Accrued interest on bonds represents the interest earned but not yet paid since the last interest payment. Bonds typically pay interest at the end of an accrual period, usually six months or a year, known as 'coupon' payments. Different bonds may use various methods to calculate interest, often based on a standardized day-count fraction (DCF). Learn how to calculate accrued interest for your bond by following these steps.

Steps to Follow

Gathering Necessary Information

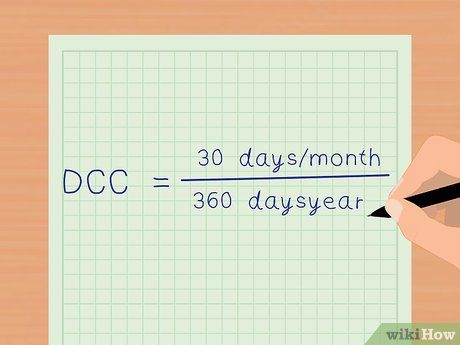

Determine the Day-Count Convention - The day-count convention (DCC) determines how the day-count fraction (DCF) is calculated for accrued interest. Refer to your bond's indenture (contract) to find the DCC used. It could be 30/360, actual/actual, or a combination like 30/ACT or ACT/360. Regardless of the convention, the method will have little impact on the interest earned.

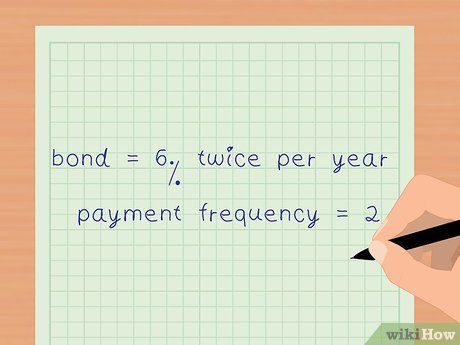

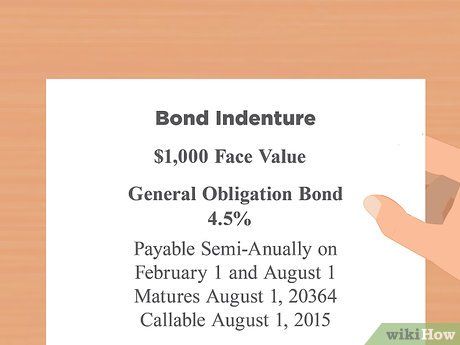

Verify the Interest Rate and Payment Frequency - Check the coupon rate and how often interest payments are made on your bond. The coupon rate indicates the annual interest as a percentage of the bond's par value, while the payment frequency tells you if interest is paid annually or semi-annually (once or twice a year). This data is typically found in your bond agreement.

Determine the Last Coupon Payment Date - Review your records to find the date of the most recent coupon payment made by your bond.

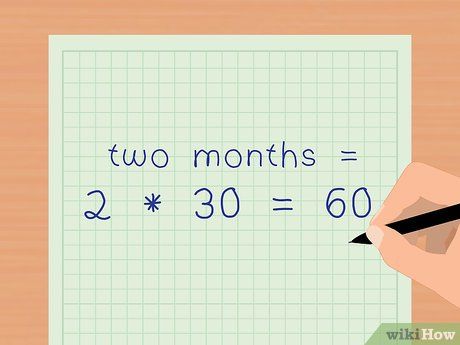

Calculate Days Since Last Coupon Payment - Depending on your bond's day-count convention (DCC), count the days elapsed since the last coupon payment. For instance, if your bond follows a 30/360 convention and two months have passed, multiply 2 by 30 to get 60 days for calculations.

Confirm the Bond's Face Value - Identify the face or par value of your bond, which is the amount paid at maturity. This information is clearly stated in your bond agreement.

