Understanding how to manage personal finances is crucial, yet financial literacy often goes unaddressed in educational settings. Whether your child or student is in primary school or nearing adulthood, educating them about finances can lay the groundwork for their future success. Commence by teaching them about budgeting and expense management. Elucidate the concept of credit, its significance, and responsible credit card usage. Emphasize the value of saving and introduce fundamental investment strategies. Given that money management can seem abstract and intricate, leverage apps and other tools to simulate tangible real-life scenarios.

Procedures

Initiating Budget Oversight

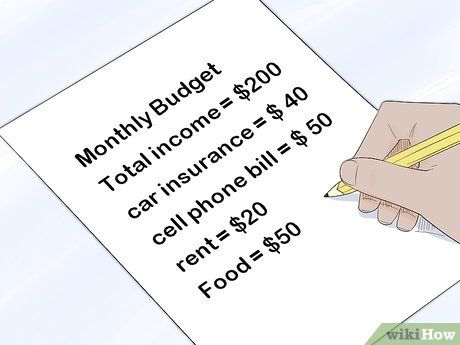

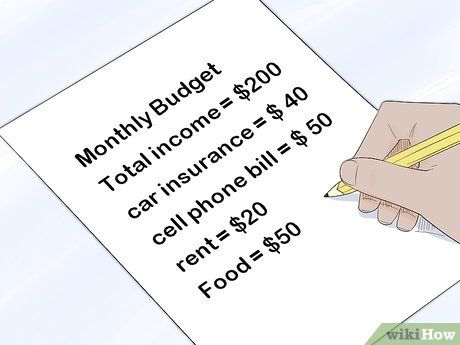

Demonstrate accurate income and expense estimation. Create a spreadsheet or draft a mock monthly budget using pen and paper. Outline total income and categorize expenses, such as car payments, insurance, cellphone bills, and entertainment expenses.

- Emphasize that income and expenses may vary monthly, highlighting the importance of continuous tracking.

Customize the example budget to suit your student or child. For example, incorporate your teenager’s actual income and expenditures from the previous month. Detail their after-tax earnings from their part-time job and tally up expenses like car insurance, cellphone bills, clothing, haircuts, and social outings.

- Begin with these simple illustrations, then progress to a more intricate sample budget encompassing rent, utilities, and groceries.

- For younger students, utilize straightforward figures, such as a $10 weekly allowance and expenses for treats, toys, and other small items.

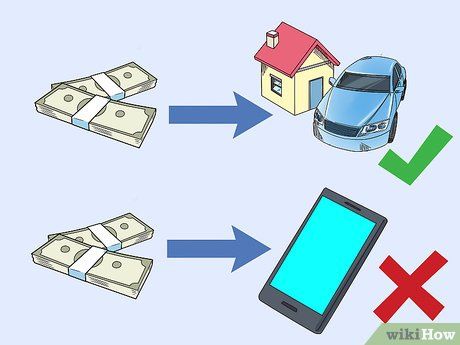

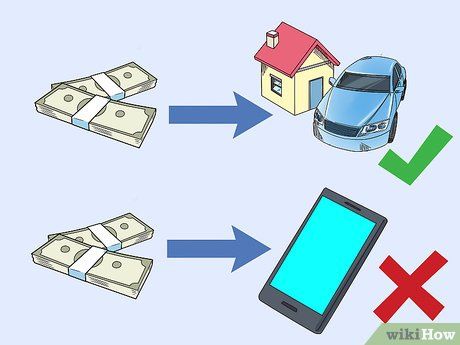

Clarify the distinction between needs and wants. Explain to your learner that essentials like housing, utilities, and other basic bills take precedence. When finances are tight, prioritizing rent or car insurance outweighs dining out or purchasing a new cellphone.

- Subtract their expenditures from income and discuss how balancing needs and wants influences their budget. Prompt them to pinpoint primary needs and discretionary wants that can be trimmed to save money.

