In the field of economics, marginal utility (MU) serves as a measure to gauge the value or satisfaction derived by a consumer from the consumption of a product or service. In essence, MU quantifies the change in total utility divided by the change in the quantity of goods consumed. Put simply, MU represents the additional satisfaction gained from each extra unit of consumption.

Procedures

Applying the Marginal Utility Formula

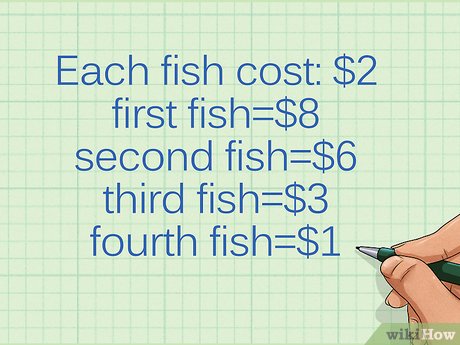

- For instance, suppose you're hungry and decide to purchase fish for dinner. Let's assume each fish costs $2. If your hunger is such that you'd be willing to pay $8 for the fish, then the fish offers $8 worth of utility. In essence, you're prepared to spend $8 to attain the satisfaction derived from the fish, irrespective of its actual price.

- For instance, suppose you plan to eat two fish. However, after consuming the first fish, your hunger diminishes. Now, you would only pay $6 for the additional satisfaction from the second fish. The second fish is not as valuable to you now that you're partially full. Consequently, the two fish together provide a total satisfaction of $6 + $8 (from the first fish) = $14.

- Note that whether you actually purchase the second fish is irrelevant. Marginal utility (MU) is concerned solely with what you would be willing to pay for it. In practice, economists utilize intricate mathematical models to forecast what consumers would hypothetically pay for goods.

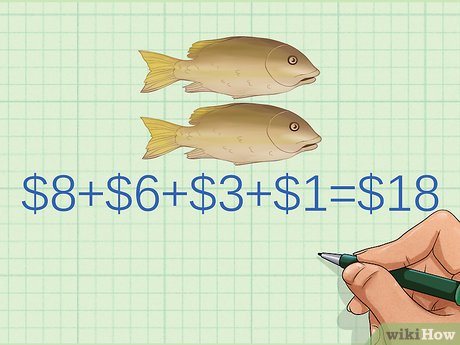

- Continuing the previous example, let's assume you decide to eat four entire fish. Following the consumption of the second fish, you feel somewhat satiated, willing to pay approximately $3 for the subsequent fish. After the third fish, you're nearly full, willing to pay only $1 for the final fish.

- The satisfaction you derive from it is nearly offset by the feeling of fullness. Hence, the four fish collectively provide a total satisfaction of $8 + $6 + $3 + $1 = $18.

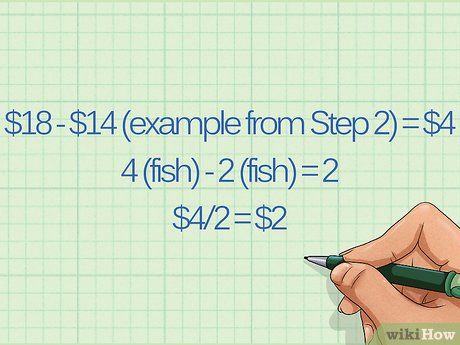

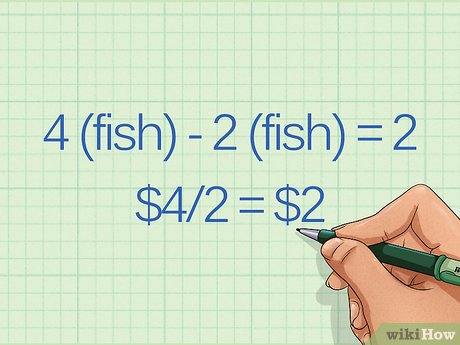

- $18 - $14 (from the previous step) = $4

- 4 (fish) - 2 (fish) = 2

- $4/2 = $2

- This indicates that, between the second and fourth fish, each additional fish contributes only $2 of satisfaction. This is an average figure; the third fish is actually worth $3, and the fourth is worth $1, naturally.

Calculating MU for Additional Units

- Finding this is simpler than it seems. Simply employ the standard equation to ascertain the MU when the change in the quantity of consumed goods is one.

