Understanding how interest accumulates on savings accounts isn't always straightforward. While some may think it's as simple as multiplying the interest rate by the principal, it's often more complex. Many savings accounts compound interest monthly, meaning that each month, a portion of the annual interest is calculated and added to your balance. This continuous cycle of interest calculation and addition to your balance is known as compounding. To accurately calculate future balances, it's best to use a compound interest formula. Keep reading to discover more about this type of interest calculation.

Key Points to Remember

- Familiarize yourself with the compound interest formula and gather all necessary variables before performing calculations.

- If you're dealing with interest and regular contributions, start with the accumulated savings formula, input your variables, and solve the equation.

- Utilize spreadsheet software for compounding interest calculations. Label and input your variables, construct the equation, and leverage Excel's financial functions.

Actionable Steps

Understanding Compound Interest Calculations

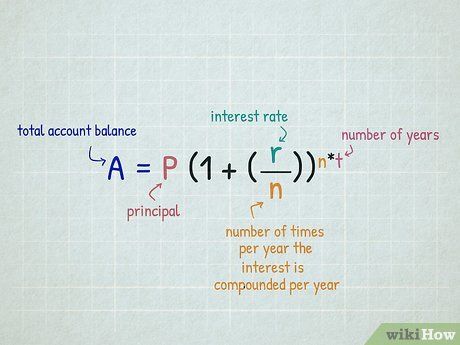

Familiarize yourself with the formula used to calculate compound interest.

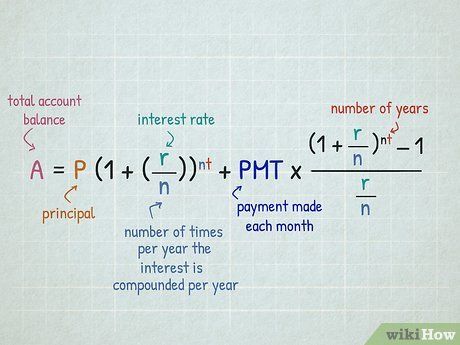

Familiarize yourself with the formula used to calculate compound interest.- (P) represents the principal amount, (r) is the annual interest rate, and (n) denotes the number of times interest is compounded per year. (A) is the total account balance after including interest.

- (t) signifies the time periods over which interest accumulates, matching the rate of interest (e.g., if the interest rate is annual, (t) should be in years). To determine the fraction of years for a given period, divide the total months by 12 or the total days by 365.

Identify the Variables in the Formula

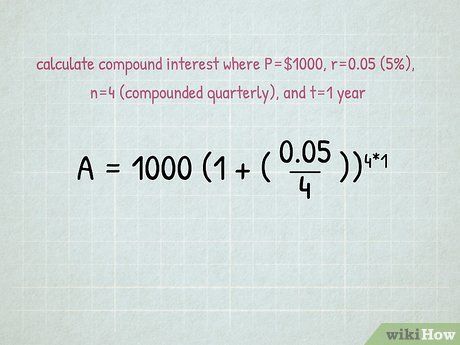

Input your values into the equation.

Input your values into the equation.- For daily compounded interest, apply the same process, but replace 4 with 365 for variable (n).

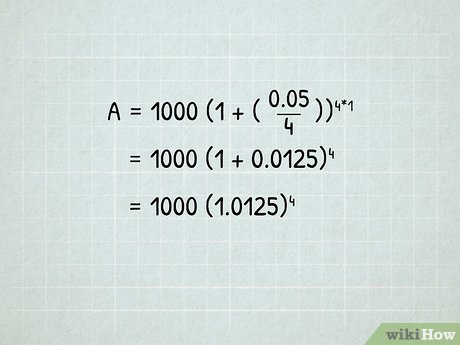

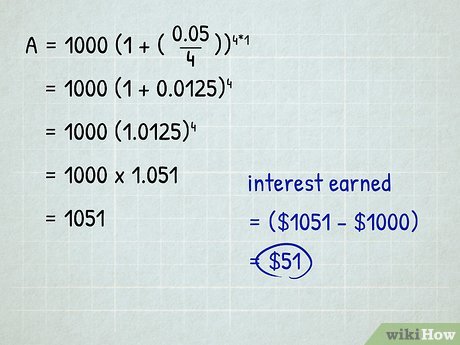

Perform the calculations.

Perform the calculations. Solve the equation.

Solve the equation.Calculation of Interest with Regular Contributions

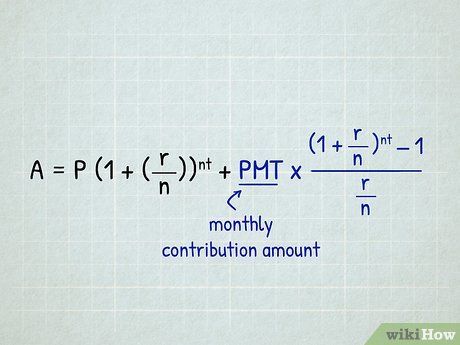

Start by using the accumulated savings formula.

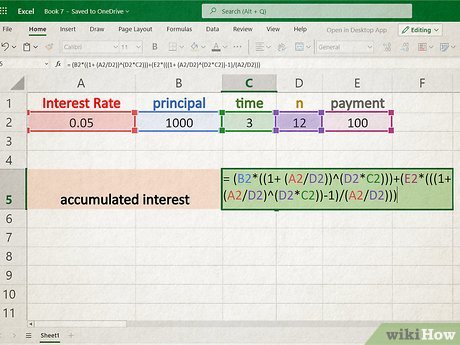

Start by using the accumulated savings formula.- A convenient method is to split the compound interest for the principal from that of the monthly contributions (or payments/PMT). Initially, compute the interest on the principal using the accumulated savings formula.