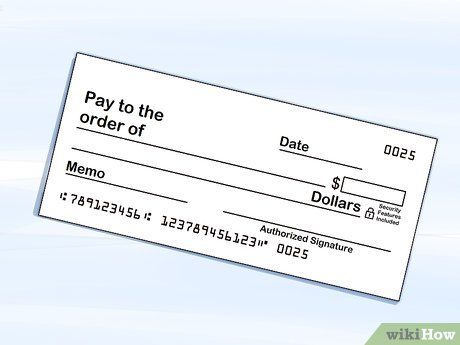

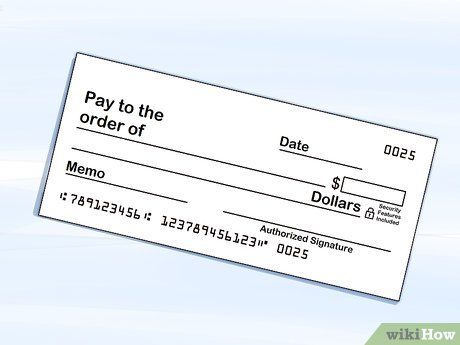

Demonstrate the process of making bill payments. Highlight that the primary methods for bill payment are through checks or debit cards. Display a physical check and outline how to complete the date, payee, payment amount, and signature sections. Then, navigate to an online bill payment platform and illustrate how to input debit card billing details.

Introduce the significance of saving money. While saving money warrants its own dedicated lesson plan, you must touch upon it during your budgeting explanation. Emphasize the importance of setting aside 10 to 20 percent of their income and emphasize the need to increase savings as they grow older.

- Incorporate specific reasons for saving, such as for emergencies, home down payments, and retirement.

- You can also instruct them to establish separate savings accounts to facilitate savings for multiple objectives. Demonstrate how they can physically allocate money into distinct jars or envelopes to monitor their savings progress.

EXPERT ADVICE

Paridhi Jain

Early financial education empowers children to make informed money decisions as adults. Start teaching children about money early on. Kids can begin understanding basic concepts such as currency exchange rates, interest on savings, and the relationship between money and work. Establishing this groundwork through practical life lessons will instill positive financial habits that last a lifetime.

Utilize budgeting tools to replicate real-life situations. Once the fundamentals are covered, encourage your learner to create and manage hypothetical budgets using smartphone applications. Personal finance simulations offer tangible, relatable examples and reinforce budgeting skills.

Understanding Credit and Debt

Define credit and its wide-ranging impacts on life. Explain that credit entails borrowing money from a lender with the expectation of repayment by a specified date or with added interest. Emphasize that failure to repay credit obligations can hinder access to leases, mortgages, vehicles, employment, and other essential aspects of life.

- Comprehending credit is a crucial initial step towards financial literacy. If the individual already carries some debt, you can also assist them in devising a basic repayment strategy for managing that debt.

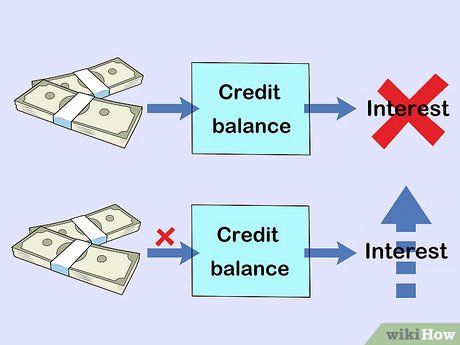

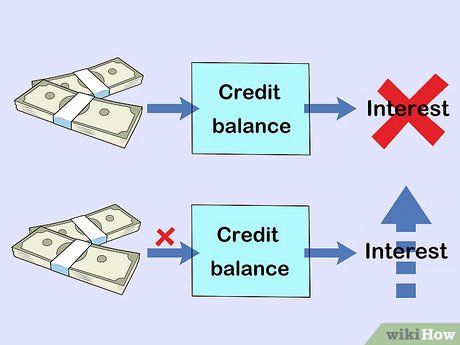

Illustrate how interest functions. Clarify that paying off a credit card balance by its due date eliminates the need to pay interest. Highlight that individuals with better credit profiles typically receive lower interest rates on credit cards, mortgages, and auto loans. Explain that interest on a loan can compound if left unpaid, becoming part of the principal, or the original loan amount.

- Draw a comparison between a credit balance and library books to aid comprehension. Just as returning a borrowed book eliminates additional charges, paying off a credit card balance by its due date avoids accruing additional costs, or interest.

Elaborate on how credit scores are determined. Inform your student that building a favorable credit score requires time and effort. Outline that credit scores consider factors such as payment history, outstanding balances, length of credit history, recent credit inquiries and account openings, and variety of credit types. Emphasize that a low credit score can impede access to loans, leases, employment opportunities, and other essentials.

