If you've never computed net present value (NPV) before, it might seem a bit puzzling initially. But fret not—once you grasp the formula, NPV calculation becomes straightforward. We'll guide you through the process step by step, providing examples along the way, so you can quickly determine the desired value.

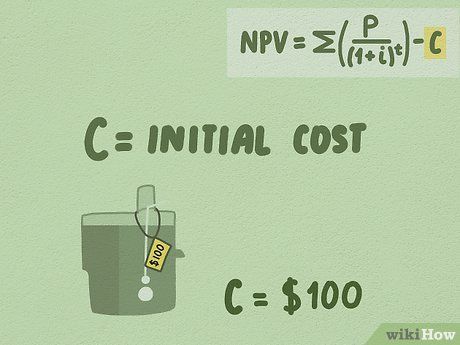

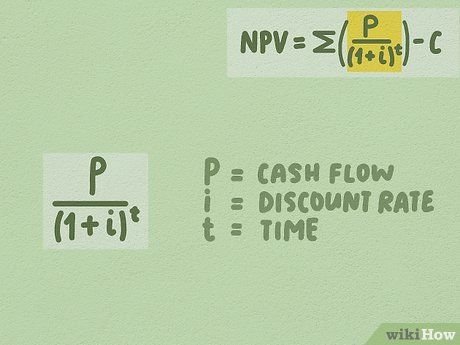

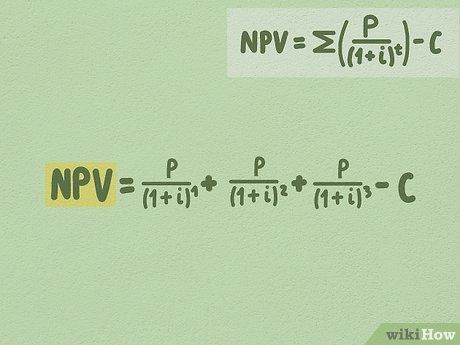

NPV can be computed using the formula NPV = ⨊(P/ (1+i)t ) – C, where P = Net Period Cash Flow, i = Discount Rate (or rate of return), t = Number of time periods, and C = Initial Investment.

Steps to Follow

NPV Calculation Tool

NPV Calculation Tool

NPV Calculation ToolNPV Computation

- For instance, let's consider a scenario where you manage a small lemonade stand. You contemplate purchasing an electric juicer for $100, which would streamline the juicing process compared to manual extraction. In this case, the $100 represents your initial investment.

- In the lemonade stand example, let's assume you've researched the juicer online and found that it typically functions well but tends to break after around 3 years. Here, you'd use 3 years as the time frame in your NPV calculation to ascertain if the juicer will recoup its cost before potentially malfunctioning.

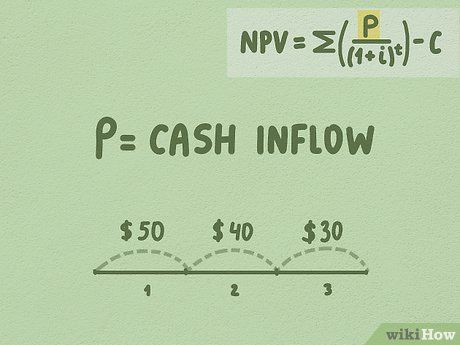

- Continuing with the lemonade stand example, based on past performance and future projections, you anticipate that implementing the $100 juicer will yield an additional $50 in the first year, $40 in the second year, and $30 in the third year by reducing labor time for juicing (and consequently reducing wage expenses). Hence, your anticipated cash inflows are: $50 in year 1, $40 in year 2, and $30 in year 3.

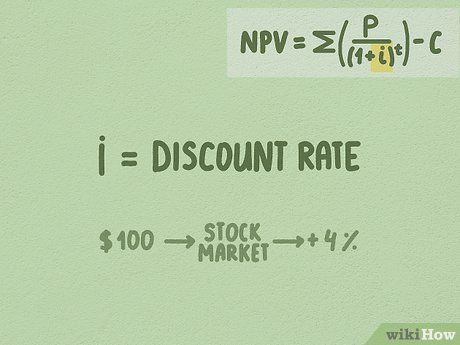

- In corporate finance, a firm's weighted-average cost of capital is often employed to determine the discount rate. For simpler scenarios, the return rate on a savings account, stock investment, etc., can suffice as the discount rate instead of the investment under evaluation.

- In the lemonade stand example, suppose that without purchasing the juicer, you'd invest the funds in the stock market, where you anticipate earning 4% annually. Here, 0.04 (4% expressed as a decimal) serves as the discount rate for our computation.

