When you're perusing your favorite department store, the price tags don't show the complete picture. Many cities and states impose a sales tax, which adds to the cost of items like that trendy jacket or stunning jewelry. It's crucial to quickly calculate how much you'll pay at checkout. Follow these simple methods to find out your final bill.

Steps to Follow

Calculating the Precise Sales Tax Amount

Find out the sales tax rate applicable in your area. You can search online or inquire with a store employee. While states typically set a statewide sales tax, certain municipalities may impose additional taxes. This leads to variations in the sales tax rate from one city or county to another.

- Not all purchased items are subject to sales tax. Consult online resources to understand what is and isn't taxed in your locality.

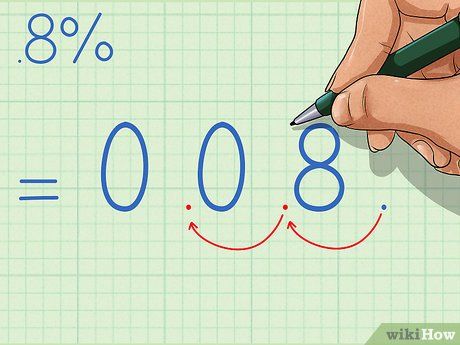

Converting the sales tax percentage to a decimal. To do this, simply take the percentage number and imagine a decimal point after it. Then, move that decimal point two places to the left. For example, if the sales tax rate is 8%, the decimal equivalent would be .08.

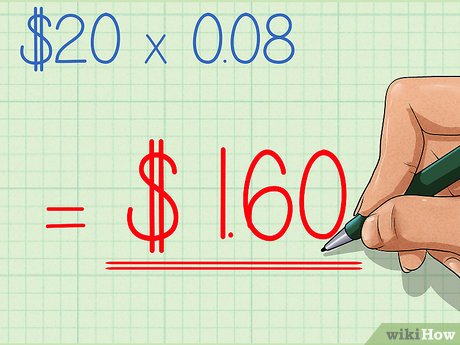

Multiplying the item price by the decimal figure. This step calculates the amount of tax charged for the purchase. For instance, if the item costs $20 and the sales tax rate is .08, you multiply $20 by .08 to get $1.60, the amount of sales tax.

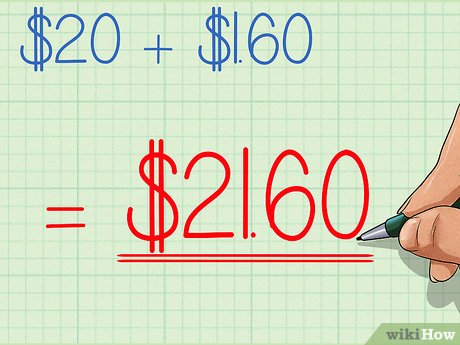

Adding the calculated tax amount to the listed price. This gives you the total amount you'll pay at the checkout. For example, if you'll be charged $1.60 in sales tax for a $20 item, you'll add $1.60 to $20, totaling $21.60.

Estimating the Sales Tax

Approximating the sales tax rate to 10%. This simplifies the multiplication process. When estimating sales tax, the aim is to make mental math easier. Instead of focusing on exact amounts, aim for a close enough estimate. Rounding up to 10% ensures you'll have sufficient funds. Remember, if rounding down, your estimate will be slightly lower than the actual amount.

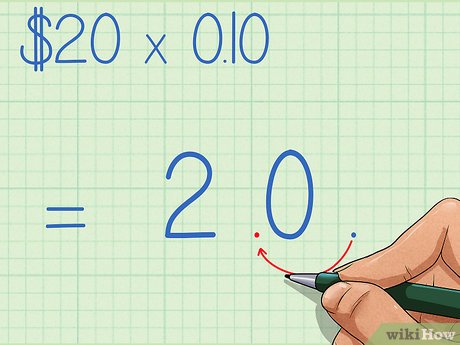

Shift the decimal point in the item cost one place to the left. This gives a quick estimate of the tax amount. No complex math needed—just move the decimal, providing you with 10% of the item's price.

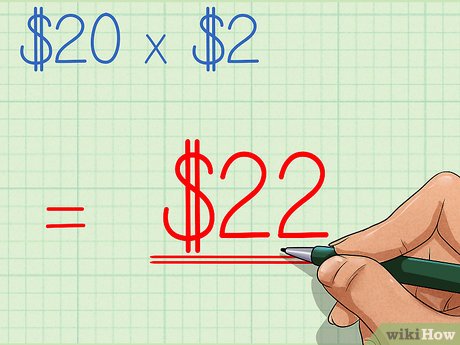

Combine the estimated tax with the item's cost. Since we rounded up, your estimate might be slightly higher than the actual tax. However, it ensures you're prepared to cover the total expense. Using our previous example, adding $20 and $2 yields an estimated total of $22, including tax.

Useful Tips

- Native American individuals are exempt from sales tax.

- Only five states, namely Alaska, Montana, New Hampshire, Delaware, and Oregon, have no state sales tax.

- To calculate, multiply the dollar amount by 1.X, where X represents the sales tax percentage divided by 100. For instance, if an item costs $20 with a 7% sales tax, multiply $20 by 1.07, resulting in $21.40. Alternatively, add 7 cents for every dollar.