Tax identification numbers are crucial for Vietnamese workers. Yet, many are unaware of the most accurate methods to retrieve their personal or business tax ID. In this article, Mytour presents 7 simple ways to lookup TIN, ensuring swift and effective searches.

What is a Tax Identification Number?

A Tax Identification Number consists of a combination of letters, digits, and characters issued by tax authorities. This unique sequence ensures tax management efficiency by preventing duplication. TIN facilitates convenient income declaration for individuals.

Tax IDs are represented in two specific formats:

- A 10-digit numerical sequence.

- A 13-digit sequence with characters like hyphens. No alphabets are included.

Here are 7 Online Methods to Check Individual Tax ID through reputable websites, along with simple step-by-step instructions. Let's explore these methods for quick lookup!

How to Check Tax ID via Electronic Tax Website

Step 1: Visit the Electronic Tax website of the General Department of Taxation - Ministry of Finance.

Access Electronic Tax

Access Electronic TaxStep 2: On the main interface of the website, click on the Personal option.

Select the individual section.

Select the individual section.Step 3: Next, click on the Look up NNT information.

Select Look up NNT information

Select Look up NNT informationStep 4: Enter your ID card/CCCD number and Verification Code. Leave the Tax ID field blank and click Look up, the tax ID result will be displayed.

Click Look up

Click Look upHow to Check Tax ID via Online TNCN website

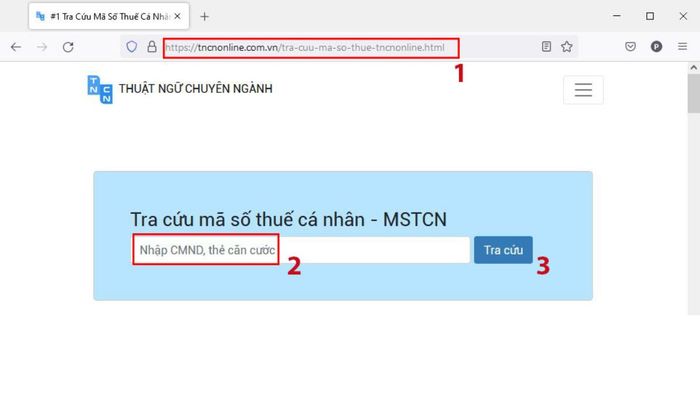

Step 1: Go to the personal tax ID lookup page on TNCN Online. Enter your ID card/CCCD number and click Look up.

Enter Information to Search for TIN

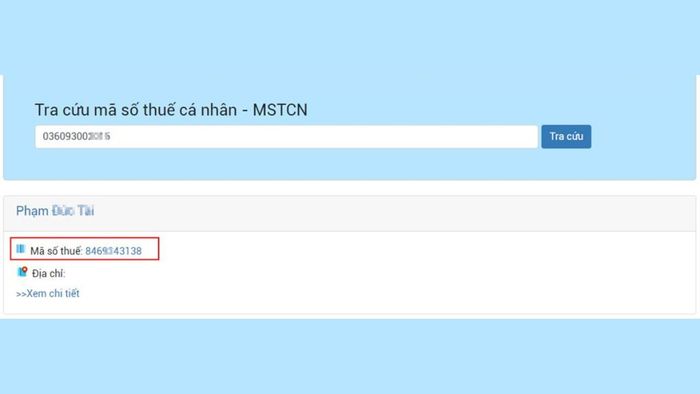

Enter Information to Search for TINStep 2: You will receive information about your personal tax identification number on the screen.

Receive Tax Identification Information

Receive Tax Identification InformationHow to Check Tax ID via Vietnam Tax website

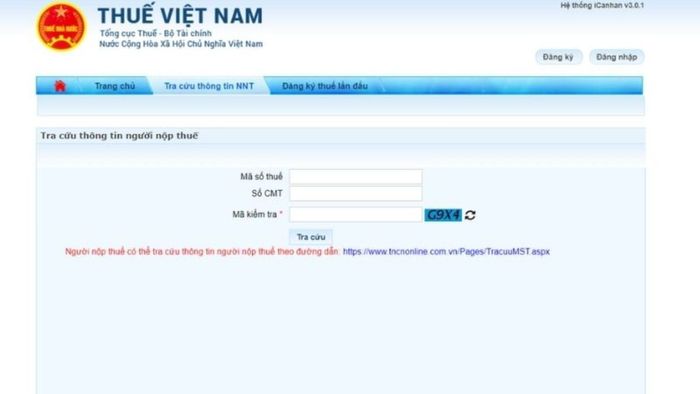

Step 1: Visit the Vietnam Tax website as shown in the interface below.

Access Vietnam Tax website

Access Vietnam Tax websiteStep 2: Fill in your ID card/CCCD number in the ID/ID card box, then enter the confirmation code.

Fill in the information

Fill in the informationStep 3: Click on the Lookup box, the result will be displayed immediately.

