Financial exploitation can manifest in various forms such as constant requests for money, gifts, access to your credit cards, or attempts to gain control over your financial assets. Knowing how to handle relatives who exploit you financially can be challenging. Supporting family members in need often feels like the right thing to do, but it's important to set clear boundaries and find alternative ways to offer support that don't involve money. Communicate openly with your relatives about your discomfort and establish arrangements that are mutually acceptable.

Key Actions

Initiating a Conversation with Your Family Member

Understand their motives. Before immediately agreeing or declining a financial request from a relative, take time to evaluate the situation. Consider your own financial situation, past experiences with the relative's repayment behavior, and whether providing assistance would truly address the underlying issue. It's crucial to prioritize maintaining healthy boundaries in your relationship and recognize when saying no might be the most beneficial option for both parties involved.

- While declining a request may be challenging, it can ultimately safeguard your relationship from potential resentments or conflicts arising from financial transactions.

- Refusing a request can sometimes be the most supportive action, preventing the enabling of harmful behaviors. If a relative has a history of not repaying loans or exploiting others financially, it's important to assertively decline their request.

Initiate a discussion about financial matters. Broaching the subject of money requires sensitivity, so approach financial conversations carefully. Ask pertinent questions to understand how you can offer assistance without prying into irrelevant personal matters. Express your willingness to help in ways beyond monetary aid, and emphasize your supportiveness while discussing alternative solutions.

- Empathize with their situation and consider what form of assistance would be most beneficial to them.

- Say, “I acknowledge your request, but I'd appreciate more details. What are the funds intended for, and do you foresee future financial needs?”

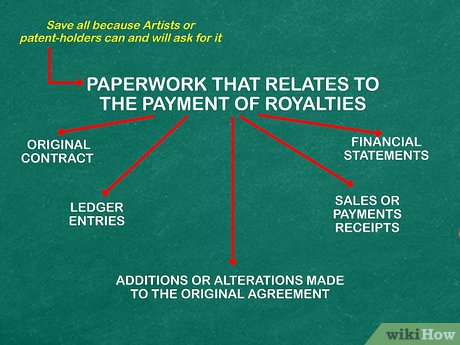

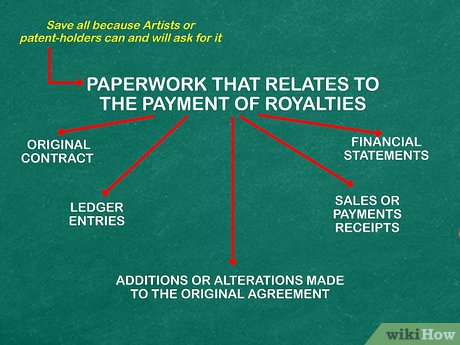

Hold them accountable. If a relative commits to repayment but fails to follow through, establish measures to ensure accountability. Clarify that any financial assistance provided is a loan, not a gift, and devise a repayment schedule or other accountability mechanisms. Set deadlines for repayment and document the agreement to ensure mutual understanding of expectations.

- Say, “I'm willing to assist you by offering a loan instead of a gift. Let's devise a repayment plan that works for both of us.”

Addressing Requests

Define clear boundaries. A relative who repeatedly seeks financial aid may escalate their requests over time, even if the initial assistance was warranted. To avoid being taken advantage of or placed in uncomfortable situations, establish firm boundaries regarding financial support. Communicate the extent of your willingness to provide assistance, and indicate that continuous reliance on your aid is not acceptable.

- Say, “While I'm willing to assist you on this occasion, I'm not comfortable with it becoming a regular occurrence. Please consider alternative options for future needs.”

Assertively decline. Ultimately, the decision regarding the use of your finances rests with you, and you have the authority to refuse requests, even under pressure. You're entitled to decline without providing an explanation, maintaining your stance firmly and without wavering. Express care and support for your relative while emphasizing that financial assistance is not feasible.

- Say, “I understand your need for financial support, but I'm unable to assist you at this time.”

- Avoid stating, “This will be the last time.” Such statements may be misconstrued, leading to repeated requests. Instead, firmly assert your decision without leaving room for negotiation.

