The MB Bank App is developed by MB Bank to provide customers with the quickest and most convenient money transaction experiences. Currently, this software also offers many benefits such as free money transfers and payments. Let's explore in detail the information, outstanding features, and simple, fast usage of MB Bank on Android and IOS phones with Mytour below.

What is MB Bank App?

MB Bank is an application released by the Military Commercial Joint Stock Bank to help customers have good, fast, and convenient experiences in online money transactions. It is commonly referred to as MB Bank, and users can trust its credibility as it is a commercial joint-stock bank under the Ministry of Defense of Vietnam.

MB Bank, being directly under the Ministry of Defense, is highly reputable

MB Bank, being directly under the Ministry of Defense, is highly reputableKey Features of the MB Bank App

In today's bustling and competitive banking market, to establish a strong presence, MB Bank's app not only prioritizes credibility but also offers numerous advantages and convenient features to enhance user experience. Here are the highlighted features of the app compiled by Mytour:

Free Transactions Anytime

Typically, other banks charge transaction fees, regardless of the transaction amount. However, MB Bank strives to ensure that customers incur no additional charges for any type of transfer—it's completely free.

Additionally, funds are transferred to the recipient immediately, even on holidays or Tet. This feature attracts a large number of customers to switch to MB Bank accounts.

Transactions on MB Bank can be conducted anytime, anywhere, and are entirely free

Transactions on MB Bank can be conducted anytime, anywhere, and are entirely freeEasy Account Checking and Management

Most of the basic features needed for transactions are available on the MB Bank app. You can easily check and manage your bank account in a safe and convenient manner.

The system includes functions such as balance checking, viewing the list of transferred accounts, checking the history of all transactions, and managing loans. Additionally, MB Bank now offers features to open and close savings accounts directly on the app. Users no longer need to go to the bank and wait in line.

High Security, Customer Information Always Safe

The app uses the Digital OTP system, eliminating the need to wait for messages and enter OTP codes as before. This is convenient for all transactions in Vietnam and abroad. Furthermore, MB Bank has features like fingerprint or Face ID login for the quickest account access.

Accumulate Points for Rewards

MB Bank offers various promotional programs and point accumulation for rewards when using the app for transactions. Using services like money transfers, savings deposits, bill payments, etc., earns you different points for easy accumulation. Once you have accumulated enough points, you can exchange them for attractive rewards provided by MB Bank, such as discounted airfare, hotel stays, shopping, and more.

MB Bank's app offers a rewards program for point redemption

MB Bank's app offers a rewards program for point redemptionEasy Bill Payments

Currently, online bill payment is widely used and preferred by many users. With the MB Bank app, you only need to perform a single payment operation for bills such as electricity, water, internet, etc. The system will automatically remember this for subsequent accesses. Additionally, the app can be used to purchase mobile phone cards, flight tickets, movie tickets, pay taxes, and more.

Accumulate for Your Children

To meet the needs of customers with young children who want to save for their comprehensive development, MB Bank has introduced the 'My Loving Family' service package integrated into the app. This package allows you to allocate a monthly amount for each child in the household.

You can save money for your children with the MB Bank app

You can save money for your children with the MB Bank appAll savings in this account will belong to your child when they turn 15. The registration process is easy, requiring only your marriage certificate and your child's birth certificate.

Withdraw from ATM without using a card

Withdrawing money from an ATM without using a card is not yet widespread. However, MB Bank has incorporated this smart feature into the app, providing convenience to customers. You can withdraw money at MB's ATMs without using a traditional card. So, if you happen to forget your card, withdrawing money is still normal.

Customize Your Interface

An eye-catching and regularly upgraded interface attracts more users. Therefore, the MB Bank app has developed a feature to customize the interface according to customers' preferences. You can choose between a refreshing green or a pure white interface to switch back and forth based on your own preferences.

Guide on How to Download the MB Bank App on Android and iOS

With many outstanding features, MB Bank is currently attracting a large number of app users. However, before proceeding to download the MB Bank app, you need to meet the following conditions to open an account with this bank:

- Nationality: Vietnamese citizens or foreigners with temporary residence in Vietnam for at least 12 months.

- Age: At least 18 years old and possessing normal civil behavior.

- Legality: Customers are required to have a valid ID card/passport. The legal documents must be clear, without tears or distortions.

