'Commodities' is a broad term encompassing raw materials and agricultural products; metals such as silver, gold, and copper; and crops like corn, soybeans, and grains. Making a profit in commodities can be challenging. Roughly ninety percent of commodities traders end up losing money rather than making it. One of the reasons why commodities trading is tough is the absence of a perfect timing for entering or exiting the market. It is crucial for you to comprehend the market dynamics. Additionally, you need to understand how economic factors influence commodity prices. There are numerous ways to invest in commodities, including the futures market, purchasing options on futures contracts, physical commodities (gold and silver being examples of easily storable commodities), Commodity ETFs (exchange-traded funds), and investing in companies whose business revolves around commodities. This article will focus on the commodities futures market. You must determine which futures contracts you want to invest in, analyze the charts, and formulate your trading strategy.

Procedures

Engaging in Physical Commodities Trading

- Pay a premium above the spot price when purchasing coins or bullion. Premiums can amount to up to 25% of the spot prices.

- Provide cash for the entire purchase price. If an investor wants to leverage their purchase, they must locate and negotiate with a private lender willing to accept the metal as collateral.

- Incur additional fees for storage and insurance to safeguard against theft.

- Accept the risks of illiquidity. Finding a buyer for a significant amount of gold, for instance, could be challenging and costly.

- For instance, the World Gold Council maintains a list of trustworthy sites selling gold coins and bullion.

- Some companies that sell gold offer secure storage options for buyers.

Engaging in Commodity Futures Trading

- A buy order entails receiving the commodity, while a sell order involves delivering it.

- Commodity futures, like other assets, are monitored in the market. Traders profit by purchasing commodities (or commodity derivatives) at one price and selling them later at a higher price.

- A buyer of a futures contract earns profit if the future market price exceeds the purchase price. Conversely, a seller profits if the future market price is lower than the sale price.

- Instead of taking physical delivery of a commodity, futures traders close their positions by taking a contrary position to offset their obligation for delivery or receipt. For example, a contract buyer would sell before the delivery date, while a contract seller would buy.

- Commodities traders use two main types of analysis to forecast prices: fundamental and technical analysis. Fundamental analysis involves studying global events, such as weather forecasts and political developments, to predict prices. On the other hand, technical analysis focuses on historical price trends to anticipate future ones.

- Price trends reflect investors' perceptions of supply and demand dynamics. Fundamental analysis guides long-term price expectations, while technical analysis reflects short-term investor sentiment.

- Visit the CME Group, comprising four futures exchanges, to explore futures market fundamentals.

- For example, owning 1000 barrels of oil and experiencing a $1 price change equates to about a 1.2% movement, representing a 20% profit or loss on the investment.

- Hedging is feasible because futures and spot prices converge upon contract expiration. To close their position, companies buy physical commodities at spot prices while selling their futures contracts at the same rate.

- For instance, if the spot and futures prices reach $7.00, a company would pay $700,000 for wheat on the spot market. However, having purchased 100,000 bushels on the futures market at $5.50 ($550,000), they'd sell the contract at $7.00 ($700,000), earning $150,000 to offset spot market costs.

- Be aware that results from paper trading may lack emotional involvement, complicating decision-making when real money is at stake.

- Benefit from the firm's ability to diversify investments and negotiate favorable terms, enhancing the potential for returns while minimizing risk.

- Clients must deposit $5,000 to $10,000 in commodity accounts and adhere to initial and maintenance margin rules set by commodity exchanges.

Trading Futures Options on Commodities

- Option prices track the underlying futures contract, which, in turn, mirrors the commodity's spot price. For instance, an option to buy a Dec Corn contract at $3.50 a bushel reflects the futures option's price.

- Option holders typically sell their positions rather than exercising them, either by selling the option or buying it back.

- Writing options entails the risk of delivering a futures contract, potentially leading to higher profits but also greater risks.

- Premiums are highest when strike prices are near the spot price and options have longer durations.

- Options spreads might enable you to offset investment costs by selling options to other investors while acquiring options for a later date.

Trading Stocks Linked to Commodities

- Commodity stock prices are influenced by factors beyond commodity prices, such as company performance or reserve values.

- Stocks are less volatile than futures and offer ease of buying and selling. You can also explore mutual funds investing in various commodity-related stocks.

- Unlike commodities or options, stocks and bonds are long-term investments without expiration dates.

- Analyze commodity-related stocks fundamentally or technically. Use fundamental analysis to assess the company's value and future prospects.

- Once you've chosen a stock, monitor its price movements to identify optimal buying and selling opportunities.

- Cash and margin accounts are available, with the latter offering short-selling and borrowing capabilities. Note that leverage increases both profit potential and risk.

- Diversification reduces the risk of holding stocks in a single company. Consider investing in multiple companies within the same or different industries to mitigate risk.

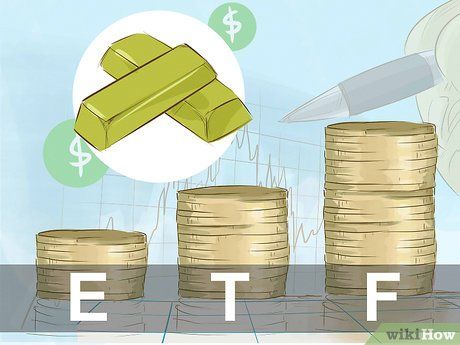

Investing in Commodity Mutual Funds and ETFs

- Investors can access the commodities market without directly trading highly leveraged commodities. Additionally, since these funds also invest in related stocks, they can perform well despite negative commodity price movements.

- For instance, mining company stocks may rise even if the mined commodity price falls due to factors like company debt and cash flow.

- Major companies offering commodity index funds include Pimco Real Return Strategy Fund, Oppenheimer, Barclays, and JP Morgan.

- Commodity mutual funds provide professional management and diversification, making them suitable for inexperienced investors.

- Commodity ETFs trade like stocks, experiencing frequent price changes due to trading activities.

- ETFs generally have lower fees than mutual funds.

- However, ETFs carry credit risk, as their issuer may fail to repay under certain circumstances.

Insights

-

To thrive in trading, remember this: buy low and sell high. Yet, in the realm of commodities, enthusiasm peaks when prices soar and fear grips when they plummet. Falling for the hype leads to buying high and selling low, a sure path to losses. Instead, view price fluctuations as opportunities to either enter or exit positions, depending on your stance and asset dynamics.

-

If you're new to trading or lack substantial capital, steer clear of commodities. It's a high-stakes game, demanding a readiness for the associated risks.

-

Before investing in a futures fund, scrutinize the prospectus. Past performance doesn't guarantee future success in the volatile futures market.