Initiating a marijuana edibles venture in California might present fewer obstacles than entering the cannabis sector as a cultivator. Although you'll still need to navigate local and state licensing protocols for manufacturing and distributing cannabis products, you won't encounter the substantial expenses and permits linked with cultivating cannabis plants. In California, there's currently a single regulatory framework for both medical marijuana and adult-use marijuana enterprises. Consequently, the registration and licensing procedures for edibles ventures in California are almost identical—whether you're targeting medical or non-medical markets! Below, we'll provide you with a step-by-step manual for kickstarting your own cannabis edibles venture in California.

Steps

Establishing Your Business

Review your local regulations. Although Proposition 64 legalized marijuana in California, numerous cities and counties have individual ordinances that may restrict cultivation, manufacturing, or sale of cannabis products (whether medical or recreational). Before launching your venture, conduct an online search for “cannabis ordinances” along with your city and county name to ensure the legality of your edibles business.

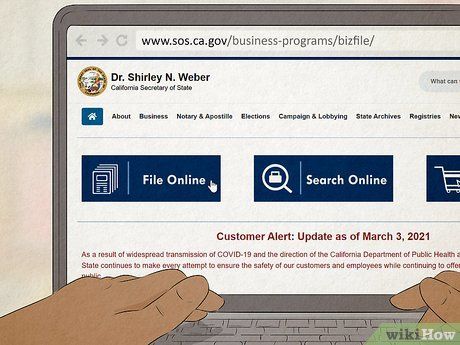

Officially register your business with the California Secretary of State. Choose a distinctive and memorable name for your edibles enterprise. Then, determine whether to register as a Corporation (including for-profit and nonprofit), Limited Liability Company (LLC), Limited Liability Partnership (LP), or Sole Proprietorship (SP). Each entity type comes with its own tax structure and level of personal liability—consult the California Secretary of State website to determine the best fit for you!

- Begin with a Statement of Registration, followed by a Statement of Information within 90 days.

- Sole proprietorships are exempt from registration.

- Registration fees are $75 for an LLC and $105 for a corporation.

- Nonprofit incorporation is possible, but cannabis industry nonprofits do not receive tax exemption in California.

- Visit https://www.sos.ca.gov/business-programs/bizfile/ for registration.

Develop a business plan. Your business plan should outline your company's operations, organizational structure, competitors, product offerings, and marketing/sales strategies. For cannabis businesses, a comprehensive business plan is essential for securing funding (discussed later).

- Consider whether you'll produce your own edibles or rebrand existing products for your edibles business. Regardless, the state classifies you as a “manufacturer,” but your choice will influence the types of suppliers you pursue.

- If you plan to rebrand, seek co-packers; if you're making your own edibles, source wholesale cannabis oil/plant products.

Secure private investment or obtain a grant through a social equity program. Since cannabis remains federally illegal (despite state legality in California), major banks won't provide loans to cannabis businesses. Seek third-party investors and craft a compelling pitch highlighting your business's value.

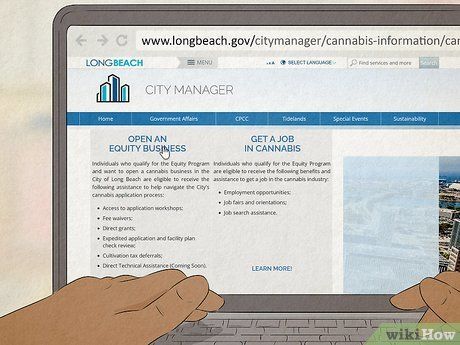

- Some cities/counties prioritize applications and offer grants to individuals affected by the War on Drugs and cannabis criminalization.

- Cities supporting “equity applicants” (and potentially offering grants) include Humboldt County, Coachella, Rio Dell, Long Beach, Los Angeles, Oakland, Sacramento, the City and County of San Francisco, and San Jose.

- Apply for grants through your city's website or search for your city's 'cannabis social equity program.'

- On average, launching a legal edibles business and sustaining it through the first year costs approximately $250,000.

Municipal Licensing for a Medical Marijuana Enterprise

Find a suitable property compliant with local zoning regulations. While you won't need to secure a greenhouse or cultivation site, ensure your chosen city permits dispensaries or cannabis product manufacturing. Statewide, cannabis businesses cannot operate within a 600-foot radius of a K-12 school or daycare facility, with potential additional distance requirements from your local city or county.

- In California, cannabis businesses cannot operate from a private residence or require passage through an alcohol or tobacco retail establishment.

