Obtaining a Central Know Your Customer number for investment purposes

A Central Know Your Customer (CKYC) number is legally mandated in India for individuals intending to invest in mutual funds or other financial assets. Possessing a CKYC number demonstrates to financial regulators that you are a legitimate investor and aids in identity verification. The process of obtaining a CKYC number is relatively straightforward, and once acquired, it does not require reapplication. By providing essential personal documents and completing the application form accurately, you can obtain your CKYC number and commence investing promptly.

Key Points to Note

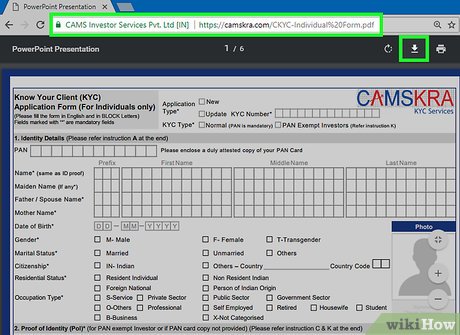

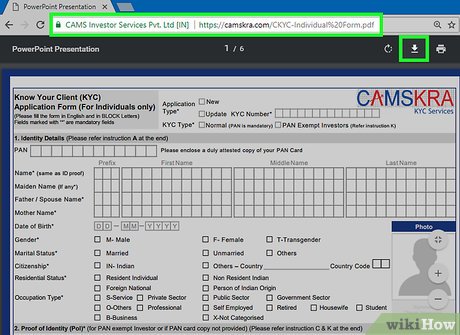

- Download and print the official CKYC application form. Fill in your personal details as per the form's guidelines.

- Provide your Permanent Account Number, along with proof of identity and address such as passport number or driver's license.

- Submit the completed form along with a passport-sized photograph to the local registrar's office.

Procedures

Procedure for CKYC Number Application

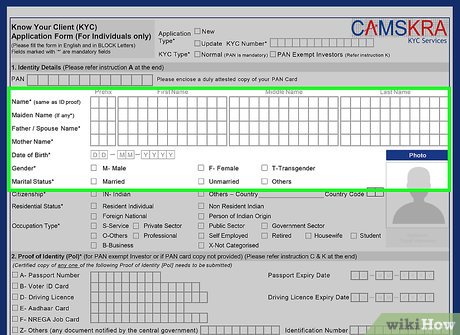

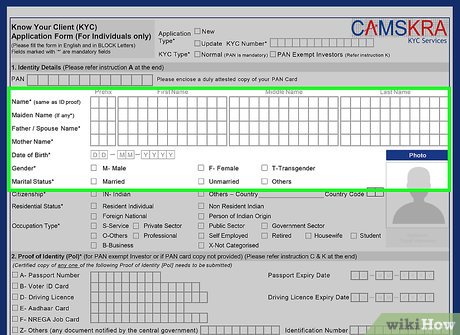

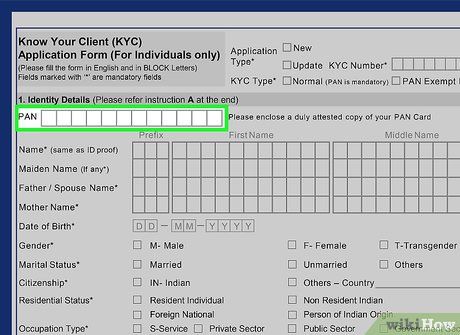

Provide essential personal details on the form. Fill in your full name, as well as the full name of your father or spouse. Additionally, include your date of birth, gender, occupation, and marital status.

- Specify your citizenship level and residential status.

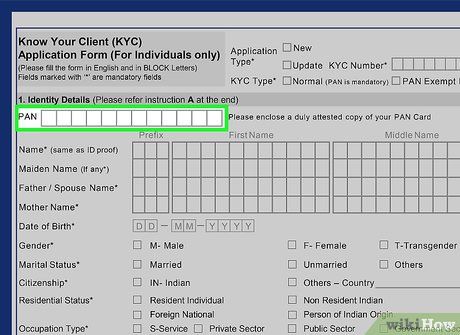

Include your Permanent Account Number (PAN). PAN is a 10-digit number issued by the federal Income Tax Department. If you don't have one, apply through the government’s Income Tax Department.

