Should you use financial management apps or not?

Managing personal finances has always been a challenging issue for many. Hence, the increasing use of financial management apps, especially among the younger generation.Financial management apps are akin to digital financial notebooks or Excel spreadsheets, facilitating quick expense recording. Moreover, they come with features analyzing spending habits, integrating with stock markets, banks, or budget setting to help you control expenses effectively.

Discover Top Expense Management Apps You Must Know

Money Lover

Money Lover stands out as one of the most recognized and preferred apps. It offers users numerous tools for efficiently managing and tracking expenses over short or long periods.By creating expense charts, Money Lover enables users to easily and visually control their finances, allowing for well-planned spending.Additionally, Money Lover integrates with over 20 banks, enabling users to monitor their account balances' fluctuations and adjust their spending accordingly.- Download the Money Lover financial management app on the App Store here.

- Download the Money Lover financial management app on CH Play here.

Discover Spendee

Spendee is a widely trusted app with a simple, eye-catching interface that makes it easy to use even for first-time users.The app's advantage lies in its ability to efficiently track expenses by day, week, or month, helping you set the most effective budget goals. Additionally, Spendee integrates with various domestic banks, allowing you to effectively monitor your account transactions.- Download the Spendee expense management app on App Store here.

- Download the Spendee expense management app on CH Play here.

Explore MISA MoneyKeeper

MISA MoneyKeeper is regarded as a mobile expense management book with an extremely simple, easy-to-use interface, all set up in Vietnamese.The app helps users easily record their income and expenses through the most intuitive charts. This helps you easily track and control your budget usage, making it easier to plan your finances effectively.- Download the MISA MoneyKeeper expense management app on App Store here.

- Download the MISA MoneyKeeper expense management app on CH Play here.

Discover Mint

Mint is a personal expense management app widely used by young people for its user-friendly and intuitive interface. Mint helps users easily manage expenses over different timeframes through various charts, enabling users to control their budgets and provide them with the best spending advice.Additionally, Mint also integrates with multiple banks to help you easily track your account income and expenses, as well as manage transactions effortlessly.- Download the Mint personal finance management app on App Store here.

- Download the Mint personal finance management app on CH Play here.

Discover Home Budget with Sync

Home Budget is an expense management app that helps you easily record your own and your family's expenses on a daily basis, synthesized into charts for the most intuitive view. This helps you make the most accurate and optimal spending plans.Additionally, Home Budget is equipped with predictive spending and simulation features, alerting users to unnecessary expenses to adjust their budgets most effectively.- Download the Home Budget expense management app on App Store here.

- Download the Home Budget expense management app on CH Playhere.

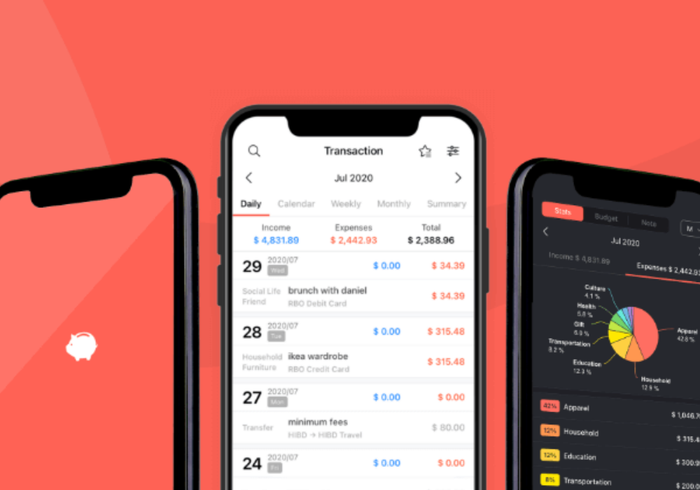

Explore Money Manager

Money Manager is an electronic wallet that helps users manage expenses optimally. You can easily manage your finances through Money Manager's detailed statistical charts on a daily, weekly, and monthly basis in the most intuitive way.In addition, the app allows users to customize main and subcategories and can be changed according to individual preferences to optimize your experience.- Download the Money Manager expense management app on App Store here.

- Download the Money Manager expense management app on CH Playhere.

Explore Pocket Guard

Pocket Guard is an internationally reputable expense management app. With Pocket Guard, you can rest assured with high security with 128-bit SSL encryption and a 4-digit password.The app will help you easily manage your cash flow, summarize income and expenses to analyze and evaluate to report to you financial trends in the month. This helps you have a visual understanding to set appropriate spending plans for yourself.Pocket Guard is also connected to various banks so you can easily control account transactions. In addition, the app has many other modern features such as storing bills, loan payments, etc., to meet various needs of users.- Download the Pocket Guard financial management app on App Store here.

- Download the Pocket Guard financial management app on CH Play here.

Some principles to help you manage spending optimally

The 6 Jars principle

This is a principle to help you manage your finances efficiently. With this principle, your total income will be distributed and divided into 6 different jars as follows:- Jar 1 - Essential Spending: accounts for 55% of your income and is used for daily essential needs including food, drinks, fuel, utilities...

- Jar 2 - Long-Term Savings: accounts for 10% of your income and is used for long-term savings goals such as buying a house, buying a car, business...

- Jar 3 - Education Fund: accounts for 10% of your income and is used to invest in your knowledge by attending courses such as language, skills... or buying books, attending talks with experts...

- Jar 4 - Enjoyment: accounts for 10% of your income to reward yourself with things you love such as shopping, entertainment, travel...

- Jar 5 - Financial Freedom: accounts for 10% of your income and is usually used for activities such as investing in interest-bearing savings, buying insurance...

- Jar 6 - Charity Fund: accounts for 5% of your income and you will use this money for sharing with the community, society. However, if your finances do not allow, you can reduce the % of this fund to fit best.

The 50 20 30 Rule

Concerning the 50 20 30 rule, your total income will be divided into 3 main categories including 50% for essential expenses, 20% for investment and savings, and the remaining 30% for purposes such as entertainment, watching movies... However, you can also adjust the amount in each category for optimization.

Conclusion

Above are the hottest expense management apps that Mytour has just introduced to you. Through them, help you easily and effectively manage your budget.- Read more articles: iOS tricks, Android tricks, Windows tricks