Essential Steps

Process of Transferring Property from a Trust

Review the Trust Documents

After your parent's passing, the trustee will typically provide notice within a few months. This notice contains vital information about the trust, including a list of beneficiaries and details of the assets held within it.

Reach Out to the Trustee

If your parent's trust designates a trustee, they will handle the administration and distribution of assets. Identify the trustee, whether an individual or institution, and initiate contact.

Pro Tip: Consider hiring a trust attorney if you're designated as the trustee. Their expertise ensures compliance with legal obligations and effective trustee duties.

Allow Time for Debt Settlement

The trustee is tasked with managing creditors and tax obligations, often involving asset liquidation to satisfy debts. Typically, this process concludes within a year, ensuring timely distribution to beneficiaries.

Finalize Property Transfer Documents

Upon debt resolution, documents facilitating property transfer vary based on asset type. While personal property may require no formalities, real estate and titled property demand specific documentation for ownership transfer.

Navigating the Probate Process

Review the Will

Examining your parent's will is a crucial step to understand their wishes regarding property distribution. Seek emotional support if needed, as this can be a challenging task.

Insight: In cases of significant assets, like real estate, probate may be necessary even without a will. State laws dictate asset distribution in the absence of a will.

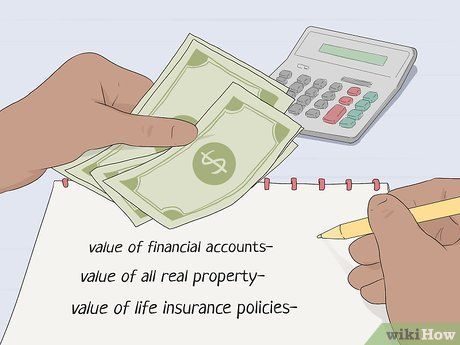

Determine Estate Value

Assessing your parent's estate value is pivotal for probate procedures. Simplified processes may apply for smaller estates, while larger ones require formal probate.

Pro Tip: Assets exempt from probate, such as life insurance policies, aren't factored into estate valuation.

Appoint a Personal Representative

The personal representative oversees estate administration, including debt settlement and asset distribution. If named in the will, follow their designation; otherwise, select a capable individual.

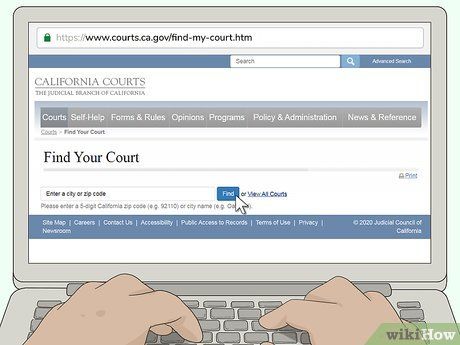

Select the Appropriate Probate Court

Identify the probate court based on your deceased parent's residence or property ownership. In some cases, proximity to where your parent spent their final days may influence the choice of court.

Submit the Will to the Court Clerk

Some probate courts require submission of the will before initiating the formal process. Contact the clerk's office for specific guidelines, and ensure to keep copies for your records.

Complete the Probate Application

Utilize the provided form for simplified procedures or enlist an attorney for formal probate. Filing fees vary and are typically reimbursed from the estate.

Engage Legal Representation

Consider hiring an attorney to navigate estate administration, especially if designated as the personal representative. Ensure compatibility and seek multiple consultations before finalizing your choice.

Insight: Attorney fees for estate administration are typically governed by state laws, occasionally subject to court orders.

Participate in Court Proceedings

Attendance at court hearings is necessary for property distribution. Simplified procedures may require only one court appearance, whereas formal probate may involve multiple hearings, especially for property approval.

Completing an Affidavit

Compile a List of Heirs

Document all living relatives of your deceased parent and their relationship to you. If no will exists, being the next of kin is typically necessary for property transfer. Otherwise, obtain affidavits from other potential heirs renouncing their claims.

Request Affidavit Forms

Inquire with financial institutions for specific affidavit forms tailored to your parent's assets. Alternatively, state court websites may offer appropriate forms. Ensure all required information is included for smooth property release.

Complete Necessary Affidavits

Provide details of your parent's passing and any related court proceedings. If multiple heirs are involved, ensure their signatures on the affidavits. Notarization may be required for absent signatories.

Insight: While notarization of affidavits may not be mandatory in all states, it's advisable as some institutions may require it for processing.

Collect Property Ownership Documents

In addition to the death certificate, gather necessary documents proving your parent's ownership. Institutions holding the property will provide specific requirements.

Submit Affidavits to Relevant Authorities

For titled property, submit affidavits to the local title office. For financial accounts, submit to the respective institutions. Personal property without documentation can typically be claimed directly.

Valuable Insights

Important Notes

- After the passing of a parent, there's typically a waiting period of around a month before you can proceed with the property transfer process. Timeframes may vary depending on the state regulations.

- This guide focuses on property transfer procedures following a parent's demise in the United States. If you reside in another country, it's advisable to seek guidance from a local estate planning attorney as regulations may differ.