Investment firms routinely update their clients on their return on investment (ROI). If you're an investor, chances are you've received a quarterly return report showcasing the performance of your investments over the past three months. Understanding the strength of your investment (and comparing it to others) becomes easier when you can convert the quarterly return to an annual equivalent. This can be done using a calculator or even pen and paper.

Key Points to Note

- Annualizing a quarterly return provides insight into how an investment might perform over a year under consistent conditions.

- The formula for calculating annual rate of return is: Annual Rate of Return = [(1 + Quarterly Rate of Return)^4] – 1.

- You can substitute the quarterly rate of return with a daily rate of return to estimate annual returns after a few days.

- Keep in mind that investment values can fluctuate over time, and an annualized return is not guaranteed.

Steps to Follow

Finding the Necessary Information

Acquire the quarterly report for your investment. You can receive this through mail or access it online via your account. Alternatively, you can locate this data on the company's official website.

Locate the quarterly rate of return. Within the report, you'll find various figures depicting the performance of your investment over the specified period. Focus on identifying the percentage figure known as the rate of return (ROR), indicating the growth or decline percentage over the last three months.

- For instance, at the end of the numerical data, it might indicate a quarterly return of 1.5 percent. The annual return would be higher, considering potential growth in each quarter. The annualized return represents the growth percentage if the investment maintained the same growth rate throughout the year.

Determine the number of time periods in a year. Before annualizing, ascertain the duration being evaluated. In this case, it's three months as per the quarterly report. Calculate how many such periods occur in a year. For quarterly reports, there are four three-month periods (quarters) in a year. Utilize the value 4 accordingly in the annualizing formula.

- For monthly returns, you would use the value 12.

Computing the Annual Rate of Return

Compute the annual rate of return. To calculate the annual rate of return for a quarterly investment, use this formula: Annual Rate of Return = [(1 + Quarterly Rate of Return)^4] - 1. The number 4 represents an exponent. Essentially, you raise the quantity '1 + quarterly rate of return' to the fourth power and then subtract 1 from the result.

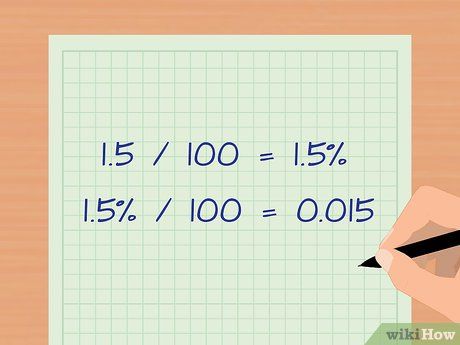

Convert your quarterly ROR into a decimal. For instance, if your quarterly ROR is 1.5%, divide it by 100 to convert it into a decimal form: 1.5% divided by 100 equals 0.015.

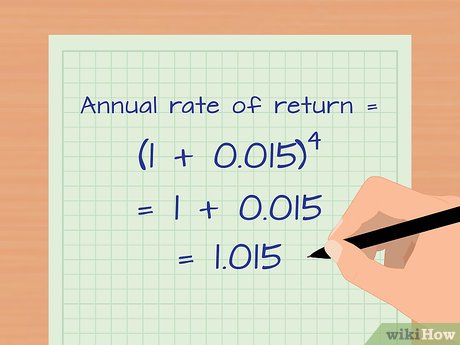

Input your figures. Using the previous example, substitute 0.015 as the quarterly ROR. Consequently, the annual rate of return = (1 + 0.015) raised to the fourth power.

- When you add 1 to 0.015, you get 1.015.

Utilize a calculator to exponentiate that value. If you lack a calculator with exponent capabilities, you can find one online or purchase one from a local office supplies store. Raising 1.015 to the fourth power yields 1.061364.

- If you don't have an exponent-capable calculator, you can manually multiply 1.015 by itself four times.

- Following our example, the revised formula appears as: Annual Rate Of Return = 1.061364 - 1.

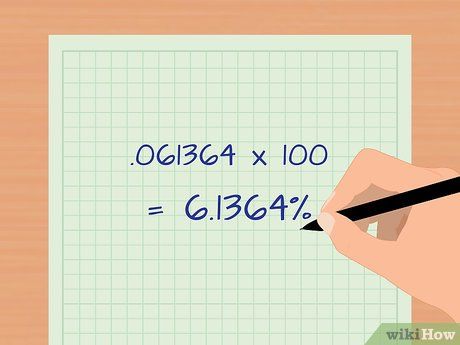

Subtract 1 from the result. This equals 0.061364, representing your annual ROR as a decimal. Multiply this decimal by 100 to obtain the percentage rate of return.

- For instance, in our example, 0.061364 x 100 = 6.1364% for the annual rate of return.

Annualizing Returns on a Daily Basis

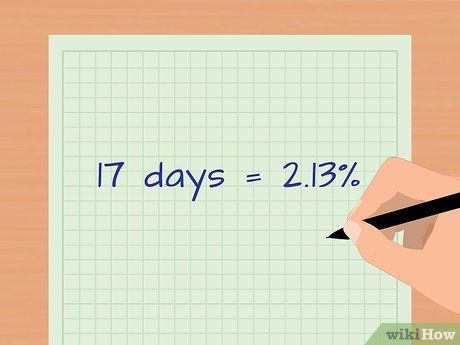

Calculate the Annual Rate of Return based on days. If you have a new investment and want to determine the Annual Rate of Return based on days rather than months, and you've held the investment for 17 days with an earned return of 2.13%.

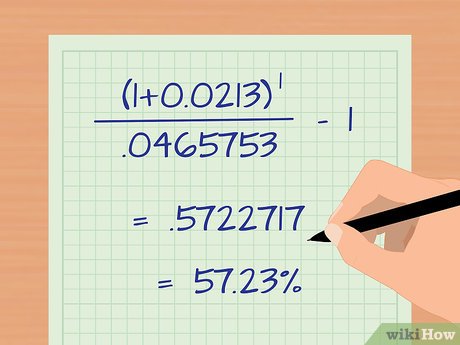

Input the numbers into the formula. For this scenario, divide 17 (number of days the investment was held) by 365 (total days in a year) to calculate the exponent: 17 / 365 = 0.0465753.

- To convert the 2.13% interest rate to a decimal, divide 2.13 by 100, resulting in 0.0213.

- The formula would appear as follows: ((1+0.0213)^1/0.0465753) – 1 = Annual Rate of Return. ((1.0213)^21.4706078)-1 = 1.5722717 - 1 = .5722717. Multiply this by 100 to convert to a percentage: 57.23% annual rate of return.

Exercise caution when annualizing returns. Earning 2.13% over a certain number of days or months does not guarantee the same earnings throughout the year. Stock market returns fluctuate daily, but you can make a rough estimate.

Helpful Reminders

-

'Quarterly return' is also the term used to describe tax returns that certain employers, self-employed individuals, and recipients of unemployment benefits must file every three months.

Essential Tools

- Quarterly return documentation

- Calculator

- Pen

- Paper