Manual Calculation of Bond Accrued Interest

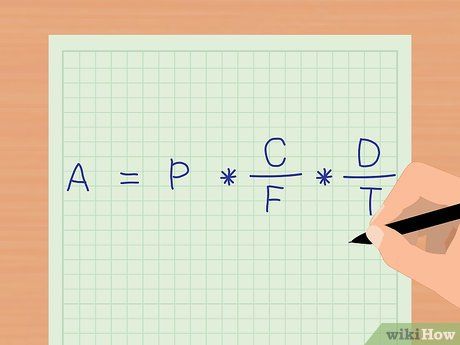

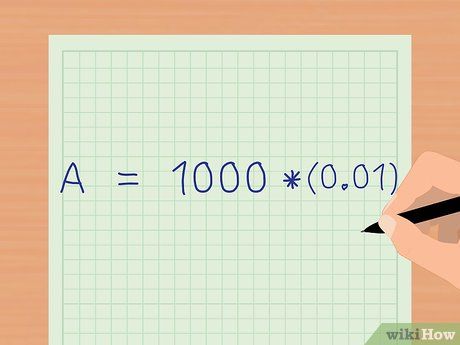

Understand the Formula for Calculating Bond Accrued Interest.

Understand the Formula for Calculating Bond Accrued Interest.- 'A' represents the accrued interest earned, the value you're calculating.

- 'P' stands for the bond's par value.

- 'C' denotes the annual coupon rate, expressed as a decimal.

- 'F' indicates the payment frequency per year.

- 'D' signifies the days since the last coupon payment.

- 'T' is the total days in the payment period.

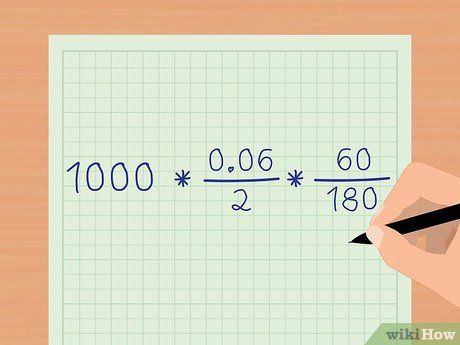

Provide Your Input Values.

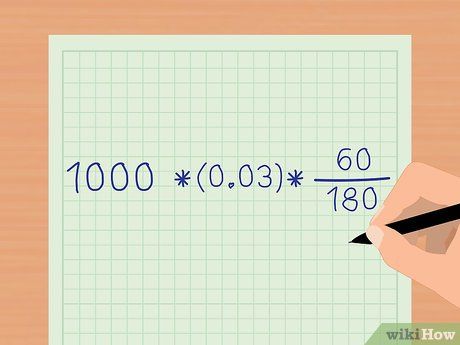

Provide Your Input Values. Determine the Periodic Interest Rate.

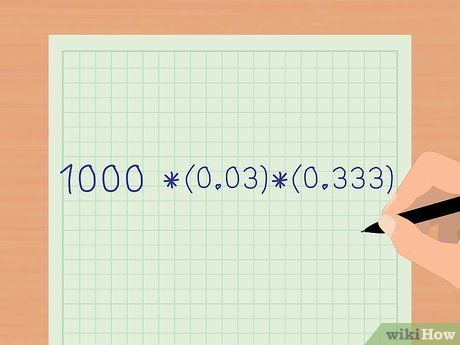

Determine the Periodic Interest Rate. Compute Your Day-Count Fraction.

Compute Your Day-Count Fraction. Find the Accrued Interest Value.

Find the Accrued Interest Value.Using Excel for Calculating Bond Accrued Interest

Start Excel and make a new sheet.

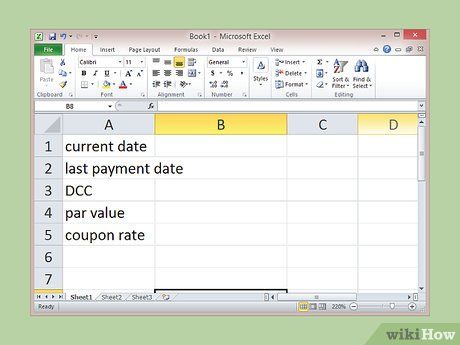

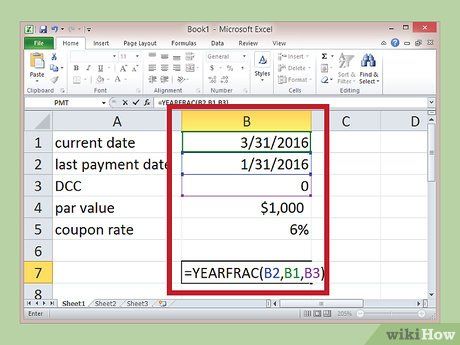

Type the variables' names in the first column. Enter the current date, last payment date, DCC, par value, and coupon rate in separate rows of the first column. For instance, put the current date in A1 and the coupon rate in A5.