- As explained by this formula, you can figure out the interest earned on your savings account with recurring monthly deposits and interest compounded daily, monthly, or quarterly.

Apply the second part of the formula to find the interest on your contributions. (PMT) denotes your monthly contribution amount.

Recognize your variables. Refer to your account or investment agreement to locate the following variables: principal 'P', the annual interest rate 'r', and the number of periods per year 'n'. If you don't have these variables readily available, contact your bank for this information. The variable 't' signifies the number of years, or fractions of years, being calculated and 'PMT' represents the payment/contribution made monthly. The account value 'A' denotes the total value of the account after your chosen time period and contributions.

- The principal 'P' represents either the balance of the account on the date you're starting the calculation from.

- The interest rate 'r' denotes the interest paid on the account annually. It should be expressed as a decimal in the equation. For example, a 3% interest rate should be entered as 0.03. To obtain this number, simply divide the stated percentage rate by 100.

- The value of 'n' simply represents the number of times the interest is compounded per year. This should be 365 for interest compounded daily, 12 for monthly, and 4 for quarterly.

- Similarly, the value for 't' denotes the number of years you'll be calculating your future interest for. This should be either the number of years or the portion of a year if you're measuring less than a year (e.g., 0.0833 (1/12) for one month).

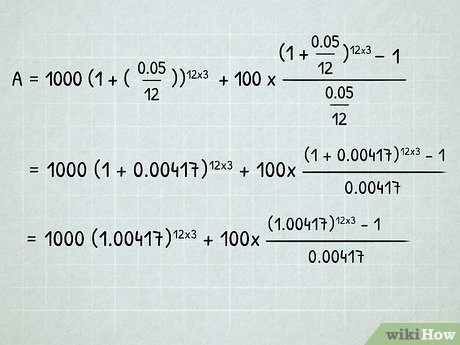

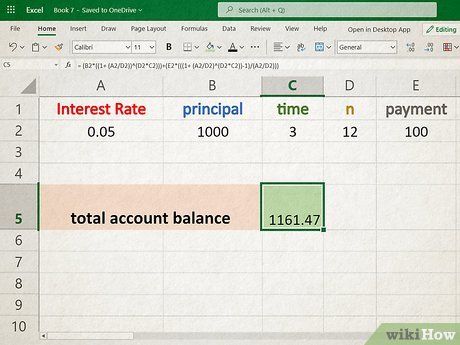

Insert your values into the formula.

Insert your values into the formula. Simplify the expression.

Simplify the expression. Evaluate the exponents.

Evaluate the exponents. Compute the final results.

Compute the final results. Compute the total interest earned.

Compute the total interest earned.Using Spreadsheets for Compounding Interest Calculations

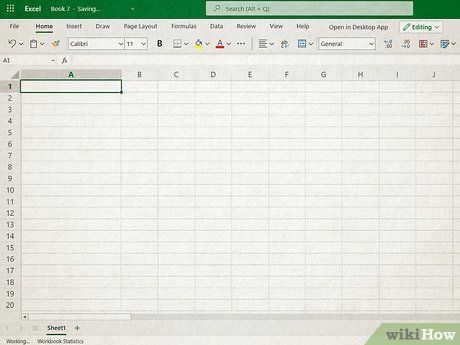

Launch a new spreadsheet. Programs like Excel and Google Sheets streamline the mathematics involved in such calculations and provide ready-made financial functions for compounding interest.

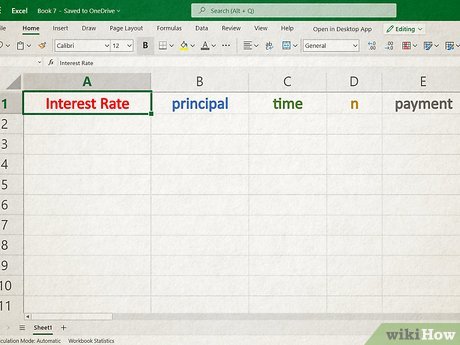

Name your variables. In spreadsheet applications, maintaining clarity and organization is vital. Begin by assigning clear labels to a column of cells containing essential information for your computation (e.g., interest rate, principal, time, n, payment).

Enter your variables. Populate the adjacent column with data pertaining to your specific account. This not only enhances the readability and interpretability of the spreadsheet but also facilitates experimentation with different scenarios by adjusting one or more variables.

Define your equation.

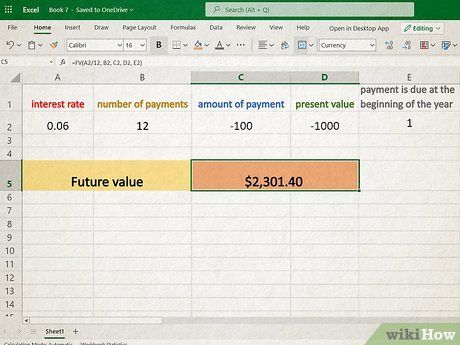

Define your equation. Utilize financial functions.and

Utilize financial functions.andUseful Documents

Guide to Compound Interest

Guide to Compound Interest Comprehensive Guide to Accumulated Savings Interest

Comprehensive Guide to Accumulated Savings InterestUseful Tips

-

Alternatively, albeit with increased complexity, one can compute compound interest for an account with irregular payments. This involves separately calculating the interest accrued for each payment/contribution (utilizing the same equation as described above) and is most effectively executed using a spreadsheet for simplification.

-

Another option is to utilize a freely available online annual percentage yield calculator to ascertain the interest gained on your savings account. Simply search the Internet for 'annual percentage yield calculator' or 'annual percentage rate calculator' to find numerous websites providing this service at no cost.