Understanding whether two stocks tend to move in sync is valuable. When constructing a diversified portfolio, it's essential to include stocks with differing trends. The Pearson Correlation Coefficient offers insight into the relationship between the returns of distinct stocks.

Steps

Standard Deviation and Covariance

Collect stock returns. To compute the correlation coefficient, gather data on returns (daily price fluctuations) for two stocks within the same timeframe. Returns are determined by the difference in closing prices of the stocks across two consecutive trading days. For instance, if a stock closes at $2.00 on Tuesday and $2.04 on Wednesday, the return is 2 percent.

- Stock price data can be sourced from market-tracking platforms like Bloomberg and Yahoo! Finance.

- Organize the returns chronologically, labeling the two stocks as X and Y for simplicity.

- For example, stock X's data might be 0.9, 1.3, 1.7, 0.4, 0.7 over five days, while stock Y's data could be 2.5, 3.5, 3.6, 3.1, 2.3.

- Correlation coefficients may fluctuate or change signs over time (from positive to negative), emphasizing the significance of the chosen timeframe.

- Short-term traders might opt for 20 or 50 days' worth of data, whereas long-term investors may prefer 150 or 250.

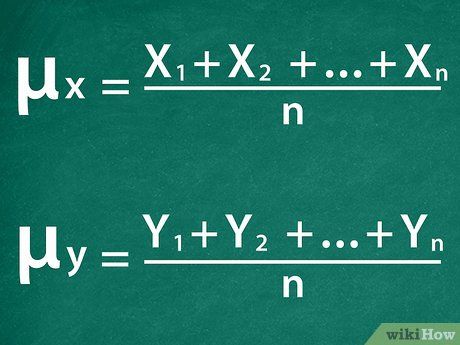

Compute the average for each group.

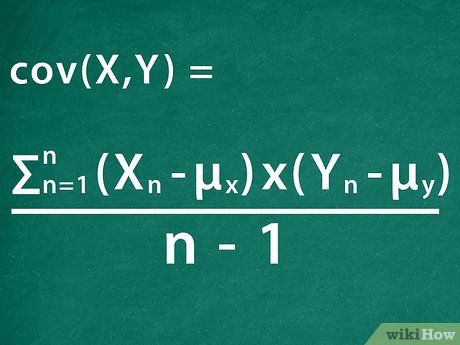

Compute the average for each group. Determine the covariance.

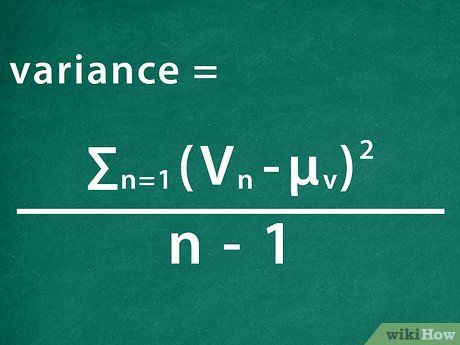

Determine the covariance. Determine the variance for each individual stock.

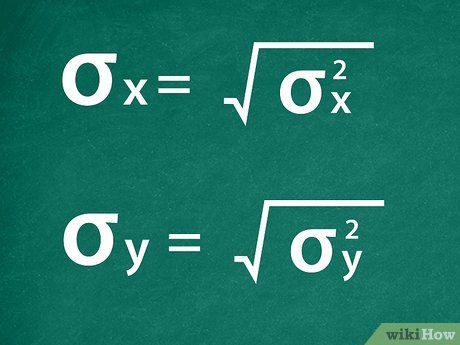

Determine the variance for each individual stock. Calculate the standard deviation.Take the square rootvariance

Calculate the standard deviation.Take the square rootvarianceCorrelation Coefficient

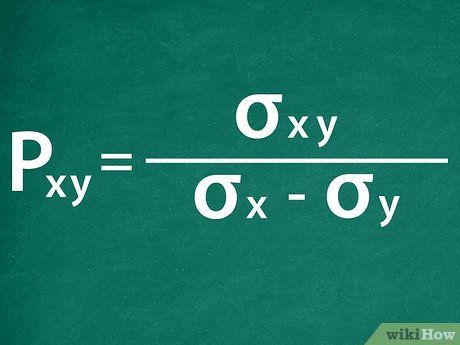

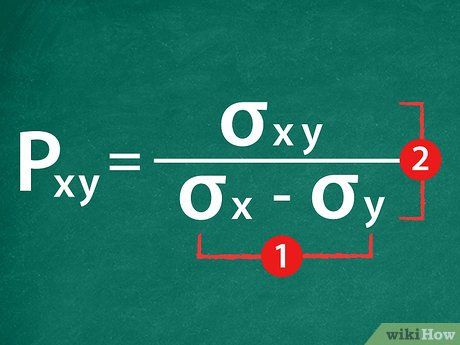

Establish your correlation coefficient equation.Find the correlation coefficient.