If you meet all the above conditions, you can download the app for usage. Below are the steps to download the MB Bank app on all current mobile phone models:

Step 1:For Android users, simply open the Play Store. For iOS users, open the App Store.

Open the Play Store or App Store to downloadStep 2:

Open the Play Store or App Store to downloadStep 2:In the search bar, enter 'MB Bank App' or 'MB Bank'.

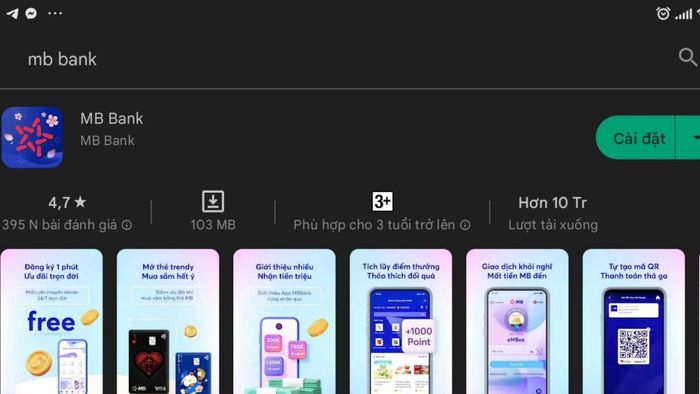

Enter 'MB Bank App' or 'MB Bank'Step 3:

Enter 'MB Bank App' or 'MB Bank'Step 3:Click install to download the app to your device. After waiting for the download process to complete, you can open it to start using.

Click install to download the app

Click install to download the appComprehensive Guide on Using the MB Bank App

The MB Bank app offers numerous standout features to make transactions more efficient and convenient for users. In essence, knowing how to register an account, check information and balances, transfer money, and withdraw from ATMs without a card is sufficient. Let's explore the ways to use this app with Mytour:

How to Register for the MB Bank App to Open an Account

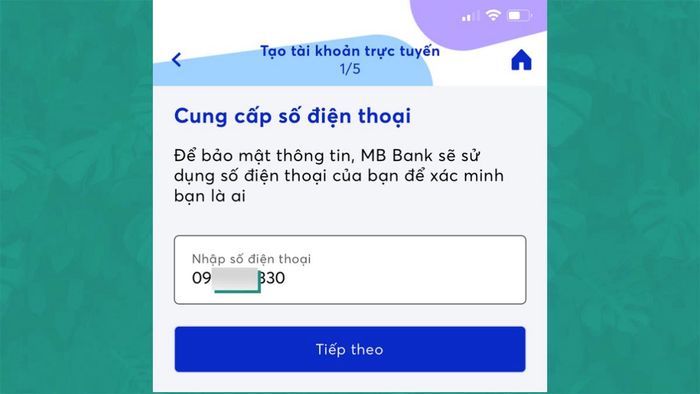

Step 1:Open the MB Bank app, select 'Register Now' on the main screen, then choose 'Continue Registration.' Enter your phone number in the blank field, select 'Next,' and enter the OTP code sent to you.

Enter your phone number in the blank field and select 'Next'Step 2:

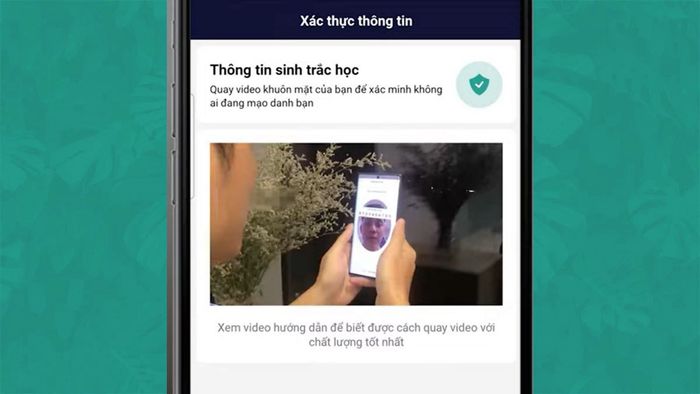

Enter your phone number in the blank field and select 'Next'Step 2:Next is the Biometric Information section. Take a photo and video of your face and ID card as instructed by the AI.

