Benefits of Borrowing Money on Momo

Need to shop or pay bills but payday hasn't arrived yet? Don't fret! Momo is an electronic wallet offering numerous conveniences. Most notably, you can easily borrow money through Momo. Let's explore the benefits of borrowing money on Momo together.

Easy Registration, No Proof of Income Required

Guide to Borrowing Money on MomoCompletely simple, just within one minute, no need for complex paperwork or cumbersome financial proofs. During that time, Momo's data processing system will check and determine whether you are eligible to use Momo's Deferred Payment Wallet or not, complying with the standards set by TPBank, as well as determining the credit limit.

Simple operations

Simple operationsTransparent, easy to calculate

With Momo's Deferred Payment Wallet on the Momo app, you won't have to pay for activation or interest for loans if users pay on time as agreed. Late interest will be calculated based on the actual borrowed amount and the number of days overdue, completely eliminating the phenomenon of 'principal generating additional interest' that causes worry and hesitation for many people.

Transparent, fast borrowing

Transparent, fast borrowingDiverse payment methods

With a vast number of retailers collaborating with Ví Momo, the scope of payment options using Momo Deferred Wallet is continually expanding. The range of products/services being developed by Ví Momo is constantly evolving. Starting from utility bills such as electricity, water, internet, cable TV, condo fees, tuition fees, ... Up to now, users of Momo Deferred Wallet can use it to make payments at chain stores, supermarkets, or online shopping platforms,...

Numerous different payment methods are available.The process of borrowing money via Momo is also extremely straightforward. To view the services available for payment, you simply need to find Momo Deferred Wallet in the Momo app and open the Payment Services section.

Numerous different payment methods are available.The process of borrowing money via Momo is also extremely straightforward. To view the services available for payment, you simply need to find Momo Deferred Wallet in the Momo app and open the Payment Services section.Not subject to nuisance calls

Unlike other online or direct borrowing methods, when using the Momo wallet, users are reminded to make payments directly on the app, without causing any disturbance or fatigue. When you want to repay a loan, you just need to make a few simple and quick touches.

Various ways to borrow money on Momo

When borrowing money on Momo, users can completely forget about annoying debt reminders, even avoiding facing threats as when borrowing from loan sharks.

Guide on how to borrow money easily and quickly on Momo

Borrowing money on Momo is very easy, however, if it's your first time, Mytour is sure that there will be quite a few of you who don't know how to proceed correctly. If you're still unsure about

how to borrow money quickly on Momo, here's

a guide to borrowing money on Momo:

Choosing the loan amount

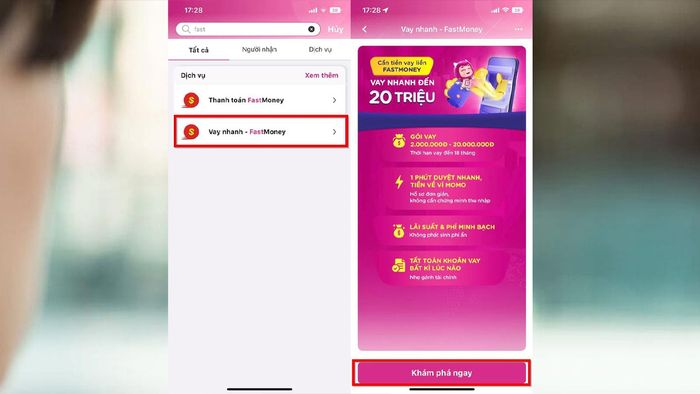

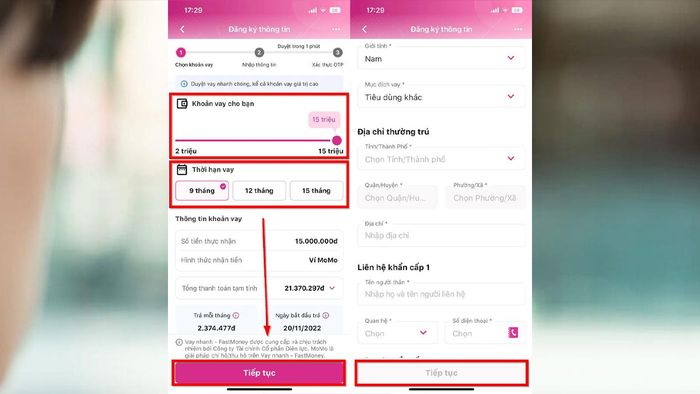

Click on the 'Borrow now' button to open the Momo app, then select the desired loan amount and term.

Register your information

To complete the borrowing process, you need to fill in your personal information and identity card number (ID) in the Momo app.

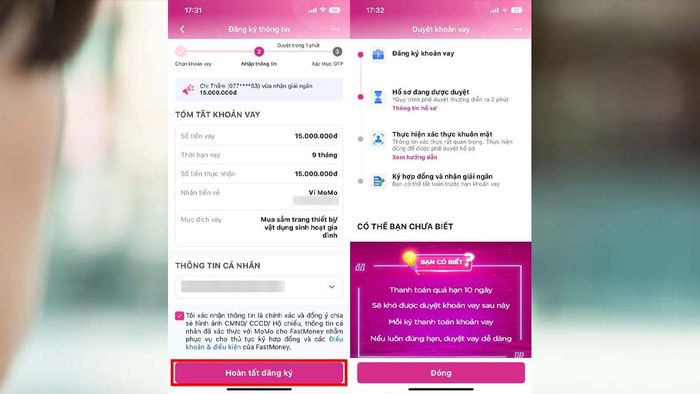

Signing the contract

Users need to enter the OTP (One-Time Password) sent via SMS to confirm and sign the loan agreement. After entering the correct OTP, the contract signing process will be completed.

Waiting for approval and disbursement

After completing the information input and signing the contract, you just need to wait for your application to be approved. Typically, the process of reviewing applications and disbursing funds into your Momo Wallet takes only about 1 minute. You will receive the borrowed amount immediately in your Momo account once your application is approved.

Frequently asked questions

In addition to the benefits mentioned when borrowing from Momo, users also have many questions about how to borrow money on Momo. Below are frequently asked questions when users use the borrowing service of Momo wallet, please refer:

What is borrowing money quickly on Momo?

Quick Loan is a modern financial service providing consumer loan products. This product is provided by two companies:

- Electricity Finance Joint Stock Company (EVN Finance), in collaboration with service provider company Amber Fintech.

- MB Shinsei Co., Ltd.

Conditions for quick loans on Momo

To experience the Quick Loan product, you need to be a Momo e-wallet customer and have completed account verification. Moreover, you also need to be on the list of customers allowed to experience the Quick Loan product.

How much can you borrow quickly on Momo?

Quick Loan currently offers loan packages of up to 20 million dong for customers. However, the lending institution will decide which loan packages to provide to customers. For detailed information, please contact the hotline of the following partners:

Note:

- The lending institution will be decided by Momo.

- Payment information displayed on the loan package selection screen is an estimated amount and may vary depending on the actual disbursement date.

An article guiding how to borrow money quickly and easily on Momo

An article guiding how to borrow money quickly and easily on Momoprovides a convenient and popular financial solution for users nowadays. However, to ensure a smooth borrowing experience on Momo without any trouble, users need to understand the procedural process clearly. We hope that you will choose a reputable loan provider to solve any financial difficulties encountered.

- See more articles in the same category: Momo Wallet, app