Opting for a career in banking presents promising opportunities. Whether you're seeking temporary employment or a lifelong profession, working in a bank can propel your professional growth. There are diverse roles available, ample chances for career advancement, and attractive employee benefits awaiting you. With a strong resume and the required qualifications, you can successfully land a job in banking.

Procedures

Qualifications Needed to Work at a Bank

Evaluate potential bank positions based on your qualifications. Beyond the teller role commonly associated with banks, there exist various other positions with distinct requirements, duties, and salary scales. Consider your qualifications carefully to determine the most suitable position for you.

- Teller: Responsible for handling transactions at the front desk, tellers need skills in basic arithmetic and customer service. While a high school diploma suffices for many, some banks may prefer candidates with some college education. Typically, tellers receive hourly wages, making it a common choice for individuals pursuing higher education or awaiting advancement opportunities.

- Manager: Overseeing day-to-day operations, managers supervise staff, manage schedules, and achieve sales targets. This role commands higher responsibility and salary. Banks typically require a bachelor's degree in management, business, or a related field. Managers may be hired externally or promoted from diligent tellers.

- Accountant: Responsible for managing financial records, accountants enjoy salaries comparable to managers. A bachelor's degree in accounting, finance, or a related field is typically required for this role.

Pursue higher education if your desired position mandates it. Certain roles in banking necessitate a college degree. Once you've identified the bank job you're interested in, ensure you meet the educational prerequisites.

- For teller positions, a high school diploma is typically required. If you haven't completed high school, obtaining your GED is necessary. Refer to Get a GED for advice on achieving this.

- Managerial and accounting roles usually mandate a bachelor's degree. Focus your studies on fields such as finance, business, management, or accounting to acquire the requisite skills for these positions.

Consider accepting a lower-paying position at a bank if you're aiming for a higher role. If your goal is to secure a managerial position or higher, gaining experience is crucial. Working as a teller while pursuing your degree demonstrates familiarity with bank operations. By the time you graduate, you'll have amassed valuable experience to outshine competitors in the job market. Additionally, you'll develop a vital network of contacts who may assist you in securing future employment opportunities.

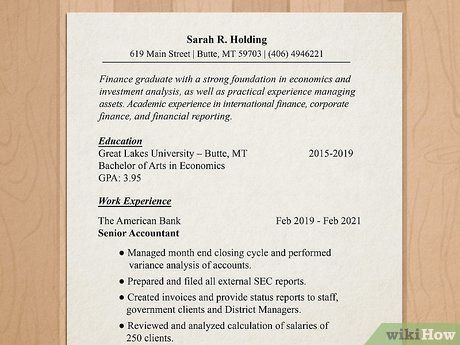

Craft a comprehensive resume. Regardless of the position you're applying for, a well-crafted resume is indispensable. Refer to Make a Resume for detailed guidance on creating a compelling resume. However, ensure your resume highlights specific aspects relevant to a bank job.

- Highlight your customer service expertise. Since most bank roles involve interacting with customers, proficiency in customer service is paramount. Any prior roles involving customer interaction—such as cashier, stock clerk, pizza delivery, barista, or fast food worker—should be emphasized. Given banks' focus on providing financial services to customers, your customer service skills are invaluable.

- Volunteer experience also contributes to your customer service credentials. For instance, volunteering at a summer camp likely involved interacting with campers and parents. Include such experiences to further illustrate your qualifications.

- Mention any experience handling money. Roles like cashier or delivery driver involve handling cash and managing transactions. These skills are relevant since bank jobs often entail regular money-handling tasks.

- Customize your resume for each application. Tailoring your resume to specific job requirements increases your chances of securing an interview.

Finding Bank Employment Opportunities

Utilize your personal network. Banks, like many industries, frequently prioritize referrals when hiring. Before submitting applications indiscriminately, explore your personal connections within the industry. Do you have relatives working in banks? Perhaps a former teacher works as a financial analyst. Reach out to these contacts to inquire about job openings or seek recommendations. Networking plays a pivotal role in the job market. Previous experience in banking or relevant internships provides a distinct advantage in building connections.

Enhance your presence on professional social media platforms. Platforms like LinkedIn provide avenues to showcase your qualifications to peers in your field. Job postings are frequently listed on LinkedIn, offering potential leads for job opportunities. An impressive profile can boost your visibility in the job market and expand your professional connections.

