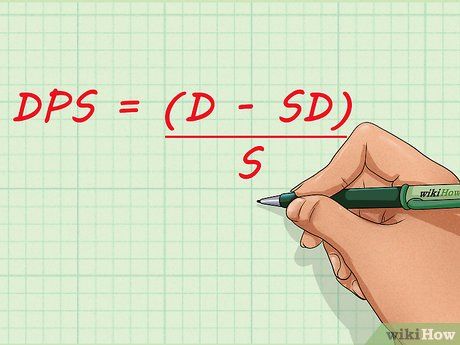

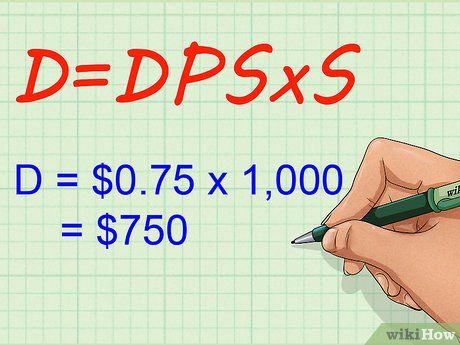

When a corporation earns profits, it generally faces two primary options. Firstly, it can reinvest these earnings back into the company by expanding its operations, purchasing new equipment, and similar ventures. (Expenditure in this manner is termed 'retained earnings.') Alternatively, it can allocate its profits to compensate its shareholders. Payments made to investors in this manner are termed 'dividends'. Calculating the dividend due to a shareholder from a company is usually quite straightforward; simply multiply the dividend paid per share (or 'DPS') by the number of shares you possess. Additionally, you can determine the 'dividend yield' (the percentage of your investment that your stock holdings will pay you in dividends) by dividing the DPS by the price per share.

Steps

Dividends Estimator

Dividends Estimator

Dividends EstimatorCalculating Total Dividends from DPS

- You can typically find D and SD on a company's cash flow statement and S on its balance sheet.

- Keep in mind that a company's dividend-payout rate may fluctuate, affecting the accuracy of your future dividend estimations.

- For instance, if you own 1,000 shares of a company that paid $0.75 per share in dividends last year, applying the formula yields D = 0.75 * 1,000 = $750. Hence, you can expect to earn approximately $750 if the company maintains a similar dividend amount this year.

- Various types of calculators are available for similar investment computations. For example, this calculator operates inversely, determining DPS based on total dividends and your shares.

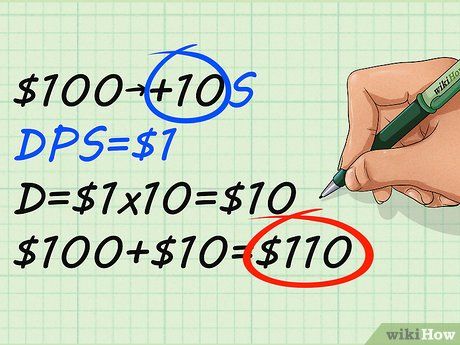

If you participate in a dividend-reinvestment plan, ensure you maintain an accurate record of your share holdings for precise calculations.

-

- For example, suppose you receive $100 annually in dividends from an investment and opt to reinvest this amount in additional shares each year. If the stock is priced at $10 per share and offers an annual DPS of $1, investing your $100 will yield ten more shares and an extra $10 in dividends annually, totaling $110 the following year. Assuming the stock price remains constant, you could purchase eleven more shares the subsequent year, and approximately twelve the year after. This compounding effect continues as long as you allow it, provided the stock price remains stable or rises. Many individuals have accumulated substantial wealth through this dividend-focused investment approach, although, of course, there are no guarantees of extraordinary results.

Calculating Dividend Yield

To begin, ascertain the current share price of the stock under examination.

- To find the latest stock price for publicly-traded companies (like Apple), visit the website of major stock indexes such as NASDAQ or S&P 500.

- Remember that a company's stock price can vary based on its performance, potentially affecting the accuracy of dividend yield estimates if there are significant price fluctuations.

- As previously mentioned, you can usually find D and SD on a company's cash flow statement and S on its balance sheet. Also, bear in mind that a company's DPS can change over time, so use recent data for accurate results.

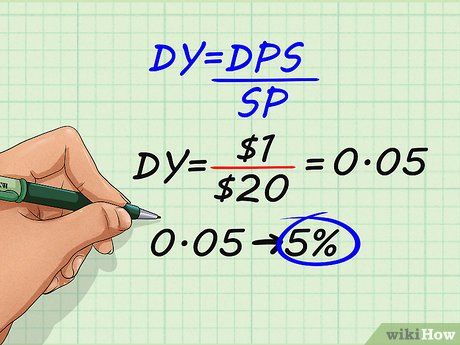

- For example, if you own 50 shares of a company bought at $20 per share and the recent DPS is around $1, the dividend yield can be calculated as DY = DPS/SP; thus, DY = 1/20 = 0.05 or 5%. This means you'll earn back 5% of your investment in dividends, regardless of the investment amount.

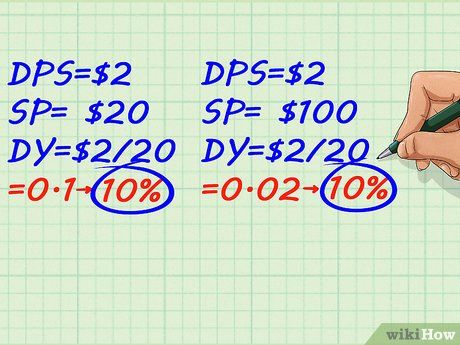

- For example, consider two companies offering $2 per share in dividends. Despite the equal dividend payments, the company trading at $20 per share offers a better deal. With each share earning 10% of the initial investment annually, compared to 2% for the $100-per-share company.

Pointers

-

Refer to a company's prospectus for detailed dividend information on a specific investment.

Cautions

- Keep in mind that not all stocks or funds offer dividends. Some focus on growth, where investment returns come from share price appreciation upon selling. Additionally, struggling companies may choose to reinvest profits rather than distribute them to shareholders.

- When calculating dividend yields, it's assumed that dividends will remain consistent. However, this assumption is not a guarantee.