Across the globe, financial institutions stand distinguished by their exclusive BIC codes, also known as SWIFT codes, facilitating seamless international transactions. Suppose funds are inbound from abroad into your account; the remitter requires your bank's 8 or 11-character BIC code. You can scour the internet for BIC codes worldwide or liaise with your financial entity to procure your bank's BIC code.

Guidelines

Scouring the Digital Realm for BIC Codes

Utilize your preferred search engine to unearth a bank's BIC code. By inputting the bank's name, its country of operation, and ideally, the city of operation, along with the term “BIC code” into your search query, you'll undoubtedly procure multiple outcomes furnishing the requisite code.

- As an illustration, a Google inquiry for “PNC Bank Pittsburgh USA BIC code” yields copious results, all revealing the accurate code PNCCUS33 for PNC Bank, N.A., headquartered in Pittsburgh, PA, USA.

Spot the BIC code within the previews of your search results. Oftentimes, you won't even need to click on any links -- the summaries displayed on the webpage typically include mention or listing of either the BIC or SWIFT code. Even if only the SWIFT code is mentioned, remember that the two codes are interchangeable.

- A BIC code comprises either 8 or 11 characters. They consistently commence with 6 letters, followed by a combination of letters and/or numbers for the subsequent 2 or 5 characters.

- PNCCUS33 and PNCCUS33XXX can be used interchangeably, as 'XXX' functions as a placeholder whenever it appears at the end of a BIC code.

Opt for a BIC code locator website instead. Various websites, such as https://www.iban.com/search-bic.html, offer the functionality to search for a BIC code provided you have the bank's name and location (country and ideally, city). Alternatively, you can browse through alphabetical lists of banks by country to uncover a BIC code at https://www.theswiftcodes.com/.

- For instance, both of the aforementioned websites furnish the BIC code for Bank of China's operations in the United Kingdom as BKCHGB2L.

Reviewing Your Account or Contacting Your Bank

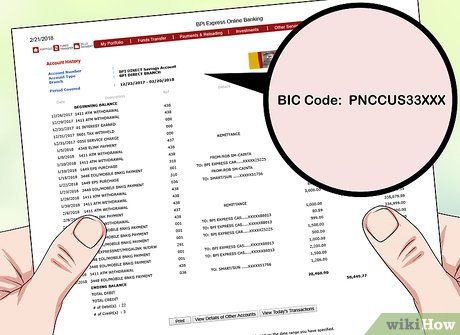

Inspect your bank statement. If you receive a paper or digital bank statement on a monthly basis, it may contain the BIC code somewhere in the fine print. Keep an eye out for “BIC” or “SWIFT” — which, as a reminder, are interchangeable — followed by a string of 8 or 11 characters.

- BIC and SWIFT codes are allocated by two distinct organizations that adhere to a unified standard, signifying that BIC codes and SWIFT codes are essentially synonymous.

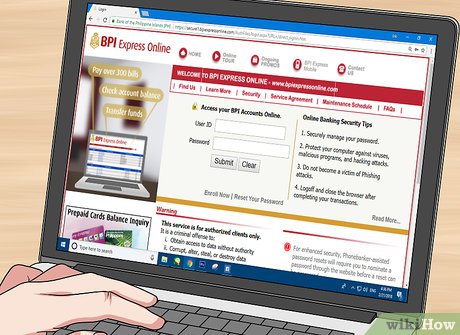

Access your online banking account. With some navigation, you should be able to locate the BIC code for your bank. For example, if you maintain an account with PNC Bank, N.A. (United States):

- Sign in to your account using your username and password.

- Select one of your accounts (e.g., “Interest Checking”).

- Click on “Show Account and Routing Numbers,” and re-enter your password if prompted.

- Proceed to “For Wire Transfers” to obtain the code PNCCUS33.

Drop by a local bank branch and inquire about their BIC code. Any teller at the bank should readily provide you with their BIC or SWIFT code, either from memory or by quickly looking it up.

Give a ring to a bank's customer service hotline and request their code. Connecting with a customer service representative might take a bit longer than getting the code itself. Once you reach out to the contact details of any bank worldwide dealing with international transactions, you can ask for their BIC code.

Understanding and Utilizing BIC Codes

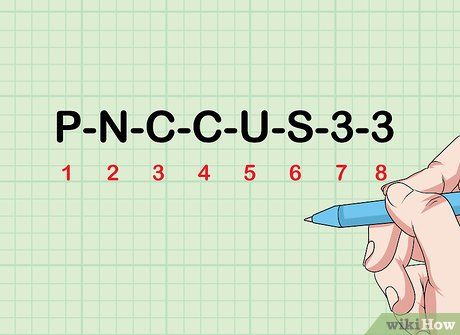

Ensure that the code comprises either 8 or 11 characters. Every BIC code globally conforms to one of these two patterns, just like every corresponding SWIFT code. Some 8-character codes might feature “XXX” placeholders at the end; for instance, you might encounter the code for PNC Bank, N.A. (USA) as either:

- PNCCUS33

- PNCCUS33XXX

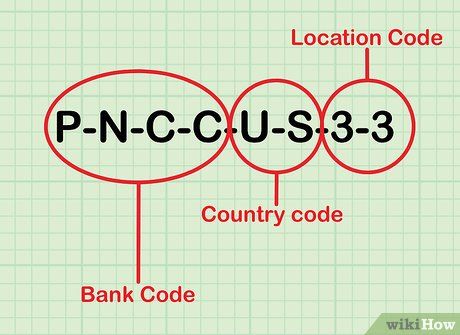

Decipher the elements of BIC codes. Each BIC code is segmented into 3 or 4 parts, either “AAAABBCC” or “AAAABBCCDDD”:

- “AAAA” denotes the bank code, always a sequence of 4 letters (no numbers).

- “BB” represents the country code, comprising only letters without any numbers.

- “CC” stands for the location code, which can consist of letters, numbers, or a combination of both.

- “DDD” may include letters and/or numbers and denotes the optional branch code, unless it's the main office (in which case it's omitted or replaced with “XXX”).

- For instance, the BIC code for the Manchester (UK) branch of the Bank of Baroda is BARBGB2LMAN — namely, BARB + GB + 2L + MAN.

Employ the BIC code of the recipient bank for international money transfers. For example, if you wish to transfer funds from your Bank of China (UK) account to your PNC Bank, N.A. (USA) account, you'll need to furnish PNC's BIC code, which is PNCCUS33 (or potentially PNCCUS33XXX), to finalize the transaction. Conversely, if the funds were flowing in the opposite direction, you'd require Bank of China's code.

Pointers

-

Although it's less common to have a BIC code without corresponding bank information, similar search tools can assist in such instances. A Google search for “PNCCUS33” yields results related to PNC Bank (USA), while inputting “BKCHGB2L” at https://www.iban.com/search-bic.html provides details about Bank of China (UK).