An annuity functions as an insurance contract with investment features. It offers a steady income stream through periodic payments for a specified duration to the annuitant or their beneficiary, commencing either immediately or in the future. Grasping the mechanics of your annuity aids in future planning and adjusting other investment strategies accordingly.

Procedures

Identifying Your Annuity Type

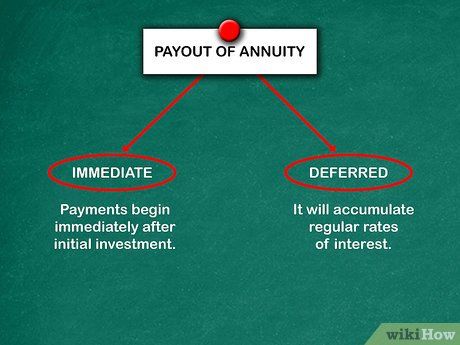

Identify the payout structure of your annuity. Refer to your documentation or contact the issuing institution to ascertain whether your annuity provides an immediate or deferred payout. In the case of an immediate annuity, payments commence promptly after the initial investment. Conversely, with a deferred annuity, it accumulates interest at regular rates.

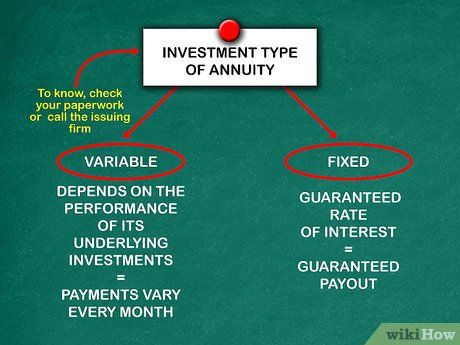

Identify the investment type associated with your annuity. Determine whether your investment is fixed or variable. You can consult your documentation or contact the issuing institution to acquire this information. A fixed annuity offers a guaranteed interest rate and payout, while a variable annuity's payouts fluctuate based on the performance of its underlying investments. Variable annuities also provide tax-deferral benefits, and you have the flexibility to choose your investments upon purchasing the annuity.

Familiarize yourself with your liquidity options. Review your annuity contract or reach out to the issuing firm to understand the liquidity options available. Some annuities impose penalties for early withdrawals, potentially diminishing your funds. However, certain annuities permit partial withdrawals without penalties, while others, like no-surrender or level-load annuities, may offer withdrawal options without any penalties.

Understanding Your Annuity's Specifics

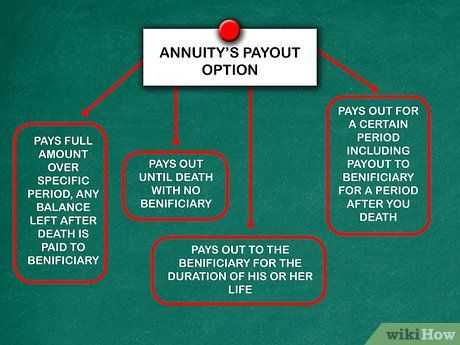

Explore your annuity's payout alternatives. One common payout option is to receive the entire annuity amount over a specified period, with any remaining balance distributed to your beneficiary upon your death. Alternatively, you can opt for payouts until your death, with or without a beneficiary, or select a payout period with payments to your beneficiary continuing after your demise. Another option is to provide payouts to your beneficiary for their lifetime beyond your own.

Ascertain the principal balance. The principal balance refers to the amount you invest in the annuity, either as an initial lump sum or through regular contributions (e.g., monthly payments). If you make periodic payments, you'll need to inquire about the current balance to calculate your annuity payments accurately. Additionally, you should receive statements detailing your principal balance regularly.

- Your annuity statements typically include information about your principal balance.

Determine the interest rate associated with your annuity. Review your annuity documentation to identify any guaranteed minimum interest rates. If your annuity offers a fixed rate, it should be outlined in your paperwork. For variable rates, you can contact the provider or access your account online for the current rate. Additionally, your statement should list your interest rate.

- Your interest rate is typically detailed in your statement.

Calculating Your Payment

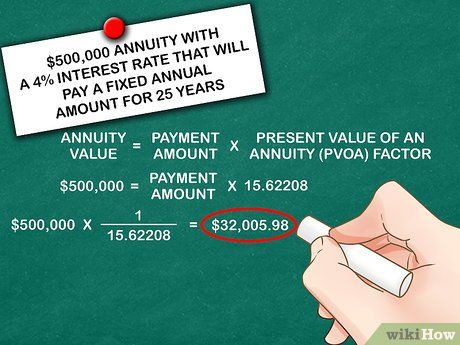

Compute your payment amount based on your unique circumstances. For instance, consider a scenario with a $500,000 annuity, a 4% interest rate, and a fixed annual payout over 25 years. The manual formula for the Annuity Value is Payment Amount x Present Value of an Annuity (PVOA) factor.

- For the given scenario, the PVOA factor is 15.62208. Hence, $500,000 = Annual Payment x 15.62208. Solving the equation yields $32,005.98 as the annual payment.

- In Excel, use the 'PMT' function to calculate the payment amount. Input '=PMT(0.04,25,500000,0)' into a cell and press 'Enter.' Excel will return $32,005.98 as the payment amount.

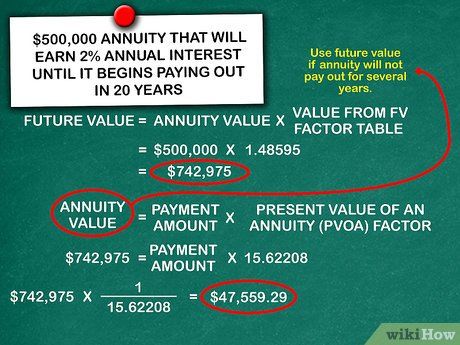

Adjust your calculation if your annuity won't begin payouts for several years. Determine the future value of your principal balance using a Future Value table, the accrued interest rate, and the number of years until payouts commence. If, for example, your $500,000 annuity earns 2% annual interest over 20 years before payouts start, the future value is $742,975. Use the FV function in Excel to find the future value, then substitute it into the annuity value calculation to derive your annual payment of $47,559.29.

- Utilize the FV function in Excel by entering '=FV(InterestRate,NumberOfPeriods,AdditionalPayments,PresentValue)' with '0' for the additional payments variable.

Useful Tips

-

To calculate monthly payments instead of annual ones, divide the interest rate by 12 and multiply the periods by 12 before plugging these values into your formula.

Caution

- Financial advisors stress the importance of not relying solely on one income source during retirement. Diversification, which involves having multiple sources, is essential for a well-rounded investment portfolio.