Click to lookup Individual or Business TIN

Click to lookup Individual or Business TINHow to Check via MASOTHUE website

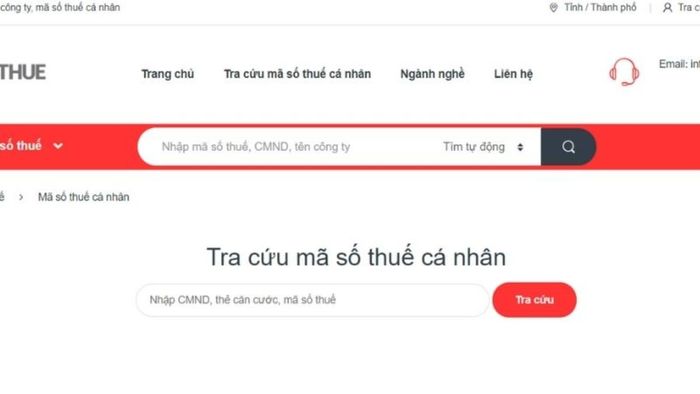

Step 1: Go to the Tax Identification Number website, then choose Individual TIN Lookup.

Visit the tax ID page

Visit the tax ID pageStep 2: Enter your ID card/CCCD information into the appropriate box.

Fill in the information

Fill in the informationStep 3: Click Lookup to receive results about your personal tax identification number.

Click Lookup

Click LookupLookup Tax ID via Messenger

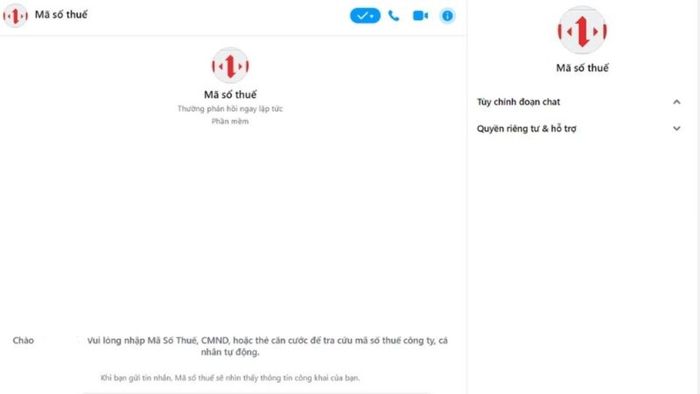

Step 1: Search for and access Tax ID on Facebook. In the Messaging section, enter your ID card/CCCD and press send to look up.

Enter ID card/CCCD

Enter ID card/CCCDStep 3: You will receive information about the tax ID, representative, address, operating hours, etc.

Receive information about tax ID

Receive information about tax IDLookup via Tax ID Lookup app

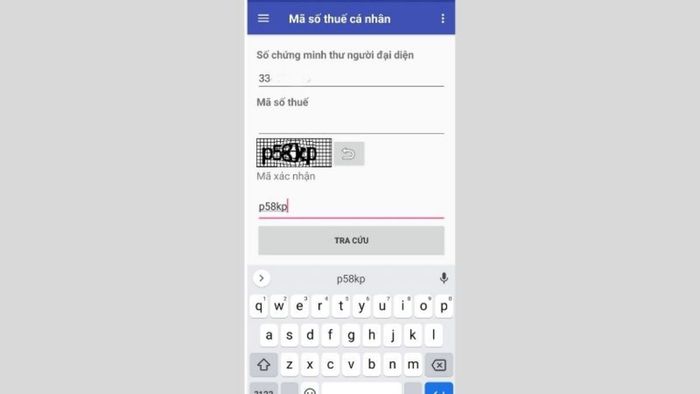

Step 1: Access Google Play and download the Tax ID Lookup app to your phone.

Download the app

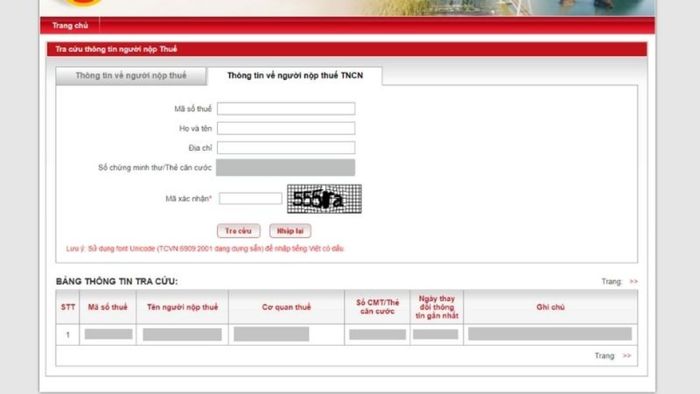

Download the appStep 2: On the main interface of the app, press on Individual or Business TIN Lookup

Select the individual or business TIN lookup section on the app

Select the individual or business TIN lookup section on the appStep 3: Enter your ID card/CCCD information and confirm the captcha code, then click Lookup. You will receive information about name, tax ID, address, representative, etc.

