If you find yourself overwhelmed by credit card debt, negotiating a settlement with your card issuer could be a viable option. A settlement involves agreeing to pay a reduced amount, which the company agrees to accept. This arrangement spares both parties the hassle and expense of legal proceedings while safeguarding your credit score. Opting for written negotiations can help prevent misunderstandings. Formalizing the agreement in writing protects both parties' interests.

Steps to Take

Drafting a Settlement Proposal

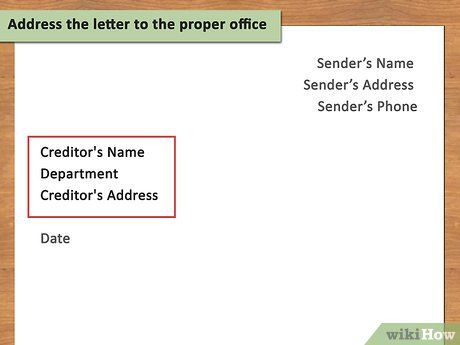

Ensure the letter is directed to the appropriate department. Identify the relevant department within the credit card company responsible for handling settlement offers. This information is typically available online or by contacting the customer service number provided on the card. When contacting the company, express your intention to propose a debt settlement and inquire about the correct mailing address. It's advisable to inquire whether the letter should be addressed to a specific individual, although addressing it to the collections office is usually sufficient. Some companies might request addressing it to a specific individual.

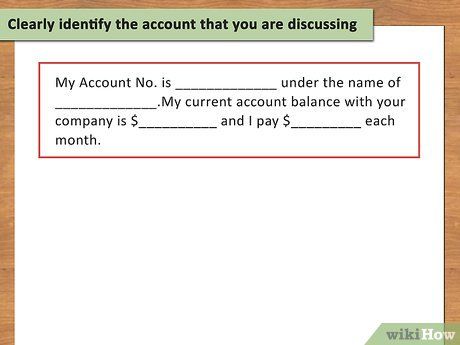

Clearly specify the account under discussion. Begin your letter by clearly stating the account number below the address. This step is crucial, especially if you have multiple accounts with the institution, to avoid any confusion about the account you are seeking to settle.

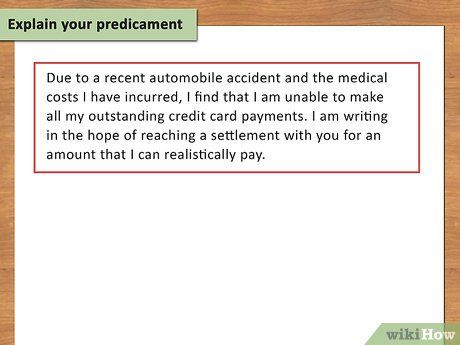

Explain your situation. While maintaining a composed tone, provide a clear explanation for your need to settle your debt. Referencing specific circumstances, such as accidents or divorce, can bolster your case. Conversely, merely acknowledging overspending may undermine your credibility, as it offers no assurance of future financial responsibility.

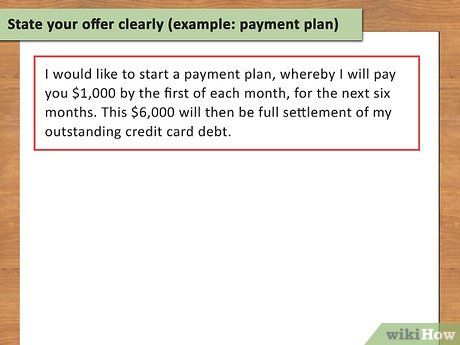

Present your offer unequivocally. Articulate the precise amount you propose to pay, along with whether it constitutes a lump sum or a phased payment plan. Clarity is key in delineating your offer, ensuring mutual understanding between both parties.

Specify a response deadline. Conclude your letter by requesting a response by a specified date, allowing a reasonable timeframe for consideration. Should you not receive a reply by the designated deadline, proactive follow-up is advisable to sustain negotiations.

For Further Negotiations

Preferably communicate with a designated individual. Whenever feasible, direct your correspondence to a specific individual responsible for managing your account. Address any subsequent communication directly to this individual by name.