- Remember, licensed businesses must adhere to regulations ensuring safety and product quality.

Compile documentation outlining your business procedures. Each city and county will have specific document requirements for obtaining a permit. Generally, you'll need to detail chemical storage and disposal methods, cannabis security measures, and ensure that marijuana edibles marked as 'Medical Use Only' are exclusively distributed to medical marijuana users.

- You may also need to outline your product preparation and testing procedures to ensure safety.

Submit an application for city and/or county licensing. Before applying for a state license, California mandates obtaining local permits. Licensing criteria usually involve premises inspections, fingerprinting, zoning checks, and more.

- Local fees vary significantly, often totaling thousands of dollars.

- For example, initial fees in the City of Santa Cruz amount to approximately $2,000 for a medical marijuana business, while in the City/County of San Francisco, they can reach around $12,500.

State Licensing for Edibles Manufacturing and Sales

Register with the California Department of Tax and Fee Administration (CDTFA). If you're involved in cultivating, processing, manufacturing, selling, or distributing cannabis, you must obtain a seller’s permit from the CDTFA before applying for a license from the Department of Cannabis Control. Additionally, if you plan to distribute cannabis and manufacture it, you must register for both a cannabis tax permit and a seller’s permit.

- There is no fee for obtaining a California seller’s permit or tax permit.

- If you distribute cannabis, you'll be subject to two cannabis taxes (from the cultivator and the customer) payable to the CDTFA.

Obtain licensing from the California Department of Cannabis Control. If you intend to manufacture edibles and extract cannabis oil/products, you'll need either a Type 6 or Type 7 license. For infusing cannabis oil or plant material into products, a Type N license is required. Alternatively, if you plan to repackage cannabis products, you'll need a Type P license. Additionally, you'll need a Type 10 license for a storefront or a Type 9 license for online/delivery sales.

- Choose Type 9 over Type 10 if high rental costs or zoning restrictions make physical dispensaries impractical.

- These permits typically cost upwards of $2,000. For instance, a Type 10 retailer license costs $2,500 for businesses with gross revenues of $500,000 or less.

- License fees increase with revenue, potentially reaching up to $96,600 annually for businesses with multi-million dollar revenues.

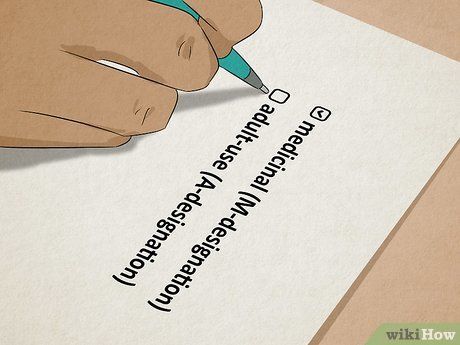

Select an M-designation on your license for producing and selling products labeled as “Medical Use Only.” When obtaining your license, you have the option to indicate whether your business will focus on medicinal (M-designation), recreational (A-designation), or both. Despite the Medicinal and Adult-Use Cannabis Regulation and Safety Act (MAUCRSA) enacted in 2017, licensing procedures for M-designated and A-designated dispensaries are identical. However, there are distinct THC limits for medical and non-medical products.

- Edibles labeled for medical use must not exceed 500 milligrams of THC per package.

- Non-medical edibles must not exceed 100 milligrams of THC per package.

- If you opt for an M-designation, you must clearly mark your “Medical Use Only” products and sell them exclusively to customers possessing a medical marijuana license. Patients must be certified by a healthcare professional through the state’s medical marijuana program, which entails evaluating the patient’s medical history and current condition.

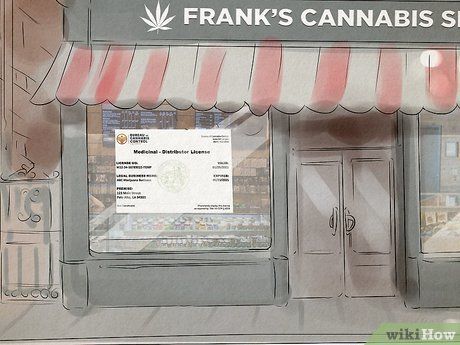

Display your license prominently. Retrieve your certificate from the licensing system and prominently display it in your storefront (or manufacturing facility if you operate without a physical storefront). After obtaining all necessary permits and meeting requirements, it’s essential to inform authorities and customers that your business is operating legally!

- Your license remains valid for one year.