Establish your correlation coefficient equation.Find the correlation coefficient. Determine the correlation coefficient.

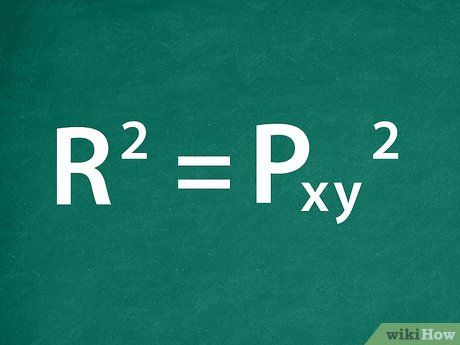

Determine the correlation coefficient. Calculate R-squared.Coefficient of determination

Calculate R-squared.Coefficient of determinationUtilization of correlation coefficients

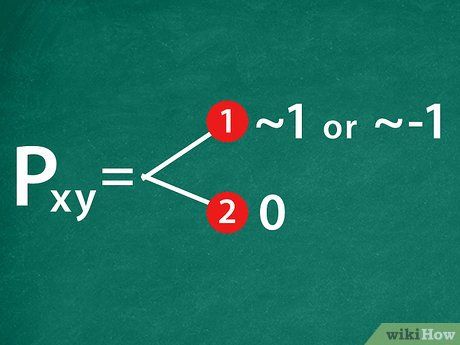

Interpret your correlation coefficient outcome. The correlation coefficient serves as an indicator for two aspects. Firstly, it reflects whether the two variables typically exhibit simultaneous movement in the same direction. A positive coefficient signifies such correlation, while a negative one indicates the opposite. Secondly, it gauges the similarity in these movements. A coefficient nearing 1 or -1 implies perfect positive or negative correlation, respectively.

- Correlation coefficients range between 1 and -1. A value of 0 denotes no correlation.

- For instance, a coefficient of 0.809, as in the prior example, suggests a high correlation between stocks X and Y. Both securities tend to move in tandem and with comparable magnitude.

Minimize risk within your investment portfolio. Correlation coefficients primarily aid in structuring diversified securities portfolios. Stocks or assets within a portfolio are compared to determine their correlation coefficient. The objective is to include stocks with low or negative correlations in the same portfolio. Consequently, when one stock's price fluctuates, the other is likely to move in the opposite or independent direction, facilitating effective portfolio diversification.

- This approach mitigates 'unsystematic risk,' inherent to individual securities.

Extend your analysis to alternative assets. Apart from stocks, the correlation coefficient is commonly utilized to evaluate relationships among various datasets, including mutual fund returns, Exchange Traded Fund (ETF) returns, and market indexes. By calculating correlations between these datasets and stock returns, portfolio diversification can be achieved or the impact of market shifts on a stock's price movement can be predicted.

- For instance, if the stock price of a gold mining company exhibits a high, positive correlation with the price of gold, an investor may anticipate that an increase in gold price would also drive up the company's stock price.

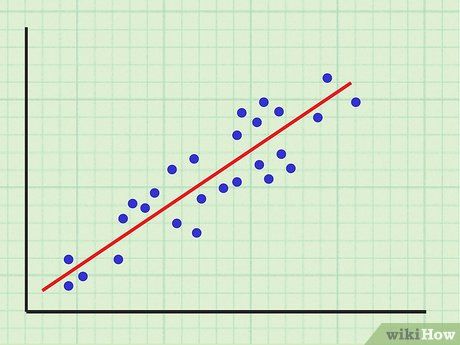

Graph stock return pairs to generate a 'scatter plot'. Utilize spreadsheet software to plot your stocks' dates and returns, facilitating data analysis. Additionally, employing spreadsheet tools, you can plot a regression line representing the best fit to the data.

- In Excel, adding this line is achieved by selecting 'Chart' and then 'Add Trendline.' The software automatically calculates a trend line based on your data.

- The correlation coefficient assesses how closely the two stock returns adhere to the regression line, indicating the degree of conformity to a linear relation such as Y = βX + α, where α and β are constants.