Handle their coercion. If you decline and face pressure from your relative, know how to react. They might resort to emotional manipulation or threaten to restrict access to something important to you (like your grandchildren). Acknowledge their desires but assert that coercion won't sway your decision and may strain your relationship. Politely request them to refrain from pressuring or manipulating you in the future.

- Say, “I understand your wishes, but there's no need to pressure or manipulate me into complying with your request.”

Seek assistance from elder care services. If you're a senior facing exploitation, seek aid from community resources. Sadly, financial and elder abuse often occur within familial circles, exploiting trust to gain access to assets. Offspring and grandchildren may exploit elderly relatives for financial gain. If you suspect such mistreatment, reach out to your community for support. Seek local resources to evaluate the situation and access assistance if required.

- While family members are frequent perpetrators of financial abuse against seniors, they're not the sole culprits. Caregivers (such as home health aides), neighbors, or professionals (like lawyers, bankers, or financial advisors) may also engage in financial exploitation.

- If you suspect financial abuse, contact the Adult Protective Services Hotline at 1-800-677-1116. You can report concerns on your own behalf or for someone you believe is being victimized.

- If you or the senior in question resides in a nursing facility, reach out to the Nursing Home Ombudsman (http://theconsumervoice.org/get_help). They'll dispatch an advocate to investigate the situation.

Creating Opportunities

Offer income-generating alternatives. Instead of simply providing funds without repayment, propose mutually beneficial exchanges. For instance, when approached for money, suggest, “Would you be open to assisting with household chores in exchange?” This approach allows money to be earned rather than freely given.

- You determine the compensation for your relative's assistance. Their willingness to contribute may reveal their genuine intentions regarding financial independence versus dependency on your support.

Impart valuable skills. The adage goes, “Give a man a fish, and you feed him for a day. Teach a man to fish, and you feed him for a lifetime.” For individuals reliant on you, equip them with the skills to self-sustain. Consider that their future hinges on more than just your support. If you've achieved financial stability through education or employment, offer to assist your relative in acquiring similar competencies.

- Collaborate on budgeting, suggest educational programs, or recommend financial advisors to help them gain independence.

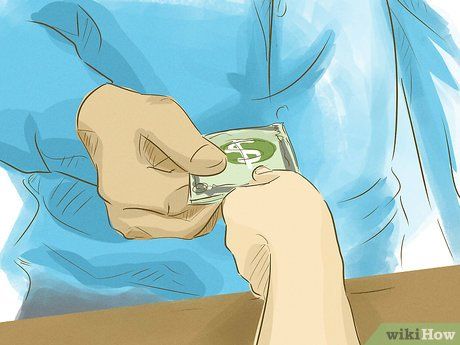

Invest in your loved one. If financially feasible, consider investing in their future. For instance, support their education or assist in launching a business venture. While this may involve a larger sum than requested, view it as an investment in their long-term financial security.

- For instance, if they're struggling as a yoga instructor, offer to help establish a yoga studio.

Non-Financial Assistance

Direct them to available resources. Instead of relying solely on monetary aid, explore alternative avenues for assistance. For instance, if they're unemployed, inform them about temporary agencies, online selling platforms, or job listings. Encourage them to seek solutions beyond financial support.

- Say, “Let's browse online job listings together to find opportunities.”

- Say, ”I understand the job search can be tough. What are your passions, and how can they align with stable employment?”

Extend a helping hand. Offer practical support to advance their career prospects or job search. For example, offer childcare during interviews or work commitments. Instead of offering money for groceries, invite them for meals at your place. Demonstrate your care and support through non-monetary means.

- Say, “While I can't provide financial assistance right now, I'm here to support you in other ways. I can help with childcare or transportation to interviews.”

Identify potential addiction issues. If addiction is a concern, recognize that providing money may exacerbate the problem. Instead, offer support and encouragement for recovery. Advocate for professional help and express your commitment to their journey to sobriety.

- If they request money, offer to contribute towards their treatment. For instance, offer to assist with detox or rehab expenses by making payments directly to the facility.

Helpful Pointers