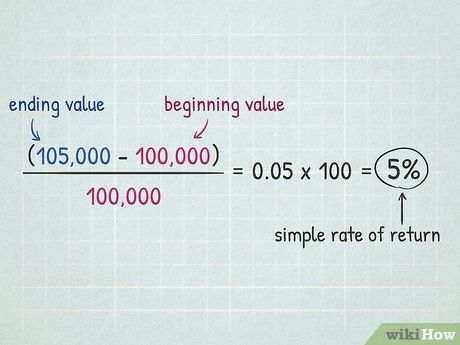

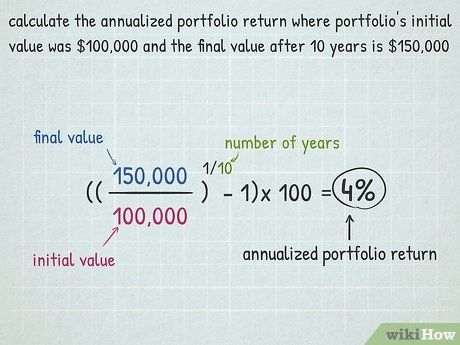

If you wish to ascertain your investment earnings, you're probably familiar with subtracting the initial value from the final value. Dividing that number by the starting value and then multiplying by 100 gives you the basic rate of return. But what if you've held your portfolio for numerous years? With your portfolio (hopefully) growing annually and compounding your returns, comparing its performance with someone else's requires the annualized portfolio return. There are 2 different methods to calculate your annualized portfolio return, depending on whether you want to adjust for the impact of your contributions and withdrawals on your portfolio's performance.

Steps

Time-Weighted Rate of Return

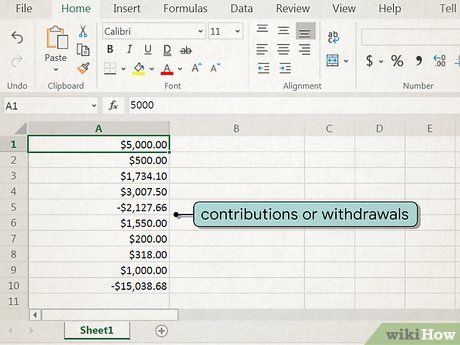

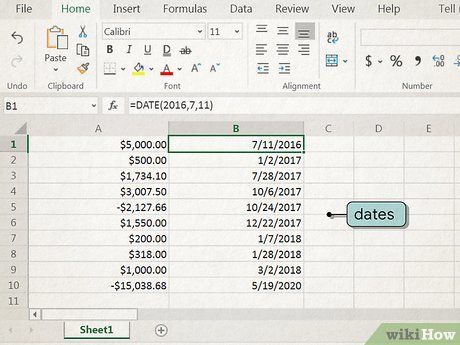

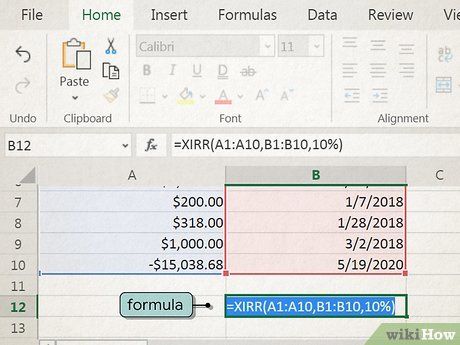

This computation provides a rate of return that disregards investor behavior (such as deposits and withdrawals), making it the optimal method for comparing the performance of investment managers and brokers.

Determine the difference between the initial and final values for each year.

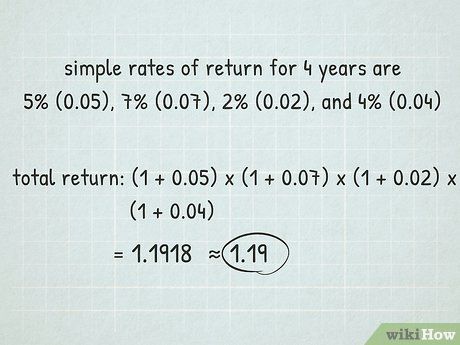

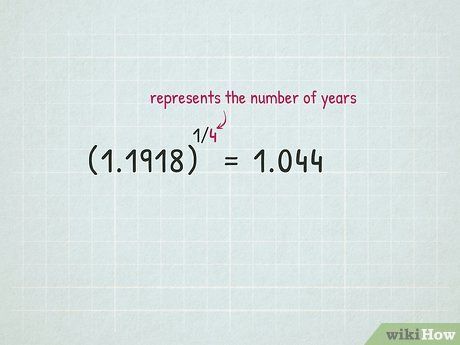

Determine the difference between the initial and final values for each year. Add 1 to each rate and then multiply them together.compoundTo find the total rate, raise the value by an exponent of 1/n.

Add 1 to each rate and then multiply them together.compoundTo find the total rate, raise the value by an exponent of 1/n.

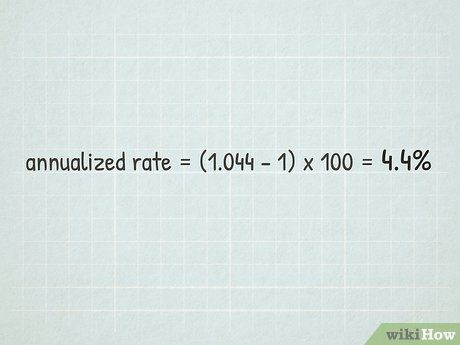

Subtract 1 from the result and then multiply by 100 to obtain the annualized rate of return.The total rate can be calculated by raising the product of (1+R1) x (1+R2) x (1+R3) x (1+R4) to the power of 1/n, then subtracting 1 and multiplying by 100.Calculate the geometric average by taking the product of all rates (1+R1) x (1+R2) x (1+R3) x (1+R4), then raising it to the power of 1/n, subtracting 1, and multiplying by 100.

Subtract 1 from the result and then multiply by 100 to obtain the annualized rate of return.The total rate can be calculated by raising the product of (1+R1) x (1+R2) x (1+R3) x (1+R4) to the power of 1/n, then subtracting 1 and multiplying by 100.Calculate the geometric average by taking the product of all rates (1+R1) x (1+R2) x (1+R3) x (1+R4), then raising it to the power of 1/n, subtracting 1, and multiplying by 100.

Helpful Pointers

-

To compute an annualized rate of return, you have flexibility in choosing the investment period, whether it's months or years. Adjust the exponent accordingly to reflect the period used. For instance, with monthly periods, apply the exponent 12/n (where 'n' represents the total number of investment periods) to derive the annualized return, as there are 12 months in a year.

-

The concept of annualized return offers valuable insight into your portfolio's performance, especially when assessing investments over extended durations.

Noteworthy Cautions

- Exercise caution with the sequence of operations during calculations to ensure accurate results. When performing manual computations, it's prudent to double-check using a calculator.