Many non-profit organizations rely on contributions from supporters. It's important to allocate these funds to a dedicated bank account separate from personal finances. This ensures transparency and enables donors to contribute directly to the cause.

Steps to Follow

Choosing the Right Account Type

Consider setting up a donation account for close friends and family. For instance, if a friend requires financial assistance for a costly medical treatment, you can facilitate the process by establishing a simple donation account.

- Contact your bank to inquire about setting up the account. You'll need to fill out an application and may also need to obtain a local business license. Your bank can assist with the license application.

- The bank application will require details about your fundraising purpose and fund distribution. Most banks mandate at least two co-signers for the account, who are authorized to deposit funds and issue checks to the beneficiary.

- In addition to a business license, you might need to register as a charity with your city or state. Your bank can guide you to the registration website. However, simple donation accounts typically don't require formal charity status.

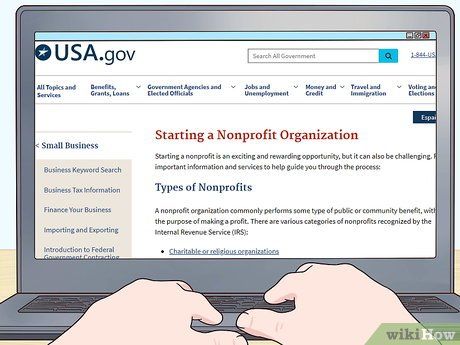

Consider reaching out to the public for donations. To broaden your fundraising efforts, formal registration as a charitable organization is necessary. This involves officially involving others in your charity, including appointing officers such as a president, treasurer, and possibly a board of directors. These individuals should be passionate about your cause and possess the necessary organizational skills. Your treasurer, for instance, should have a background in business. Additionally, you'll need to establish a not-for-profit entity (NFP) through your state's secretary of state office, with periodic financial reporting required once your charity is set up.

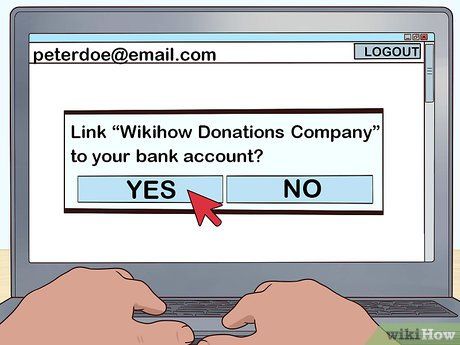

Opt for an online donation platform. Simplify the donation process for your contributors by implementing an online donation system.

Combat fraud effectively. Take precautionary measures to prevent fraud within your donation system. Utilize reputable online payment services like PayPal, ensuring that all financial transactions are accurately reconciled in a timely manner to mitigate fraudulent activities.

Explore crowdfunding opportunities. After establishing a bank account and linking it to PayPal, leverage crowdfunding platforms such as GoFundMe or Kickstarter to garner support for your cause. These platforms attract charitable individuals seeking innovative projects to fund.

Seeking Tax-Exempt Status

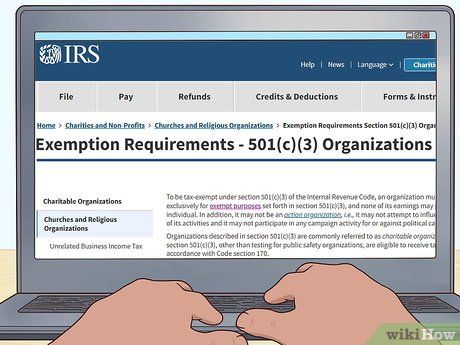

Meet the criteria to qualify as a tax-exempt organization. Contributions made to a tax-exempt organization may qualify for tax deductions for certain taxpayers. To achieve this status, you must submit an application to the Internal Revenue Service (IRS).

Adhere to the definition of an exempt purpose as outlined in the IRS code. Applicants can fulfill the criteria for an exempt purpose by establishing various types of charities. The IRS provides a list of permissible exempt purposes on its website.

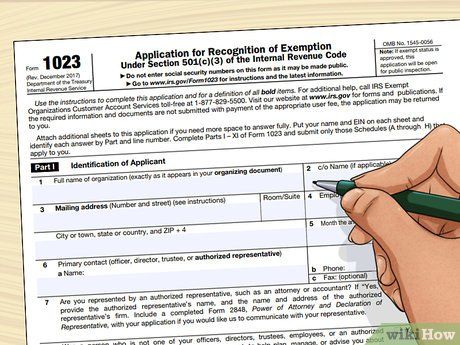

Submit an application for tax-exempt status to the IRS. Your organization must adopt the appropriate legal structure to meet the IRS requirements for charitable status. Typically, your entity must be established as a trust, corporation, or association.