Emphasize the significance of responsible credit card usage. Stress to them that while possessing a credit card is pivotal for establishing credit, it must be wielded responsibly. Reinforce the notion that a credit card should not be used for purchases beyond one's means. Use the library book analogy to underscore the importance of settling a balance by the due date.

- Highlight that allowing a balance to accumulate and credit card debt to escalate can severely impact their credit score.

Explaining Savings and Investments

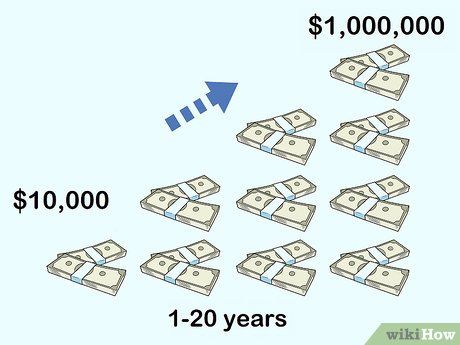

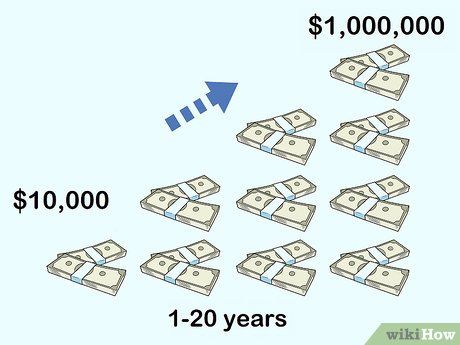

Highlight the significance of saving and increasing wealth. Reinforce the importance of saving for various purposes, from emergencies to retirement. Explain that money has the potential to grow through proper investment. Acknowledge the associated risks, but emphasize that a $10,000 investment can yield tens of thousands of dollars over a 20-year period.

Explain the functionality of checking and savings accounts. Outline that a checking account is primarily used for transactions, while a savings account serves as a place to accumulate funds. Note that both types of accounts accrue interest, with savings accounts typically earning higher interest rates and intended for long-term savings.

- Encourage the habit of automatically setting aside a portion of income into savings, such as allocating $25 from each paycheck to a savings account.

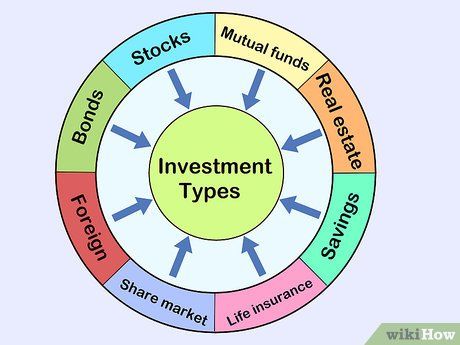

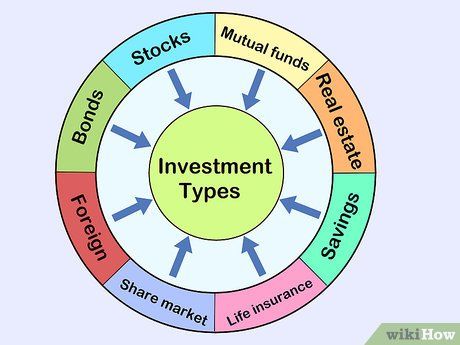

Detail the various investment options. Advise the learner to consider investing in the stock market as they mature, highlighting its potential for long-term wealth growth despite associated risks. Discuss the fundamental types of investments available.

- Stocks represent partial ownership in a company, with increased value if the company performs well.

- Mutual funds and exchange-traded funds (ETFs) pool funds from multiple investors to diversify investments, mitigating risk.

- Bonds involve lending money to governments or businesses for fixed interest rates over specified periods, offering lower risk but lower returns.

Address risk and diversification. Following the introduction of investment types, underscore the varying levels of risk associated with each. Stress the importance of diversification to mitigate risk, explaining that investing in multiple companies and asset classes is essential for a balanced investment portfolio.

Utilize stock market simulations to emulate investment scenarios. Following foundational knowledge, engage the student in investment simulation activities. Smartphone applications can simplify complex investment concepts and make them more tangible and comprehensible.

Helpful Advice