The Occupational Safety and Health Administration (OSHA) is a federal government regulatory agency responsible for ensuring that American workers operate in a safe work environment to the greatest extent possible. The agency mandates certain businesses to report their accident, injury, and incident statistics that occur on the job. These incidents are recorded on an OSHA 300 form, typically managed using a spreadsheet.

Steps

Checking If Your Business Must Report Incidents to OSHA

Determine the total number of employees in your company. If your company had 10 or fewer employees throughout the previous calendar year, you are not required to report incidents to OSHA.

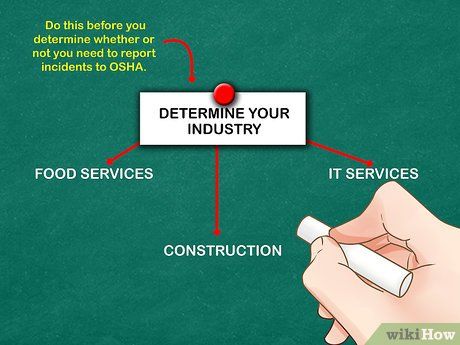

Identify Your Industry. Each business belongs to a specific industry or sector. Before determining whether you need to report incidents to OSHA, you must first ascertain your industry.

- Industries are generally categorized into broad groups such as 'Construction,' 'IT Services,' 'Food Service,' etc.

- Select one or two keywords that best describe your business, which you will need for the subsequent step.

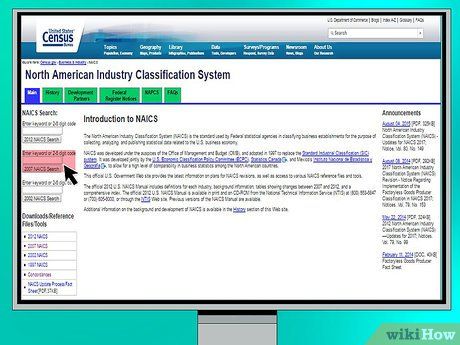

Obtain the NAICS Code for Your Business. The NAICS, or North American Industry Classification System, assigns a 6-digit code to classify businesses. This code is utilized by the federal government to compile statistics on businesses in the United States.

- Access the NAICS search site.

- Enter a keyword describing your business in the field in the upper right-hand corner of the screen, just above the '2007 NAICS Search' button. OSHA still employs the older NAICS codes, so use this search instead of the newer 2012 version.

- Click the '2007 NAICS Search' button.

- You will be presented with a list of NAICS codes and corresponding businesses. Choose the NAICS code that best matches your business.

- For instance, if your business is a restaurant and you enter 'restaurant' in the search field, you will see various codes with descriptions containing the term 'restaurant.' However, code 722110 is specifically designated for full-service restaurants.

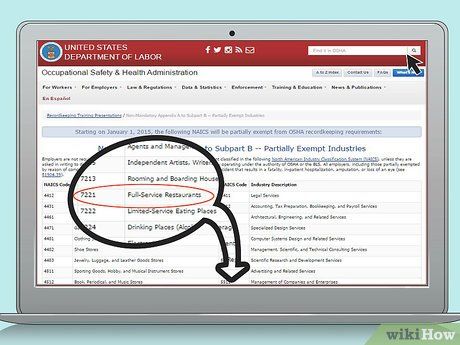

Determine if Your Business Requires Incident Reporting to OSHA Using the NAICS. Refer to OSHA's website to access the list of exempt business types based on the NAICS. You only need the first four digits of your NAICS for this step. For instance, if your NAICS is 722110, you only require the 7221 segment of the code.

- OSHA's website categorizes exempt industries by NAICS in ascending numerical order. Simply scroll down until you locate your industry code. If it appears on the list, your business is exempt. For instance, you will find that 7221 is exempt, indicating that full-service restaurants are not required to report incidents to OSHA.

- However, bear in mind that you may still need to report incidents to OSHA if requested by OSHA, the Bureau of Labor Statistics, or any other governmental organization operating under OSHA's authority.