Enter personal information

Enter personal informationLookup via TracuuMST website

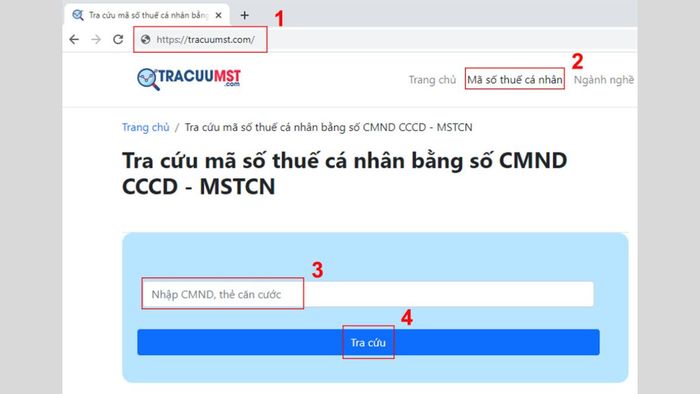

Step 1: Access the TracuuMST.com website. In the navigation bar, select Individual Tax ID. Enter your ID card/CCCD information and click Lookup.

Visit TracuuMST.com

Visit TracuuMST.comStep 2: Receive information about your personal tax ID on the screen.

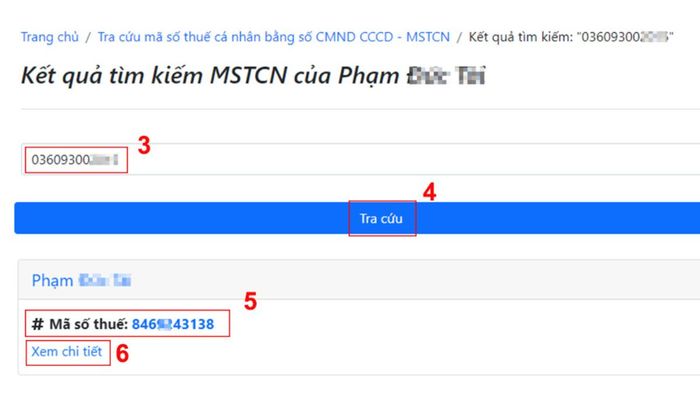

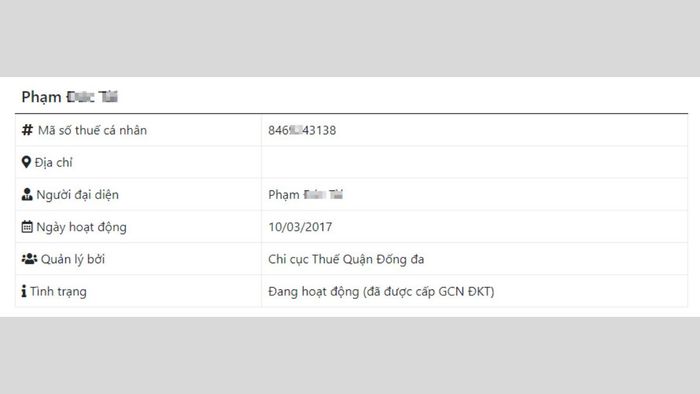

Receive lookup results

Receive lookup resultsStep 3: Your personal tax ID will be displayed. To know more about personal income tax, click on View details.

Click to view details about personal income tax

Click to view details about personal income taxFrequently Asked Questions

Here are common questions regarding individual tax ID lookup. Refer to them for the most accurate answers.

Why are there 2 individual tax IDs when looked up?

Having 2 tax IDs occurs when you've used 2 ID card/CCCD for registration previously. You need to terminate the later issued tax ID. Only the initial issued individual tax ID is valid for tax declaration purposes.

Can individuals who haven't entered the workforce be assigned an individual tax ID?

If classified as dependents, individuals not yet working can still obtain a tax ID. This applies to individuals with working parents or guardians who have tax IDs. This is for the purpose of claiming a household deduction of 4.4 million VND per month. This tax ID remains valid until the individual enters the workforce.

Tax ID for Non-working Individuals

Tax ID for Non-working IndividualsDoes changing from ID card to Citizen Identity Card (CCCD) change the tax ID?

Changing from ID card to CCCD does not require changing the tax ID. However, you need to complete the registration change procedure at the tax authority directly.

What are the impacts of not having a tax ID?

Without a personal tax ID, you are not eligible for household deductions, tax credits, or tax refunds. Registering for a personal tax ID allows tax payers with dependents to claim household deductions.

How many personal tax IDs can one person have?

Each individual is assigned only one personal tax ID for their lifetime. This is stipulated in Article 3, Article 30 of the 2019 Tax Management Law. Updating to the new Citizen Identity Card (CCCD) may result in a change of the individual's tax ID. Therefore, make sure to read the latest information.

Each person has 1 tax ID

Each person has 1 tax IDMytour has just provided you with information on how to look up personal and business tax IDs online. We hope you will successfully retrieve and verify your personal tax ID. Stay tuned to Mytour for more valuable knowledge.