Sorting through a filing cabinet can pose challenges, whether it’s storing household bills and tax records or work-related documents like completed projects and invoices. Streamline your filing system by discarding outdated files, implementing a suitable organization method, and consistently maintaining it.

Techniques

Removing Old Documents

Invest in a filing cabinet if you don't already have one. Seek out a sturdy cabinet that fits your space and budget requirements. Consider features like fire and water resistance to safeguard important documents in case of emergencies. You can find a variety of cabinets at local stores, furniture outlets, carpentry shops, and online retailers.

Commence sorting through your files. Separate anything clearly outdated or unnecessary, including:

- Receipts for items you no longer possess.

- Unwanted Junk Mail

- Outdated bills for services no longer utilized

- Former business correspondence

- Unused stamps

Don't hesitate to discard items. While certain documents such as birth certificates and tax records are undeniably vital, some junk mail or old receipts may appear important but serve no real purpose. Consider the value of each document and whether it could potentially be beneficial in the future. If its absence wouldn't be noticed for a year, it's likely safe to dispose of.

Exercise caution when disposing of items at your workplace! Obtain approval from your supervisors before discarding anything, as its significance may be greater than anticipated. Additionally, your company might have guidelines regarding retention periods and proper disposal methods.

Determine which items merit retention. This decision typically hinges on their recentness and relevance. Use discretion and contemplate whether the documents will serve a purpose in the future. Retain crucial documents such as tax information, insurance records, and vital documents for appropriate durations:

- Maintain tax-related documents for 7 years, including receipts for tax-deductible expenses. The IRS retains the authority to audit any return up to 6 years after filing.

- Retain insurance policies, mortgage statements, and proof of charitable contributions for up to three years.

- Safeguard essential documents such as birth certificates, marriage certificates, social security cards, deeds, and passports. Keep them secure and never discard them.

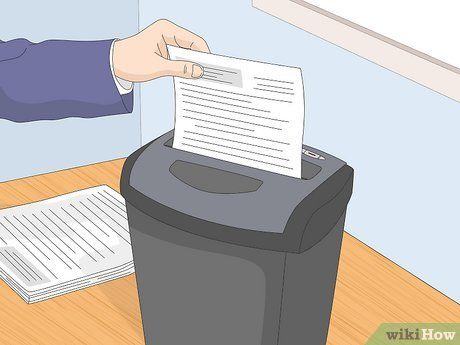

Shred every document from your designated pile. Discarding documents without shredding them could potentially expose your sensitive personal information to prying eyes. Even if uncertain of a document's sensitivity, shredding is advisable as it may contain personal details like addresses or birthdates.

Ensure secure disposal of digital media. Many communities and businesses host shred days where residents or staff can dispose of old floppy disks, CDs, or hard drives for destruction. They'll ensure proper handling.

Sorting Your Essential Documents

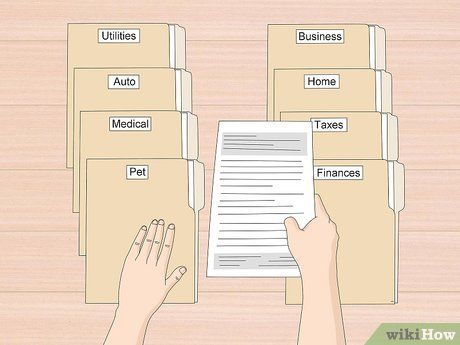

Initiate the organization of remaining files. Transition to a desk or large table and sort the papers into piles that make sense to you. These will become your individual files. Create piles that facilitate easy retrieval. Consider home cabinet categories such as:

- Utilities

- Automobile

- Medical

- Pet

- Business

- Home

- Taxes

- Finances

Consult colleagues for advice on workplace filing. Your workplace may have specific protocols for file organization. If not, consider organizing chronologically or alphabetically. Seek input from organized coworkers for effective strategies.