Utilize your school's career services if you're still enrolled. Employers often collaborate with university career offices, expecting to find qualified candidates from academic institutions. Stay engaged with your career office, subscribing to job alerts for timely notifications. These resources can be invaluable during your job search.

Engage with employees at nearby banks. Your local bank can serve as a prime starting point for exploring banking careers. Strike up conversations with tellers and managers during your visits. Once rapport is established, express your interest in pursuing a banking career. They may inform you of job openings, provide referrals, or offer valuable career guidance. Cultivating such personal connections is essential for career advancement.

Explore online job listings. Websites like Craigslist, Monster, and CareerBuilder are common platforms for businesses to advertise job openings. Browse these sites for banking job opportunities during your job search.

Visit local banks in person. While banks primarily rely on referrals for hiring, in-person visits can still yield results. Create a list of banks in your vicinity and gather their contact details.

- Visit each bank on your list and inquire about job openings relevant to your interests. While phone calls are an option, face-to-face interactions are more conducive to establishing relationships with potential employers.

- Even if they claim to have no current openings, always carry copies of your resume to leave behind in case of future opportunities.

Applying for the Job

Research the bank you're applying to. Prior to submitting your application, it's essential to conduct thorough research on both the position and the company. Familiarize yourself with the bank's mission statement and strategic initiatives. Incorporate this knowledge into your cover letter to demonstrate why you're a suitable candidate. Additionally, this research will benefit you during any subsequent interviews, showcasing your dedication and preparation.

Submit your resume and cover letter. Whether you're being referred by a bank manager or responding to an online job posting, ensure to send your resume and cover letter. Refer to Write a Cover Letter for guidance on crafting an effective cover letter.

- Include information in your cover letter regarding how you learned about the position and any referrals you may have. This personalized approach highlights your genuine interest and enhances your chances of securing the job.

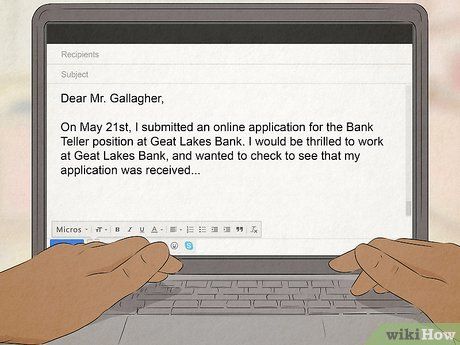

Follow up after submitting your application. The appropriate timing for follow-up varies depending on the circumstances of your application submission.

- If you applied through a job site, it may take several weeks for the company to review applications. Consider waiting at least a month before following up.

- If you were referred and submitted your application directly to a contact person, waiting a week or two before following up is reasonable. They likely have fewer applications to review and may have already assessed yours.

Prepare for the interview. If you're invited for an interview, take the time to prepare adequately. Refer to Prepare for a Job Interview for valuable insights on ensuring a successful interview. For a bank position, consider the following tips:

- Reflect on instances where you've successfully handled challenging customer interactions. Given the emphasis on customer service in banking roles, highlighting your proficiency in this area is crucial.

- Demonstrate familiarity with the company by incorporating relevant information into the conversation, such as the bank's mission statement.

- Mention any referrals you have for the position.

- Ensure your attire is professional, as bank employees are expected to maintain a polished appearance. Men and women should opt for business attire.

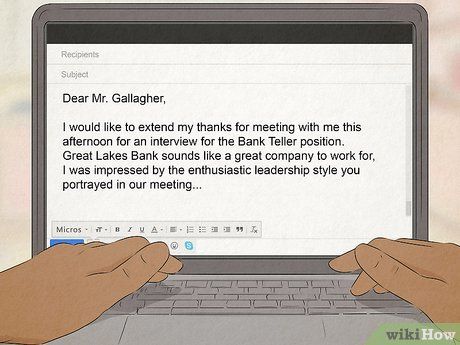

Send a follow-up email post-interview. It's advisable to send a thank-you email to the interviewer within a few days of the interview. Express gratitude for the opportunity, reaffirm your interest in the position, and convey your willingness to continue the discussion. Following this, await further communication regarding the interview outcome.

Advice

-

When communicating via phone, maintain a polite, professional, and confident demeanor.

-

Having sales experience is highly advantageous. Highlight any relevant sales experience you possess.

Caution

- Ensure honesty on your resume, but emphasize organizational skills and relevant experience.