.

- If you've been provided with a guarantor form, simply fill in all the necessary information and return it to the issuing institution.

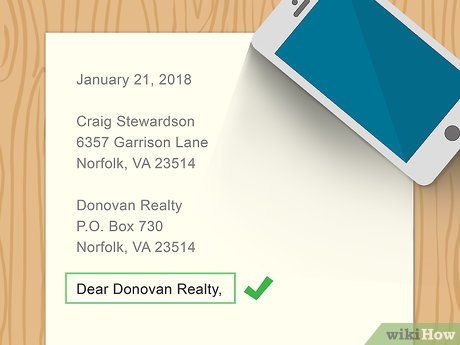

- Some word processing programs automatically include this information in your letterhead, so ensure you're not duplicating it in both the header and body of the letter.

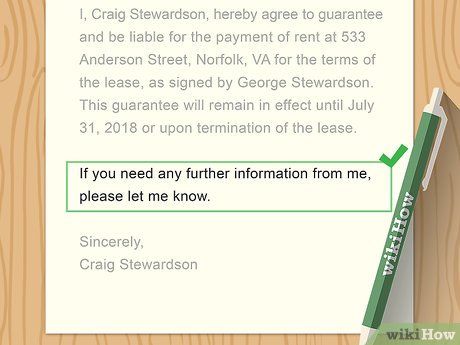

- For instance, 'Dear Pine Street Property Management,' is a simple yet appropriate way to begin your correspondence.

Section 3: Crafting Persuasive Content

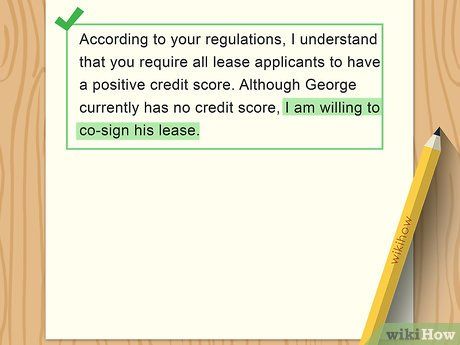

- If feasible, immediately follow this with reasons why you believe the person you're guaranteeing will fulfill their obligations independently. Confidence in their ability to fulfill their commitments should underpin your decision to guarantee. Reiterate this to reassure both yourself and the recipient.

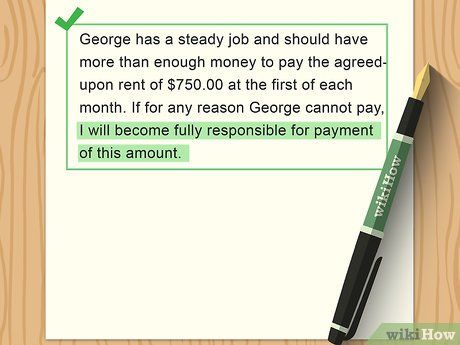

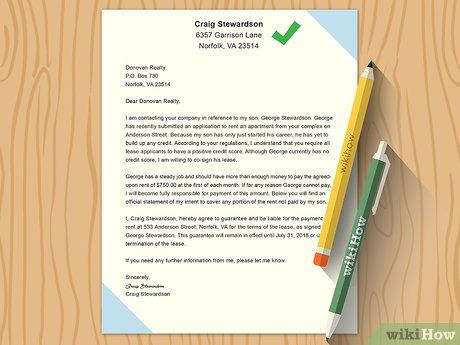

- In scenarios where you'll be making all payments, such as guaranteeing a lease for your child's college apartment, make your responsibilities explicit.

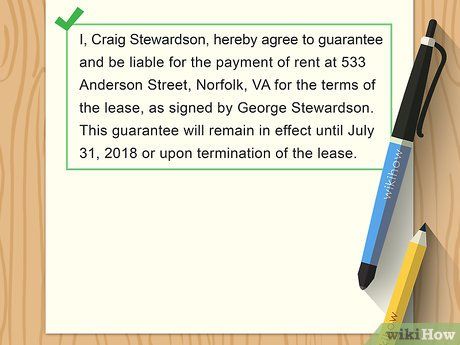

- For instance: 'I, Richard Pearson, hereby commit to guaranteeing and assuming liability for rent payments at 745 Sperry Street, Springfield, MO, for the duration of the lease signed by Amy Pearson. This guarantee shall remain valid until December 22, 2012, or upon lease termination.'

- If you're guaranteeing someone for visa purposes, provide the applicant's name, application number, address, and possibly date of birth. Consult both the applicant and the issuing consulate for guidance on letter expectations.

- Ensure the necessity of this information before including it in your letter. Disclosing sensitive financial details should be approached with caution and assurance of the institution's security.

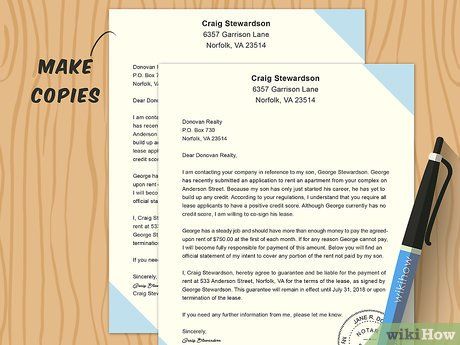

Section 4: Finalizing and Sending Your Letter

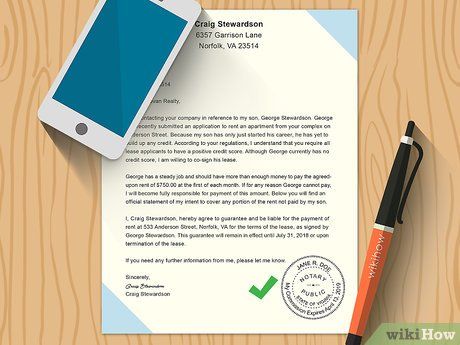

- You may also need your supervisor's signature and date on the letter, particularly if your company is guaranteeing the transaction rather than you personally.

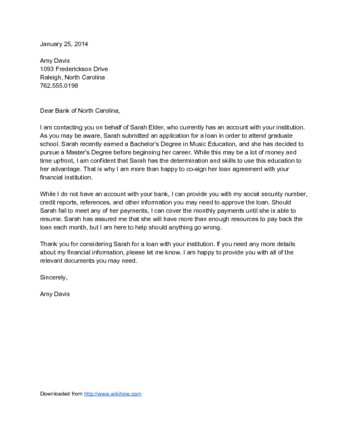

Examples of Guarantor Letters

Example Guarantor Letter for Loan

Example Guarantor Letter for Loan Example Guarantor Letter for Lease

Example Guarantor Letter for Lease Example Travel Guarantor Letter

Example Travel Guarantor LetterHelpful Tips

-

Consider using a pre-made guarantor form provided by many agencies. You'll need to complete, sign, and possibly notarize it.

Important Warnings

- Verify the legitimacy of the transaction and company before disclosing sensitive personal information like your social security number. Such details can be exploited for scams, such as identity theft.