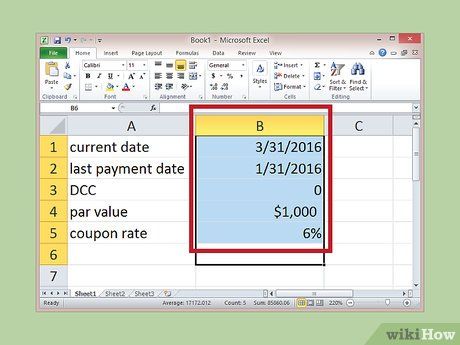

Input the variable values. Beside each variable name, enter the respective values accurately. In our example, use:

- 3/31/2016 for the current date in cell B1.

- 1/31/2016 for the last payment date in cell B2.

- 0 for the DCC in cell B3, representing the 30/360 DCC.

- $1000 as the par value in cell B4.

- 6% for the coupon rate in cell B5.

Apply the YEARFRAC function and enter values. Utilize the YEARFRAC function to compute bond accrued interest. Begin by clicking on an empty cell and typing '=YEARFRAC('. Then, select cell B2, input a comma, choose cell B1, input another comma, select cell B3, and close the function with a parenthesis.

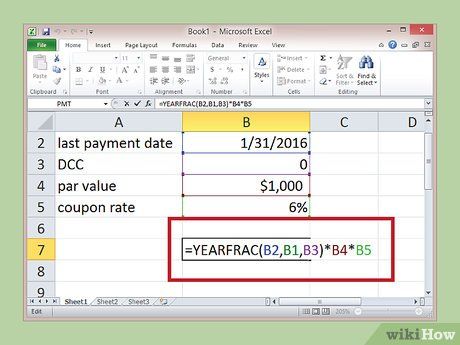

Multiply the function by the par value and coupon rate. After closing the function, multiply it by the par value and coupon rate without any spaces. Your input should resemble: =YEARFRAC(B2,B1,B3)B4B5

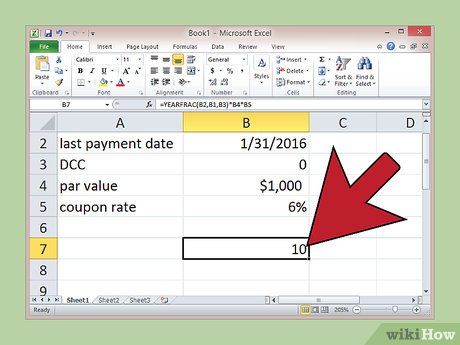

Hit enter to obtain your solution. Upon pressing enter on the cell containing your function, the program will compute your equation. Ensure the cell's number format is set to 'currency' to display the answer accurately.

- In our example, this function provides $10, matching our manual calculation.

Glossary, Calculator, Practice Problems, and Solutions

Example Glossary for Bond Accrued Interest

Example Glossary for Bond Accrued Interest Example Bond Accrued Interest Calculator

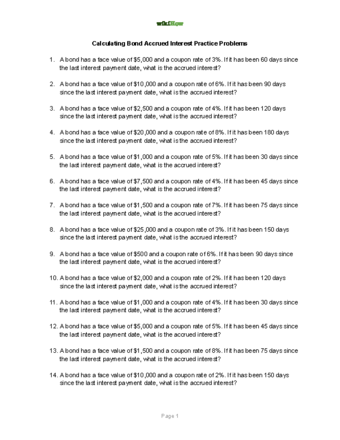

Example Bond Accrued Interest Calculator Example Practice Problems for Calculating Bond Accrued Interest

Example Practice Problems for Calculating Bond Accrued Interest Answers for Practice Problems on Calculating Bond Accrued Interest

Answers for Practice Problems on Calculating Bond Accrued InterestHelpful Tips

-

Find a useful calculator on FINRA's website at https://apps.finra.org/Calcs/1/AccruedInterest.

-

For a simple solution, use Bloomberg. Enter BXT or SXT and follow the on-screen instructions to compute the interest automatically.

-

Don't get confused by different percentage rates. Remember, the initial division yields a percentage of the total interest paid, not the annual or semi-annual rate. For example, 20/360 = 0.556 or 5.56%, which is then multiplied by the annual or semi-annual rate to obtain the rate for the period in question.