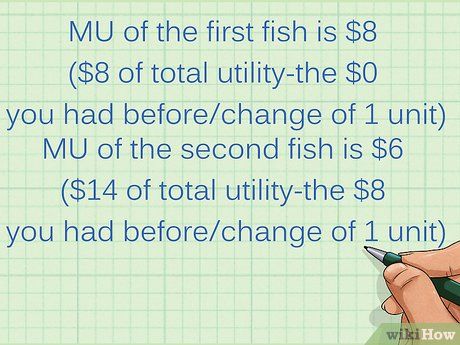

- In the preceding example, you already possess the MUs for each individual unit. When you haven't consumed any fish, the MU of the first fish is $8 ($8 of total satisfaction - the $0 you had previously/change of 1 unit), the MU of the second fish is $6 ($14 of total satisfaction - the $8 you had previously/change of 1 unit), and so forth.

Certified Public Accountant

Marginal utility denotes the additional satisfaction gained from further purchases. As purchases increase, the incremental usefulness of additional quantities typically diminishes. For instance, the second pair of shoes may offer less delight compared to the first pair, which is a necessity. This concept elucidates why individuals are willing to pay more for essentials as opposed to discretionary items.

- With this data, you would opt out of purchasing the fourth fish. Its MU ($1) falls short of its marginal cost ($2). Essentially, you're experiencing a loss of utility in this transaction, making it unfavorable.

Employing a Marginal Utility Table

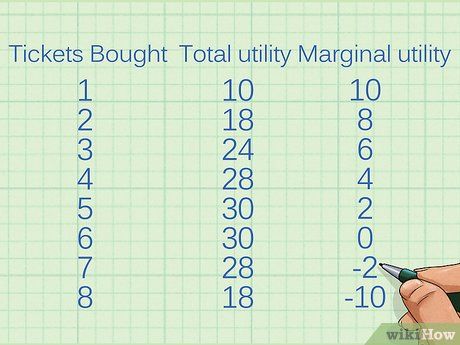

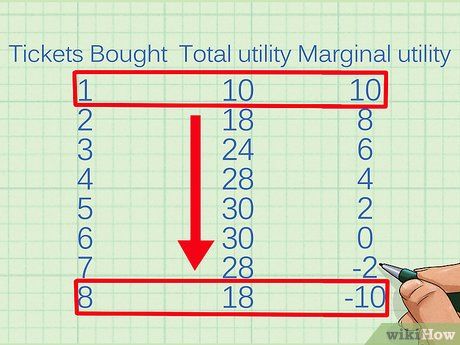

| Tickets Bought | Total utility | Marginal utility |

|---|---|---|

| 1 | 10 | 10 |

| 2 | 18 | 8 |

| 3 | 24 | 6 |

| 4 | 28 | 4 |

| 5 | 30 | 2 |

| 6 | 30 | 0 |

| 7 | 28 | -2 |

| 8 | 18 | -10 |

- It's important to note that the column headings may vary. For instance, the 'Quantity' column could be labeled as 'Items purchased' or 'Units acquired.' The key aspect is the information within the column.

- In the provided chart, the trend of diminishing returns is evident from the outset. Initially, each ticket to the film festival yields significant marginal utility. However, beyond the first ticket, subsequent tickets provide diminishing returns. Following six tickets, each additional ticket results in negative MU, decreasing overall satisfaction. This could be attributed to consumer fatigue from repetitive movie viewings.

- For instance, if the tickets in the chart cost $3 each, utility is optimized when the consumer acquires 4 tickets. Subsequent tickets yield an MU of $2, which falls short of the $3 marginal cost.

- It's noteworthy that utility isn't necessarily maximized when MU becomes negative. Goods can still provide some benefit to the consumer without being deemed 'worth it.' For example, the fifth ticket in the chart maintains a $2 MU. Although not negative, it contributes to a reduction in total utility as it doesn't justify the cost.

- Average Utility: Obtained by dividing the total utility in each row by the quantity of goods purchased.

- Consumer Surplus: Calculated by subtracting the product's marginal cost from the marginal utility in each row. It signifies the 'profit' in terms of utility that the consumer gains from purchasing each product. This concept is also known as 'economic surplus.'

Insights

-

It's crucial to recognize that the examples presented represent model scenarios. They depict hypothetical consumers rather than real ones. In reality, consumers may not always act rationally; their purchasing behavior might deviate from the utility-maximizing ideal. While economic models provide valuable insights into broad consumer behavior trends, they may not perfectly align with real-world situations.

-

If you include a consumer surplus column in your chart (as outlined earlier), utility maximization occurs at the last row before the consumer surplus turns negative.