Take a photo and video of your face and ID card as instructedStep 3:

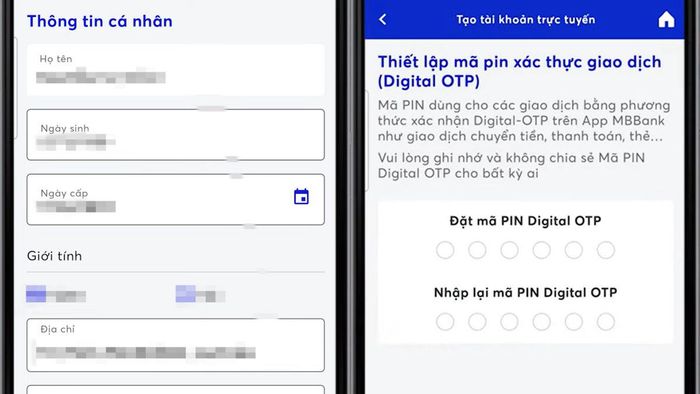

Take a photo and video of your face and ID card as instructedStep 3:The next part involves entering personal information and the PIN code you want to set for your account. Fill in all the details requested by the app.

Fill in all the details requested by the appStep 4:

Fill in all the details requested by the appStep 4:Next is the selection of the account number on the MB Bank app. Choose the type of account number you prefer and follow the subsequent instructions.

Choose the account numberStep 5:

Choose the account numberStep 5:After completing all the information and selecting to create an account, the app will ask you to confirm that the information is correct. Press Confirm and enter the OTP code sent to your phone to complete the process.

Press Confirm and enter the OTP code to complete

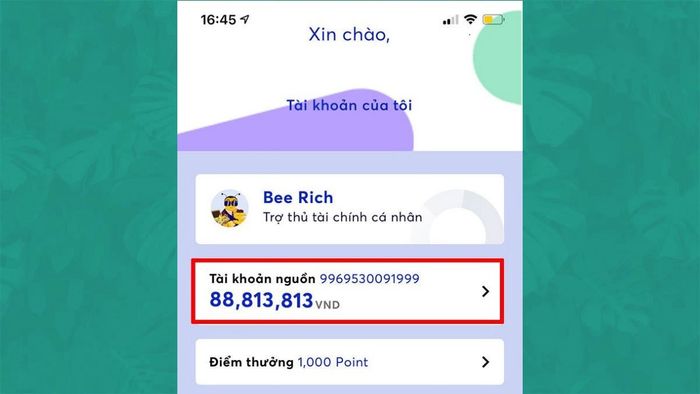

Press Confirm and enter the OTP code to completeGuide on Checking Information and Balance

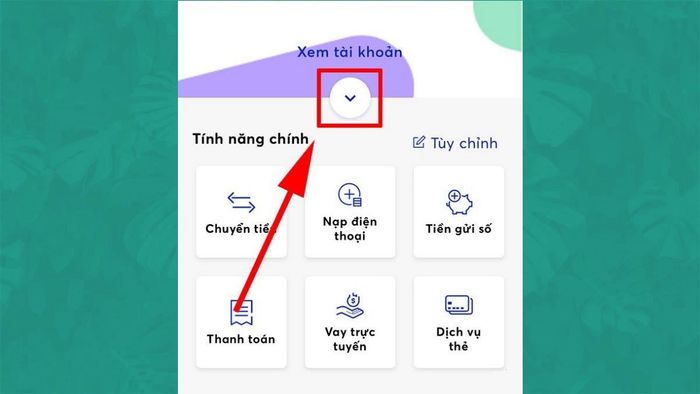

Step 1:Open the MB Bank app and tap the downward arrow below the text 'View accounts.'

Tap the downward arrow below the text 'View accounts'Step 2:

Tap the downward arrow below the text 'View accounts'Step 2:Select an item you want to check.