Calculating Employee Accidents and Injuries

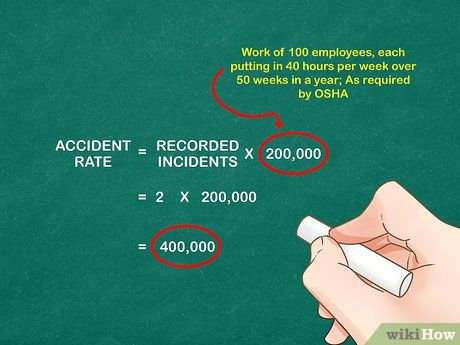

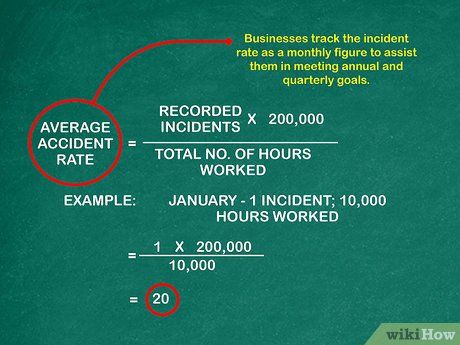

Grasp the Formula for Calculating Accidents. The formula for calculating incidents involves multiplying the number of recorded accidents in a year by 200,000 (to standardize the accident rate for 100 employees) and then dividing by the number of employee labor hours worked. Hence, the formula is accident rate = (number of accidents * 200,000) / number of hours worked.

- The figure 200,000 in this equation represents the hours worked by 100 employees, each working 40 hours per week over 50 weeks in a year; OSHA mandates that the accident rate be expressed as incidents per 100 employees with maximum straight-time hours.

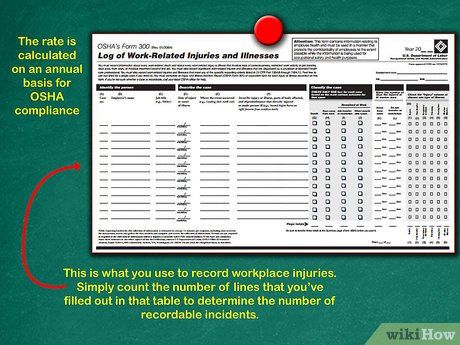

Retrieve the number of accidents and recordable incidents from the OSHA 300 log. The OSHA 300 log is where workplace injuries are recorded. Within this log, there is a table for incident recording. Simply tally the number of entries in that table to determine the count of recordable incidents.

- Remember, the rate is computed annually for OSHA compliance. Therefore, you'll need to examine data from the preceding year to derive the rate.

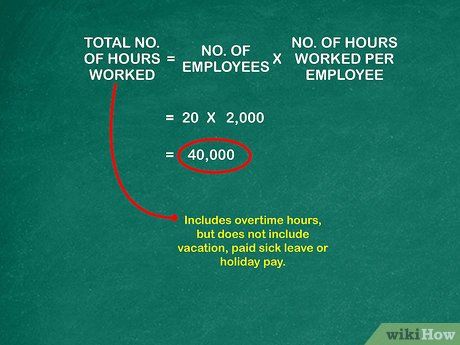

Calculate the total number of hours worked by all employees during the relevant year. This step necessitates gathering some payroll information. For example, if you have 20 employees, each working 2,000 hours in the year, then the total hours worked is 20 x 2,000, yielding 40,000 hours.

- The total hours worked include overtime hours but exclude vacation, paid sick leave, or holiday pay.

Multiply the count of recordable incidents by 200,000. For instance, if you've documented 2 incidents, then the computation is 2*200,000, equaling 400,000.

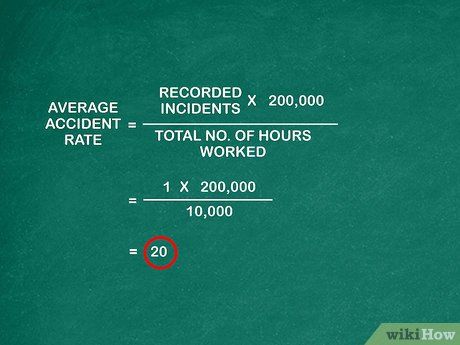

Divide the result by the total number of hours worked. Take the value obtained in Step 3 and divide it by the figure from Step 2.

- For instance, if you had 1 recordable incident out of 10,000 hours worked in a year, your calculation would be 1*200,000 / 10,000.

Calculate the monthly average incident rate. Many businesses prefer to monitor the incident rate on a monthly basis to aid in meeting annual and quarterly objectives.

- Adjust your calculation monthly to reflect the hours worked by all employees solely for that month.

- Sum the incidents and hours worked from each month, then compute the incident rate based on the totals.

- For example, if you had 1 incident in January over 10,000 hours worked, then your January average incident rate would be (1*200,000)/10,000, resulting in 20.

- Similarly, if there were eight accidents over 400,000 hours worked by employees in a year, the accident rate would be (8*200,000)/400,000, or 4.