The EU is reportedly urging leading semiconductor manufacturers like TSMC and Samsung to establish cutting-edge fabs in Europe. However, this proposition poses significant challenges given the intricacies of semiconductor production.

The EU is reportedly urging leading semiconductor manufacturers like TSMC and Samsung to establish cutting-edge fabs in Europe. However, this proposition poses significant challenges given the intricacies of semiconductor production.Europe aims to enhance competitiveness in technology and science

Although the majority of chips used in industry are developed in the US, numerous companies in Europe persist in designing chips for applications such as autonomous vehicles, IT, and telecommunications. Examples include Ericsson, Infineon Technologies, Nokia, NXP Semiconductors, and ST Microelectronics.However, not many chips are actually manufactured in Europe. Companies like Infineon, NXP, and ST Microelectronics both produce chips in their own factories and outsource a significant amount of chip manufacturing to external facilities.

JUWELS is one of the most powerful supercomputers in Europe, located at the Julich Research Center in Germany. The system comprises 38 racks of Atos' BullSequana XH200, utilizing processors designed in the U.S. and manufactured in Asia such as AMD Rome (Zen 2) and 3700 Nvidia A100-40 (Ampere) GPUs.

European authorities deeply comprehend the significance of core technology, leading to the emergence of new promotional committees such as the European Processor Initiative and the European HPC Initiative. To support these two initiatives and gradually achieve autonomy in chip supply, Europe needs its own semiconductor manufacturing industry with specialized, advanced, and proficient processes. The ultimate goal is to domestically produce 20% of chips and processors globally, a 10% increase from the present day.European Commissioner for Industry, Thierry Breton, once told Bloomberg: 'Without self-sufficiency in electronics, Europe will lack digital sovereignty.' Last year, 17 European Union member states signed a declaration to develop next-generation processors and advanced process technologies for their production. The EU plans to invest $145 billion in the common development plan and enhance cooperation among nations. This declaration also led to the establishment of the European Electronics Alliance at the end of Q1 2021. This alliance will include leading chip manufacturers, telecommunications companies, automotive firms, medical device manufacturers, and other high-tech industries in Europe.

European authorities deeply comprehend the significance of core technology, leading to the emergence of new promotional committees such as the European Processor Initiative and the European HPC Initiative. To support these two initiatives and gradually achieve autonomy in chip supply, Europe needs its own semiconductor manufacturing industry with specialized, advanced, and proficient processes. The ultimate goal is to domestically produce 20% of chips and processors globally, a 10% increase from the present day.European Commissioner for Industry, Thierry Breton, once told Bloomberg: 'Without self-sufficiency in electronics, Europe will lack digital sovereignty.' Last year, 17 European Union member states signed a declaration to develop next-generation processors and advanced process technologies for their production. The EU plans to invest $145 billion in the common development plan and enhance cooperation among nations. This declaration also led to the establishment of the European Electronics Alliance at the end of Q1 2021. This alliance will include leading chip manufacturers, telecommunications companies, automotive firms, medical device manufacturers, and other high-tech industries in Europe.Catching up with Asia

NXP Semiconductors is a Dutch-American semiconductor manufacturer, founded in 1953 and formerly a division of the Philips conglomerate. NXP specializes in producing chips for automobiles and co-invented NFC technology with Sony and Inside Secure. In 2016, Qualcomm attempted to acquire NXP but was unsuccessful due to opposition from China.

There are various ways for the EU to catch up with semiconductor manufacturers in Asia such as Samsung Foundry or TSMC regarding production lines. One approach to boost electronic self-sufficiency is to consolidate chip manufacturers in Europe, provide funding for them to develop advanced and specialized technologies, then offer financial support for them to build fab facilities in Europe. The second approach could involve enticing Samsung Foundry and/or TSMC to Europe with favorable policies. Both plans are challenging to execute and even more difficult to sustain in the long run. The second approach seems more feasible, but:

Even if GlobalFoundries and ST Microelectronics were to merge, they would still find it difficult to catch up with Samsung Foundry and TSMC in the near future in terms of R&D. Therefore, inviting companies from South Korea and Taiwan to do business in Europe would be more practical and feasible. Furthermore, not many chip design companies in Europe require overly advanced processes, and those with low production needs may not need an advanced fab facility operating at 100% capacity to turn a profit. Recently, Daimler, Volkswagen, and some other car manufacturers have complained that they cannot get enough chips from TSMC because TSMC's production lines are always overloaded to fulfill larger orders. Chip shortages have a significant impact on car manufacturers and the local economy as the automotive industry still employs tens of thousands of workers. Automakers don't really need new process nodes, and in fact, only 3% of TSMC's revenue comes from the automotive industry.