Select an item you want to check

Select an item you want to checkBank Transfer

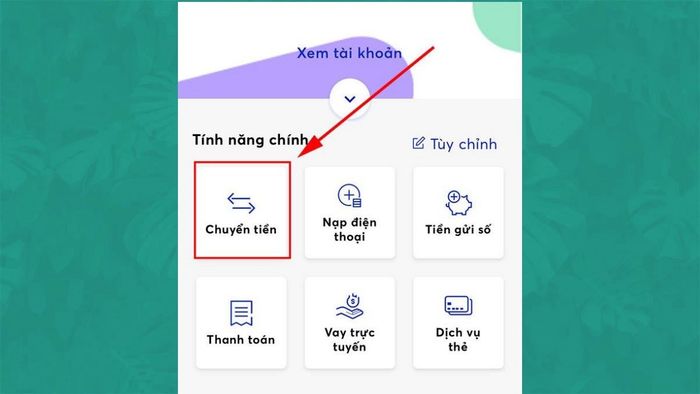

Currently, the steps for bank transfers are optimized to be very simple and user-friendly on the MB Bank app as follows:

Step 1:Tap on the 'Transfer' feature.

Tap on the 'Transfer' featureStep 2:

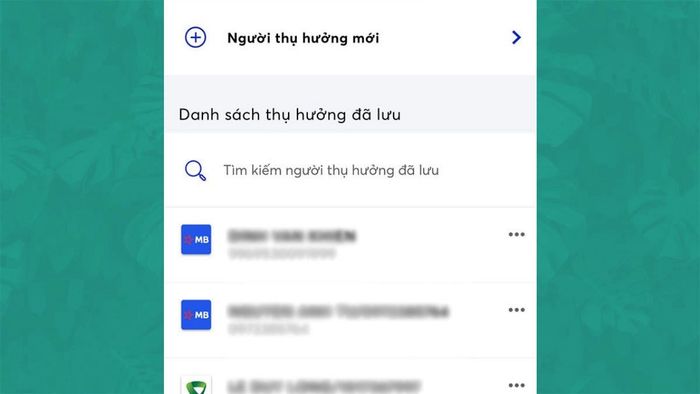

Tap on the 'Transfer' featureStep 2:At this step, you can either select the 'New Beneficiary' option or type the name of the previously transferred person.

Select 'New Beneficiary' or type the nameStep 3:

Select 'New Beneficiary' or type the nameStep 3:Choose a preferred sending method as shown below. You can select 'Transfer to bank account,' 'Transfer to ATM card,' or 'Transfer to phone number' (only for accounts using MB Bank).

Choose a preferred sending methodStep 4:

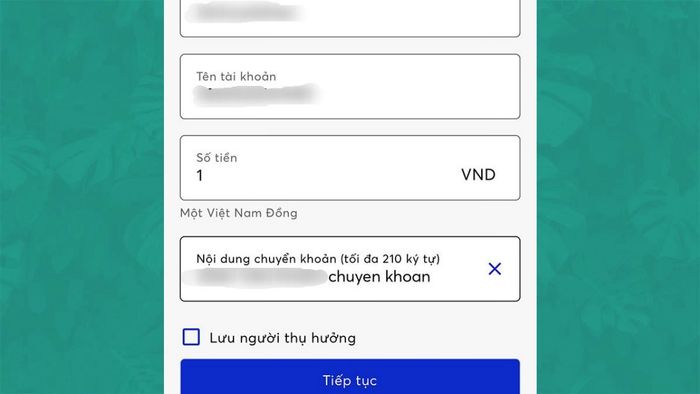

Choose a preferred sending methodStep 4:Regardless of the chosen option, you need to fill in all the required information such as the recipient's bank, account number or phone number, the amount you want to transfer, and a message. Then click confirm for the system to send the OTP code to the registered phone number.

Click confirm for the system to send OTP code

Click confirm for the system to send OTP codeWithdraw Cash at ATM without using a card

This feature is very convenient for customers who forget to bring their cards and hesitate to operate on the ATM. Let's go through the steps of withdrawing money without a card with Mytour:

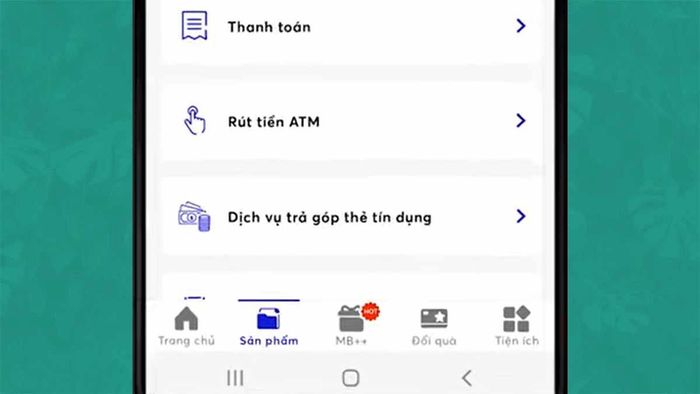

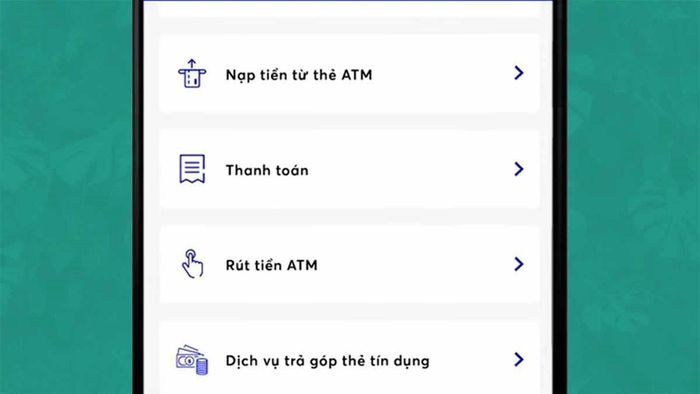

Step 1:Open the MB Bank app and select the 'Products' section.

Open the MB Bank app and select the 'Products' sectionStep 2:

Open the MB Bank app and select the 'Products' sectionStep 2:Next, choose 'ATM Withdrawal' and click on 'Generate Withdrawal Code'.

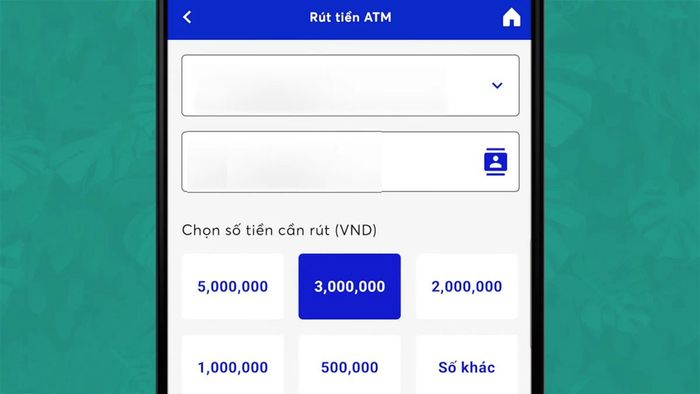

Choose 'ATM Withdrawal' and click 'Generate Withdrawal Code'Step 3:

Choose 'ATM Withdrawal' and click 'Generate Withdrawal Code'Step 3:Enter the account to withdraw, phone number, select the amount, and choose 'Continue' and 'Confirm'.

Choose 'Continue' and 'Confirm'Step 4:

Choose 'Continue' and 'Confirm'Step 4:Enter the PIN code.

Enter the PIN codeStep 5:

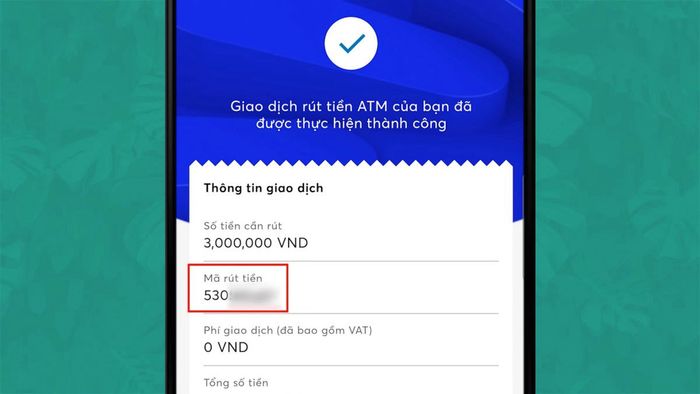

Enter the PIN codeStep 5:At this point, the account will provide a Withdrawal Code. Please take this code to the bank to withdraw the exact amount you need.

Once you have the Withdrawal Code, you can go to the ATM to withdraw the exact amount you need.MB Bank App

Once you have the Withdrawal Code, you can go to the ATM to withdraw the exact amount you need.MB Bank Appis currently being updated and enhanced by the Military Bank with many new features to ensure the utmost safety and convenience for customers. To explore more articles about this app and other banking apps, continue browsing Mytour's page.