Reference previous negotiations. In your letters, make mention of prior correspondences or discussions to provide a brief overview of the negotiation history. This helps maintain continuity in the negotiation process.

Propose an updated offer if viable. Negotiations often involve a process of compromise. If you can reasonably improve your offer, include the revised proposal in your letter. Conversely, if you've reached your limit, clearly communicate this stance, leaving the company to decide whether to accept your offer or pursue legal action.

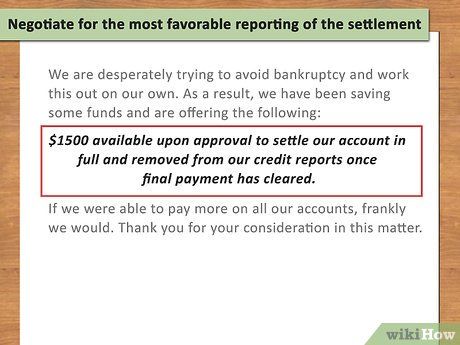

Seek favorable reporting of the settlement. When settling for less than the full amount owed, your credit score may suffer. However, you can mitigate the impact by negotiating how the settlement is reported. Request that the company report your account as 'paid,' as it is the most advantageous option for you. If not possible, suggest 'settled,' as it is preferable to 'charged off' or 'transferred,' which imply non-payment and could lead to collection agency involvement.

For Confirming Resolution

Send a final letter to conclude negotiations. Once a settlement has been reached between you and the credit card company, it's essential to formalize the agreement in writing.

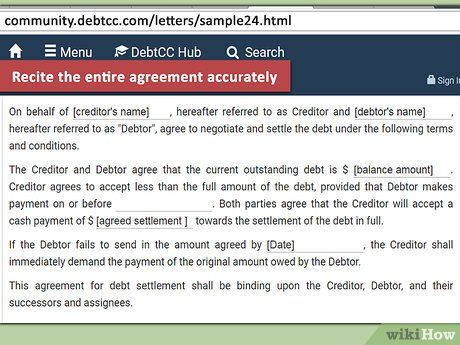

Summarize the agreement accurately. In your final settlement letter, ensure that you accurately outline all terms and conditions of the agreement. Include details such as the agreed-upon amount, payment deadlines (even for immediate payments), periodic payment dates for payment plans, and specify the settlement as 'full and final.' Additionally, address how the debt will be reported to credit agencies, aiming for a designation of 'paid.'

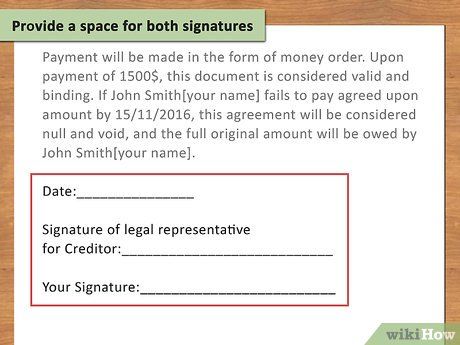

Allocate space for both signatures. Sign the letter yourself and provide a designated area for a company representative to sign, confirming their acceptance of the agreement. Send two copies of the letter, requesting the representative to sign one and return it to you. Include the phrase 'Agreement accepted' above the signature space, with a line for the company representative's signature and date.

Additional Recommendations

- Consider proposing reduced amounts for older debts, typically around 15-25% of the original debt.

- Maintain thorough documentation. Keep records of all correspondence, including letters sent and received, for future reference.

- Prior to initiating debt settlement negotiations, assess your financial capacity to determine what payments you can afford. Evaluate your outstanding debts against your income and available funds, considering your credit score as well.

Important Considerations

- Ensure you have the settlement funds available before drafting the final letter. Failure to fulfill the agreed-upon payment could result in defaulting on the settlement, leading to further complications.

- Maintain thorough documentation by retaining copies of the credit card settlement letter and all related communications, including payment receipts. These records may prove invaluable in the future.

- Be aware of the potential negative impact on your credit score due to a settlement. Any deviation from full, timely payment may result in adverse effects on your creditworthiness.