Furthermore, not many chip design companies in Europe require overly advanced processes, and those with low production needs may not need an advanced fab facility operating at 100% capacity to turn a profit. Recently, Daimler, Volkswagen, and some other car manufacturers have complained that they cannot get enough chips from TSMC because TSMC's production lines are always overloaded to fulfill larger orders. Chip shortages have a significant impact on car manufacturers and the local economy as the automotive industry still employs tens of thousands of workers. Automakers don't really need new process nodes, and in fact, only 3% of TSMC's revenue comes from the automotive industry.Semiconductor manufacturers also seek to minimize risks

According to sources from DigiTimes, TSMC may be considering opening a fab plant in Europe, partly due to geopolitical tensions and disruptions in the traditional semiconductor supply chain, which pose risks of losing customers for the company. Samsung Foundry is also contemplating a similar plan. Nina Kao, spokesperson for TSMC, told Bloomberg: 'When it comes to selecting a location for building a fab plant, we need to consider various factors, including customer demand. TSMC does not rule out any possibilities and currently has no definite plans.'The world is evolving towards globalization

While bringing the most advanced semiconductor manufacturing lines to Europe may pose political challenges, the world is becoming increasingly globalized to the point where hardly any country or bloc can completely dominate the chip industry. This is because:

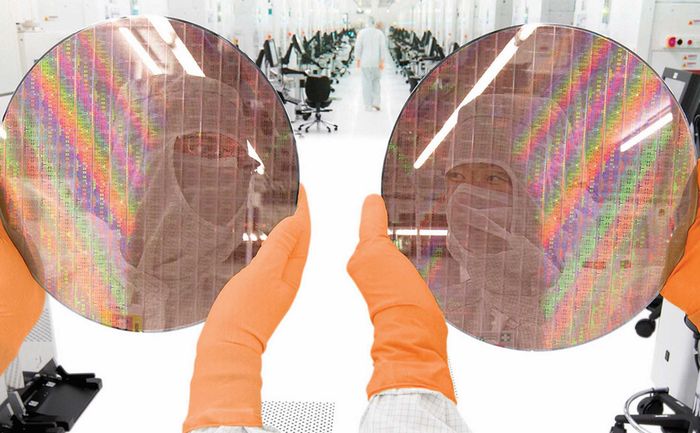

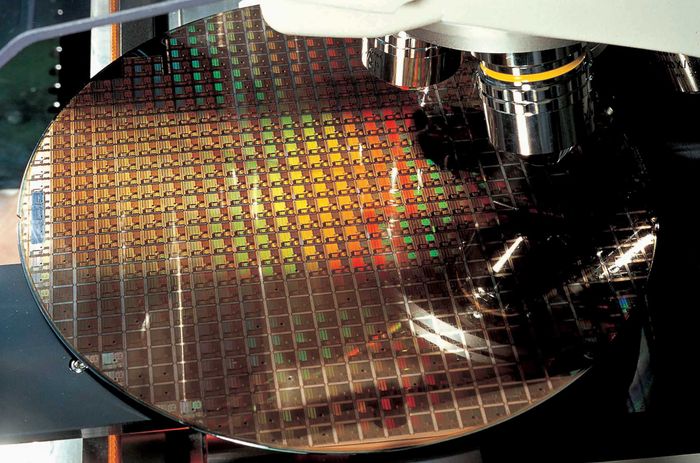

Modern fab plants use tools made by various companies from Europe and the U.S., pure chemicals produced in Japan, and wafers made in Asia or Europe. Each processed wafer needs to be diced, and each finished chip needs to be tested, packaged, using facilities in Asia. After a chip comes off the line, it needs to be installed into a device, and this assembly often takes place in China, Korea, Japan. Finally, the device runs on an operating system and software developed in the U.S.

Although digital sovereignty includes locally manufactured chips, it extends beyond semiconductors to encompass various components currently sourced from around the world.

Source: Tom's Hardware