Opt for simplicity in your categorization. The more detailed your categories, the more files you'll accumulate, leading to cabinet clutter. Keep your primary files broad, then organize documents within them.

Choose between organizing by name or date. Once you've sorted each paper into its appropriate pile, start arranging them in a manner that facilitates easy retrieval.

- For alphabetical organization, such as brands on receipts, place items starting with A at the top of the stack and work down to Z.

- For chronological sorting, like tax return dates, place the most recent documents at the top of the stack and work downwards to the oldest ones.

Insert each stack into a folder. Arrange the papers so that the top document in the stack is at the front of the folder. This ensures that the documents remain in the same order as you organized them.

Simplifying File Retrieval

Clearly mark each folder. Ensure that the tab's writing is large, readable, and understandable to you and others in your workplace or household. Consider using a label maker for enhanced clarity.

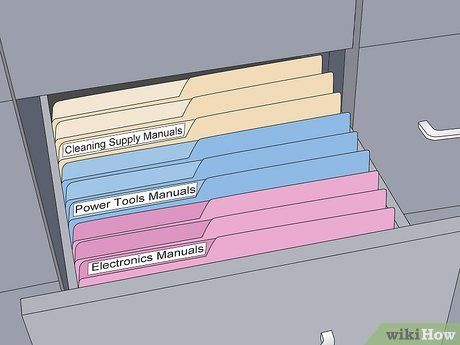

Assign each drawer its own category and label it clearly. Distribute your files among drawers in a manner that makes sense to you, with each drawer housing a distinct category. Ensure that each category contains related files, facilitating easier retrieval.

- Financial documents such as tax records, investment files, and mortgage statements may be stored in one drawer.

- Personal documents like birth certificates, passports, and medical records may be stored in another drawer.

- Instruction manuals for various items may be stored in yet another drawer.

Opt for colored folders. Associating colors with specific categories will significantly enhance the ease of locating your documents. If you already have manila folders, you can add color using highlighters or colored markers. Colored labels can also be utilized subtly for the same purpose.

Utilize your color-coded system to establish subcategories within your drawers. For instance, an Informational Materials drawer could be subdivided into folders such as 'Electronics Manuals,' 'Power Tool Manuals,' and 'Cleaning Supply Manuals.'

Adapt your system if it's not intuitive. After a month or two of implementation, don't hesitate to modify aspects that aren't functioning effectively. Prioritize accessibility by relocating different files to the front or reorganizing categories that are difficult to distinguish. Remember, your filing system should align with your workflow.

Sustaining the Organization

Stay proactive to maintain organization. Handle incoming mail and documents promptly, and file them immediately after processing to prevent clutter.

Establish an inbox on your home or office desk. Review your incoming mail daily. This practice prevents accumulation and ensures that filing remains manageable with small, regular efforts.

Regularly revamp your cabinet. Annual reorganization is advisable, with quarterly cleanouts for larger file volumes. The primary source of clutter in filing cabinets is outdated documents, so purge and shred unnecessary items as needed.

Explore digitizing some of your files. Transitioning documents to digital format reduces physical clutter in your filing cabinet. Ideal candidates for scanning include receipts, donation records, and bank statements. Some documents may already be accessible online.

Create a master document. Detail your filing system and the location of files within it. This document serves as a guide for others in case of emergencies or unexpected situations where access to your files is necessary.

Additional Advice

-

Secure your filing cabinets if you have inquisitive children or nosy family members.

-

If you encounter difficulties with the lock, refer to How to Pick a Filing Cabinet Lock.

-

For highly sensitive documents like birth certificates or property deeds, consider storing them in a safety deposit box or a fire-resistant document case if you doubt the security of your file cabinet.

Precautions

- If you reside in an earthquake-prone region, anchor cabinets to a sturdy wall to prevent them from toppling onto individuals or obstructing exits during seismic activity.

- Load your files with care. If a top drawer is full while drawers below are empty, there's a risk of tipping.