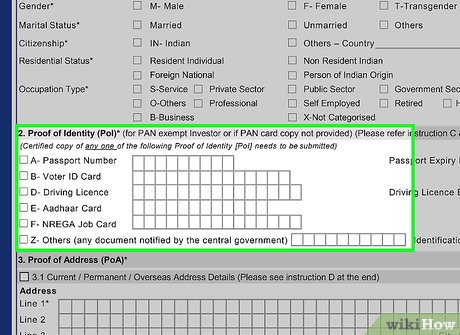

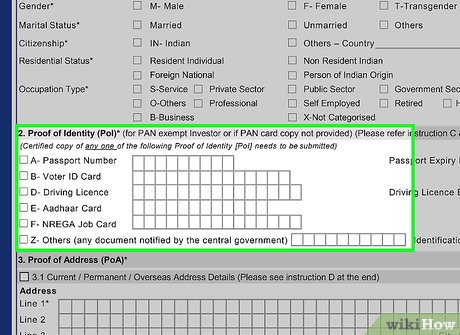

Submit proof of identity and address. Provide details of either your passport number and expiry date, driver’s license number and expiry date, voter ID card number, or AADHAR card number for identity and address verification.

- Additionally, submit copies of your passport or driver’s license as proof of identity and address. Original documents may be required during the application process.

Include a recent passport-sized photograph of yourself. Ensure the photograph is well-lit and meets the standard passport size of 2 by 2 inches (51 by 51 mm) in India. You can have a passport photograph taken at a local photography studio or passport services kiosk.

Submit the completed form to your broker or mutual funds provider. Sign the form's signature line and bring the completed form, passport-sized photograph, and a copy of your passport or driver’s license to your financial representative for processing.

- You may also visit a local financial registrar office to submit the application.

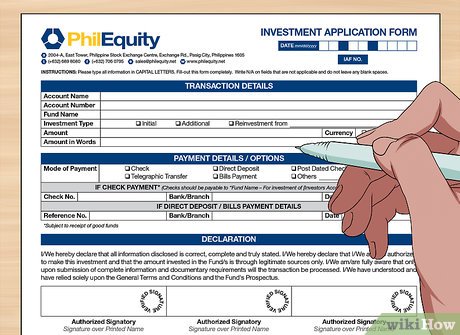

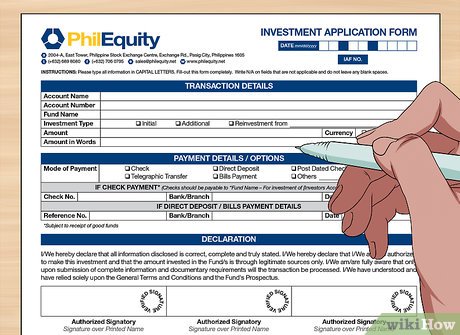

Provide a completed investment application form, if requested by your broker. Some financial representatives may require an investment application along with your CKYC application. This helps them understand your investment preferences and analyze your financial situation thoroughly.

- Ask your broker for the necessary investment application form.

Receiving and Utilizing Your CKYC Number

Wait for up to 2 weeks for your application to be processed. Legal investment activities cannot commence until your application is approved. However, you can discuss potential investments and mutual funds of interest with your financial broker or advisor during this waiting period.

Receive your 14-digit CKYC number via email or text message. Upon approval of your application, you'll receive an email or text message containing your CKYC number. The message will read: “Your KYC details have been registered with Central KYC Registry. Your CKYC identifier is 10088756711997.”

- After saving your CKYC number securely, delete the email or text message to prevent theft. A stolen CKCY number can lead to identity fraud if misused for investments by others.

Reapply if your application is declined. Should your application be rejected, it may be due to inadequate documentation. Fill out the application form again and adhere to the proper guidelines for a second attempt. Ensure thorough documentation review to enhance approval chances.

- Seek assistance from your financial broker or advisor to increase approval likelihood on your second application.

Utilize your CKYC number for investing in mutual funds and other financial instruments. With your CKYC number, you can invest funds through a broker or financial advisor. Including your CKYC number in financial applications and forms will expedite the process.

Pointers