- In the lemonade example, you're evaluating a span of 3 years, necessitating the application of your formula thrice. Compute your yearly discounted cash flows as follows:

- Year One: 50 / (1 + 0.04)1 = 50 / (1 .04) = $48.08

- Year Two: 40 / (1 +0.04)2 = 40 / 1.082 = $36.98

- Year Three: 30 / (1 +0.04)3 = 30 / 1.125 = $26.67

- For the lemonade stand scenario, the projected NPV of the juicer would be:

- 48.08 + 36.98 + 26.67 - 100 = $11.73

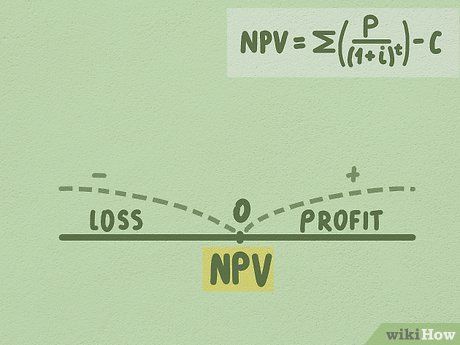

- In general, a positive NPV indicates that your investment is more lucrative than placing the funds in an alternative investment, warranting acceptance.

- A negative NPV suggests that your funds are better allocated elsewhere, prompting rejection of the proposed investment.

- It's important to note that these are broad principles; real-world investment decisions involve a more comprehensive evaluation process.

- In the lemonade stand example, the NPV is $11.73. With a positive NPV, you'd likely opt to purchase the juicer. Importantly, this doesn't imply that the electric juicer only yielded $11.73; rather, it signifies that the juicer met the 4% annual return requirement and generated an additional $11.73 in profit. Essentially, it's $11.73 more profitable than the alternative investment.

Using Cash Outflows to Assess NPV

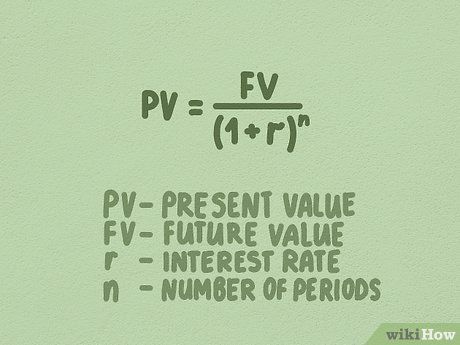

Evaluate your company's profit value over a specified duration using a PV equation.

Evaluate your company's profit value over a specified duration using a PV equation.

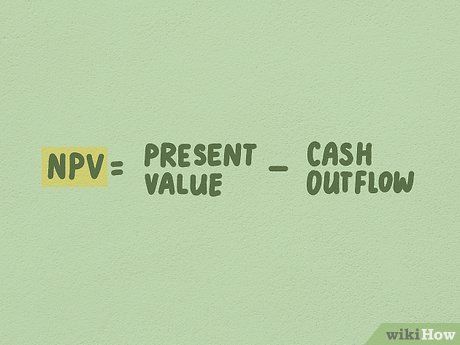

- For instance, suppose you're investing $150 in equipment for your home business, then spending $50 every 5 years on maintenance. Over a 10-year span, your cash outflow would be $150 + $50 + $50 = $250.

- If your PV stands at $1488.19 and you expect a cash outflow of $250, then your NPV equals $1488.19 - $250 = $1238.19.

Utilizing the NPV Formula

- For example, suppose you have three investment prospects: one with an NPV of $150, another with $45, and a third with -$10. In this scenario, prioritize the $150 investment, followed by the $45 one if resources permit. Avoid the -$10 investment as it yields less profit than alternatives with similar risk levels.

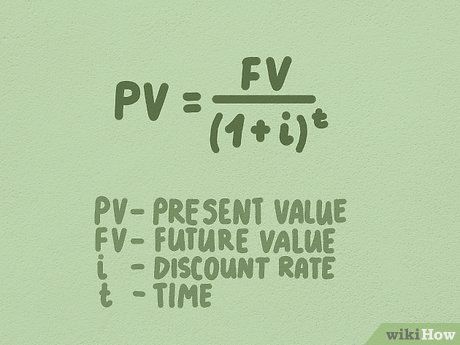

- For instance, to find out the future worth of $1,000 in five years with a 2% return rate, use 0.02 for i, 5 for t, and 1,000 for PV:

- 1,000 = FV / (1+0.02)5

- 1,000 = FV / (1.02)5

- 1,000 = FV / 1.104

- 1,000 × 1.104 = FV = $1,104.

Pointers

-

The NPV formula can determine the internal rate of return (IRR), representing the discount rate that nullifies the NPV for all project cash flows. Higher IRR suggests greater growth potential. To find IRR, set NPV to 0 and solve for the discount rate.

-

NPV calculations can also be performed using financial calculators or NPV tables, handy in the absence of a calculator for cash flow discounts.

-

Consider non-financial factors (e.g., environmental or social concerns) when making investment decisions.

Cautionary Notes

- Consider the time value of money when making financial choices. The time value of money (TVM) asserts that money available today is worth more than the same amount in the future, owing to its potential for growth through proper investment.

Essential Tools

- Pencil

- Paper

- Calculator