Important Information You Need to Be Aware Of

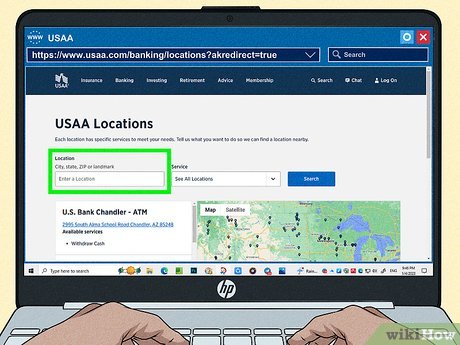

Take Advantage of ATM Finders, Money Orders, and Other Methods To ensure your USAA account remains healthy and secure, utilize the ATM finder tool on the USAA website to locate nearby ATMs that accept cash deposits. Additionally, purchase a money order with the cash you wish to deposit, then use the USAA mobile app or mail to deposit it into your account. You can also use prepaid debit cards, bank transfers, or checks from other accounts to maintain your USAA balance.

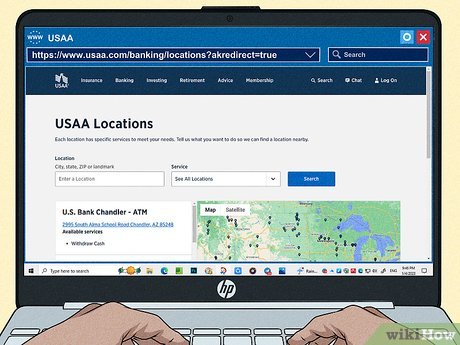

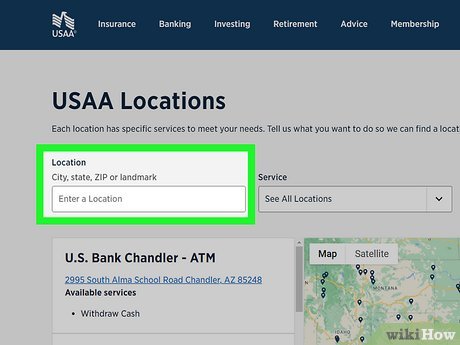

Utilizing an ATM

- Clicking on a location dot on the map reveals specific information about that site and the services offered.

- Be aware that there are relatively few locations where you can deposit cash with USAA ATMs—USAA only permits cash deposits at USAA-branded ATMs or cash withdrawals from USAA partner ATMs. The ATM locator indicates which is which.

- If you frequently deposit cash, it's advisable to consult this map before opening a checking account with USAA.

Caution: Significant portions of the country lack ATMs that accept cash deposits, including the Pacific Northwest, most of the Midwest, and certain parts of the South.

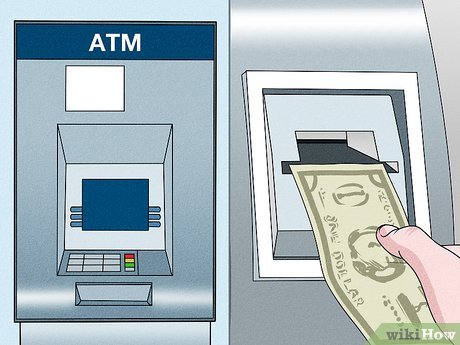

- Ensure that the machine accurately counts your cash, and retain your receipt.

- These ATMs can accept up to 30 bills at a time and do not require deposit slips or envelopes.

- Verify your USAA account within 24 hours to ensure accurate reflection of your deposit.

Exchanging Cash for a Money Order

- Single money orders typically accommodate amounts up to $1,000, so consider purchasing multiple money orders for larger sums.

- Although a fee is charged for issuing money orders, it's usually nominal—often just a couple of dollars. The US Postal Service only charges 45 cents for military money orders.

- If you encounter difficulties or confusion, seek assistance from the attendant—they are trained and knowledgeable in money order procedures.

- Retain the money order receipt for potential future reference or complications.

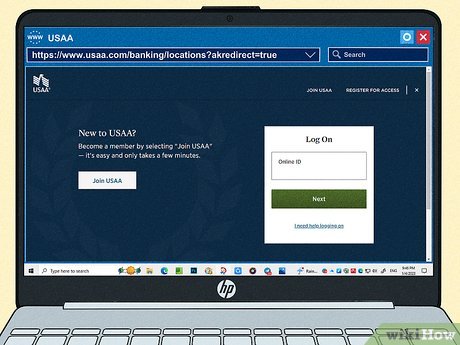

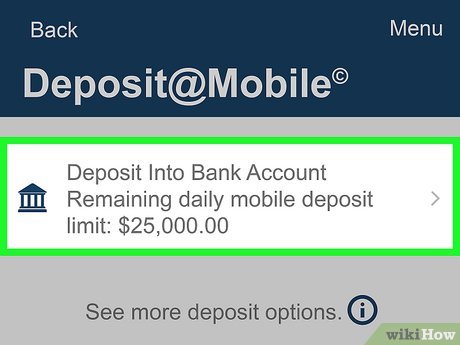

- Log in to the app using the same credentials utilized on the USAA website. Depending on your security settings, you may need to input a code (sent via text or email) to verify your identity.

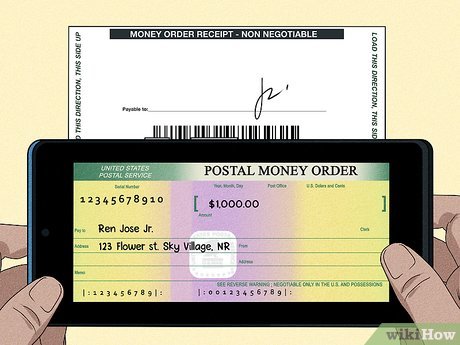

- Optionally, include your account number in the endorsement area for added security, although this step is not mandatory.

Heads up: Refrain from endorsing the back of the money order until you're prepared to deposit it. Once endorsed, the money order essentially becomes a blank check, susceptible to cashing by anyone.

- If you're a new app user or haven't deposited via mobile before, allow access to your phone's camera to finalize your transaction.

- After each photo, review its quality. If it appears blurry or skewed, retake the picture.

- Once satisfied with the images, input the money order amount. If you possess multiple accounts, select the desired deposit account.

Pro tip: Hang onto the money order until the funds are visible in your account and no longer labeled as 'pending.'

- USAA Federal Savings Bank / ATTN: Bank Priority Mail 9861 / 10750 McDermott Freeway / San Antonio, TX 78284-9908

Exploring Alternatives

- Seek out ATMs sporting an 'Allpoint,' 'MoneyPass,' or 'PNC Bank' emblem. These denote USAA Preferred ATMs.

- If you stumble upon a Preferred ATM linked to a bank branch, contemplate opening an account at that bank. This way, you can handle cash deposits and manage your USAA account from one locale.

- Explore various prepaid debit cards to identify one boasting minimal fees and convenient reload locations.

- Although USAA imposes no fees for incoming transfers, the external bank might levy a fee for initiating the transfer. Consult with a bank representative regarding potential transfer costs, particularly if you anticipate frequent cash deposits.

- Be mindful of hold durations. This approach may result in delayed availability of funds in your USAA account.

- USAA also facilitates Zelle usage, enabling customers to execute instant transfers between accounts.

- Upon receiving the check, utilize the USAA mobile banking app on your smartphone to deposit it.

Pro tip: Be mindful of any potential hold durations for personal checks to stay informed about when your funds will become available in your USAA account.