This article below provides a detailed guide on the meaning and usage of the VDB function – calculating depreciation for fixed assets in Excel.

Description: The function performs depreciation calculations for an asset over specified periods, utilizing the double declining balance method.

Syntax: VDB(cost, salvage, life, start_period, end_period, [factor], [no_switch]).

Regarding this:

- cost: The initial cost of the asset, a fixed parameter.

- salvage: The salvage value of the asset, the value after depreciation, a mandatory parameter.

- life: The number of depreciation periods for the asset, a mandatory parameter.

- start_period: The initial period for calculating asset depreciation, a mandatory parameter.

- end_period: The final period for calculating depreciation, a mandatory parameter.

- factor: The diminishing balance factor, an optional parameter, defaults to 2 if omitted.

- no_switch: A logical value used to determine whether to switch to straight-line depreciation when the depreciation exceeds the diminishing balance, an optional parameter.

+ In the scenario where no_switch = True: No transition to the straight-line depreciation method even if the depreciation value surpasses the diminishing balance.

+ In the scenario where no_switch = False or omitted: Implement a switch to the straight-line depreciation method when the depreciation value exceeds the diminishing balance.

Note:

- If you prefer not to employ the double declining balance method for depreciation calculation -> modify the value of Factor.

- All parameters (except no_switch) must be positive numbers.

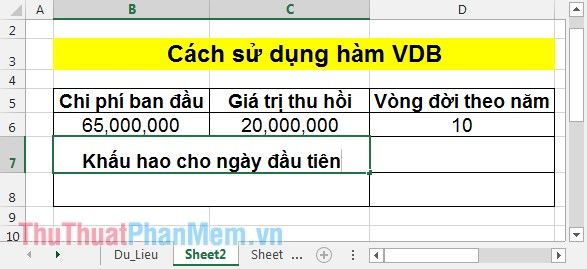

Example:

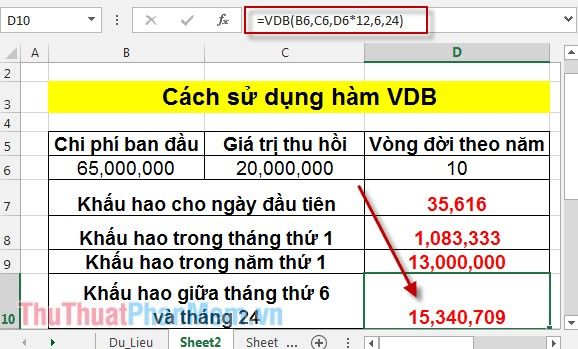

Calculate asset depreciation over specific periods. Assume the asset was purchased for 65,000,000, has a recoverable value of 20,000,000 at the end, a useful life of 10 years, and is used in multiple periods.

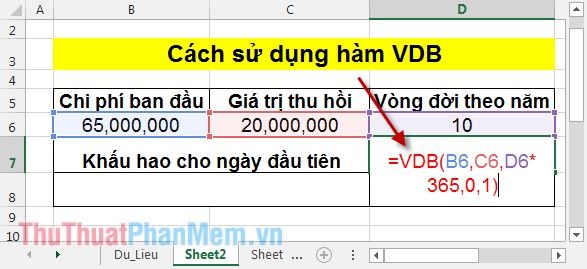

1. First-day depreciation

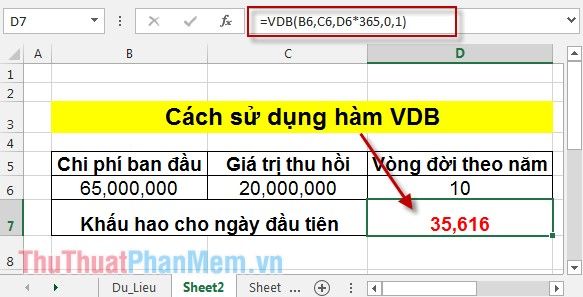

For accurate daily depreciation, the lifespan is calculated in days => input the formula: =VDB(B6,C6,D6*365,0,1) and press Enter. The depreciation value on the first day is:

Press Enter -> the depreciation value on the first day is:

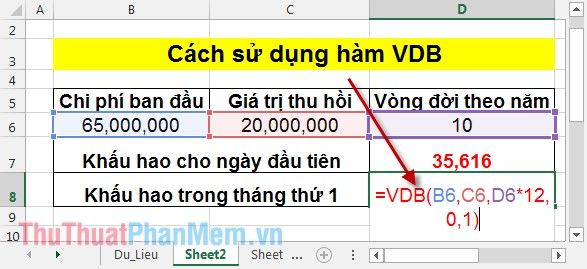

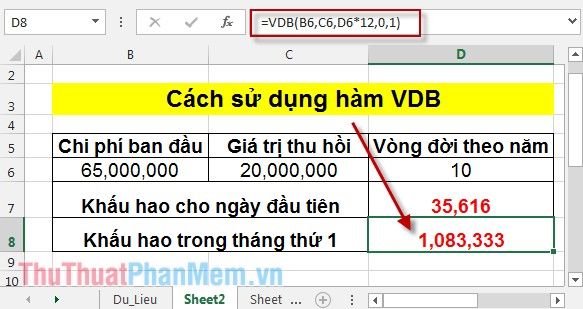

2. First-month depreciation

Since depreciation is monthly, the lifespan should be calculated in months => input the formula: =VDB(B6,C6,D6*12,0,1)

Press Enter -> the depreciation value in the first month is:

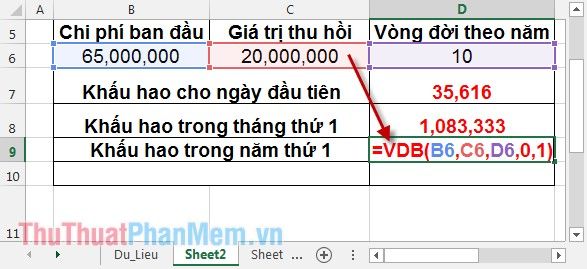

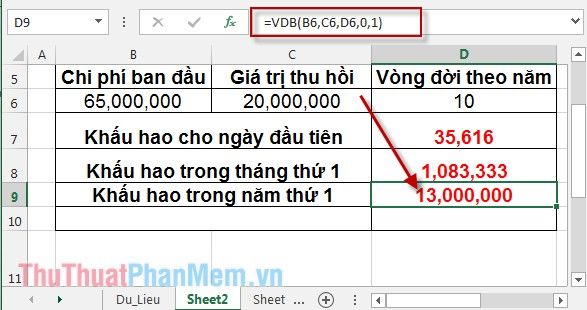

3. First-year depreciation

In the cell where calculation is needed, input the formula: =VDB(B6,C6,D6,0,1).

Press Enter -> the depreciation value in the first year is:

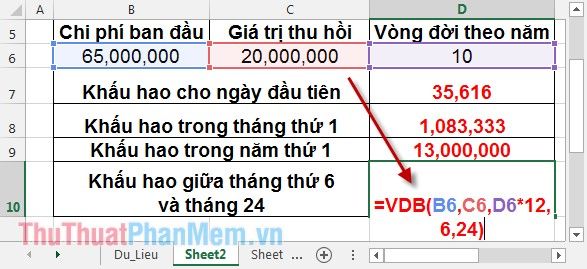

4. Depreciation from the sixth to eighth month using double-declining balance method

Since depreciation occurs between months, the lifespan is calculated monthly => in the cell where calculation is needed, input the formula: =VDB(B6,C6,D6*12,6,24).

Press Enter -> the depreciation value from month 6 to 24 is:

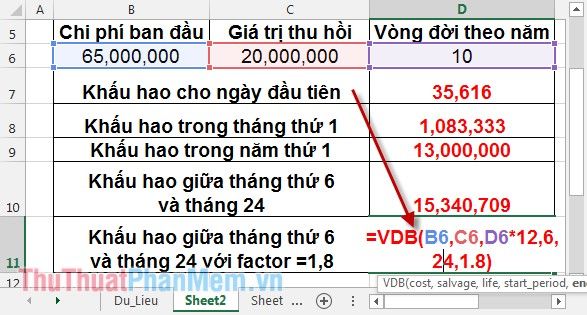

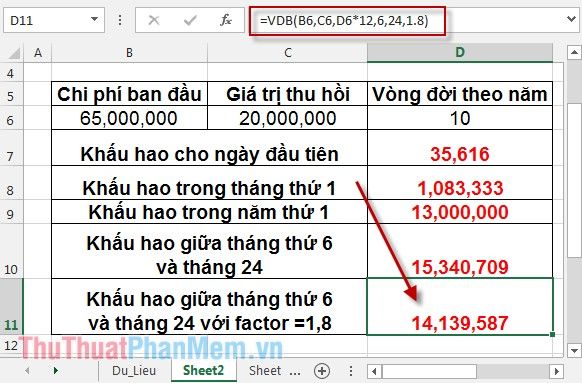

5. Depreciation from the sixth to twenty-fourth month using the straight-line method with a factor of 1.8

Similarly, in the cell where calculation is needed, input the formula: =VDB(B6,C6,D6*12,6,24,1.8).

Press Enter -> the depreciation value from month 6 to 24 using the straight-line method with a factor of 1.8 is:

Thus, calculating using the two methods of straight-line and double-declining balance yields completely different results.

The above is the meaning and various calculation cases in the VDB function, hoping to be helpful to you.

Wishing you all success!