The Net Asset Value (NAV) represents the assessed value of a share within a diversified fund, such as a mutual fund, hedge fund, or exchange-traded fund (ETF). Unlike the fluctuating stock prices during market hours, the NAV of a fund is computed at the day's end, reflecting alterations in the fund's invested securities. This daily NAV computation simplifies investors' ability to monitor their fund shares' worth, with a share's NAV typically dictating its selling price.

Steps

NAV Calculation Process

Select the valuation date. The net asset value (NAV) of a mutual fund, hedge fund, or ETF undergoes daily fluctuations in tandem with the stock market, reflecting changes in the fund's asset values. For a meaningful NAV calculation, opt for a valuation date that aligns with your requirements. Choose a specific date and ensure that all data utilized for calculating the fund's net asset value originates from this date.

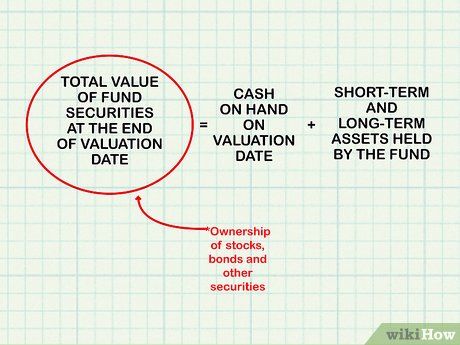

Determine the total value of the fund’s securities at the end of the valuation date. The fund’s securities encompass its holdings of stocks, bonds, and other investments. With these securities' daily updates, you can ascertain the value of the fund's investments in each type of security at the valuation date's conclusion.

- This sum should encompass the value of any cash reserves on hand on the valuation date, along with any short-term or long-term assets retained by the fund.

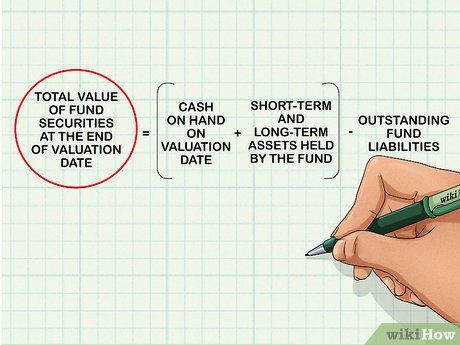

Subtract outstanding fund liabilities. Apart from investments, the fund typically carries various outstanding liabilities. These represent amounts borrowed by the fund to bolster its investments, aiming to generate interest on investments at a rate higher than its loan interest. Deduct these debt amounts from the total value of calculated securities.

- The fund's prospectus will outline its assets and liabilities. Obtain the prospectus online or via phone inquiry. Most newspapers publish daily stock listings, including closing prices of publicly traded stocks.

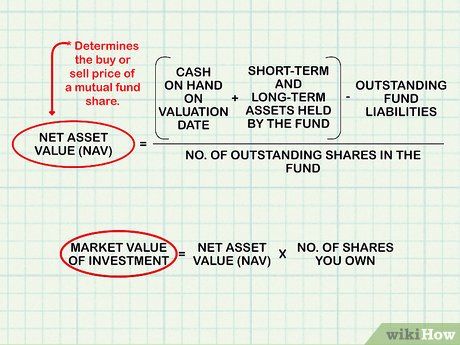

Divide by the number of outstanding shares in the fund. This calculation yields the net asset value (NAV), denoting one share's value portion of the fund's assets. If you hold multiple shares, multiplying the NAV by your share count reveals your investment's market value. Typically, NAV dictates mutual fund share buy or sell prices, allowing you to expect selling shares for a price close to NAV.

- Mutual funds compute NAV per share daily based on fund securities' closing prices.

- Mutual fund buy and sell orders execute using the NAV for the date. Since NAV calculates at business closure, investors await the subsequent business day to trade at that price.

Assessing Long-Term Fund Performance through NAV and Total Return

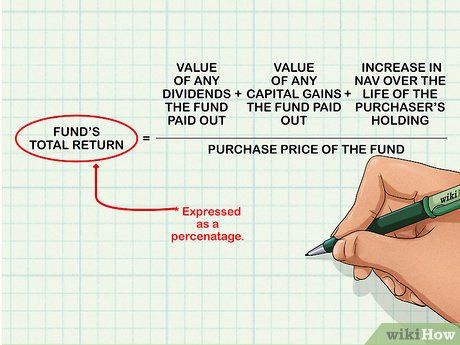

Compute your fund's total return. Fund total return encompasses dividends paid out, capital gains distributed, and NAV growth over the holding period, divided by the fund's purchase price. Expressed as a percentage, total return illustrates the cash distributions and fund appreciation received relative to the purchase price during the fund's tenure.

- Mutual funds are legally obligated to distribute capital gains (positive cash flow from buying and selling stock within mutual funds) to shareholders. Unlike stock shares, where capital gains augment share price, mutual fund holders receive capital gains directly. Consequently, relying solely on a fund's NAV isn't sufficient to evaluate its long-term performance.

Assess your fund's overall return rate. Evaluating your total return rate helps gauge whether your fund investment yields adequate income. While most funds offer diversity and mutual funds are expected to outperform the stock market, it's essential to compare your fund's performance against market fluctuations to ensure a reasonable return.

- Since 1926, the S&P 500 has yielded an annualized return of about 10 percent. From September 2005 to September 2015, it averaged about 7%. Keep in mind that returns vary based on the holding period and individual stock performance. When assessing, compare your return rate with the stock market's, considering your acceptable return rate.

Evaluate your fund's net asset value. NAV serves as a reliable gauge of your fund's investment value retention. Consistently maintaining a $50 NAV while earning $5 in annual investment income on a $50 mutual fund share equates to a 10% interest rate, surpassing typical savings account returns. Monitoring NAV allows you to track your investment's value retention and income generation.

- Financial experts advise against valuing mutual fund investments solely based on NAV, as with stock investments using daily prices. Successful mutual funds distribute all income and gains to shareholders, except for management fees, focusing on maintaining NAV while providing shareholder interest payments.

Optimize your fund allocations. After evaluating NAV and total return performance, consider adjusting your fund allocations. While mutual funds offer secure and diversified stock investments, some specialize in specific market sectors like technology or healthcare. If your fund fails to meet desired returns and you believe better opportunities exist elsewhere, reallocate your investments accordingly.

Exploring Additional Uses of Net Asset Value

Calculate a company's economic worth. Known as the asset-based approach, this valuation method subtracts liabilities from total assets. It's commonly used when businesses cease operations and prepare for liquidation.

- Select a valuation date and use the balance sheet from that day.

- If needed, adjust assets and liabilities to fair market value, reflecting current market prices for items like inventory, equipment, and property, as well as liabilities like litigation or warranty provisions.

- Include unrecorded assets and liabilities not on the balance sheet but impacting the company's value, such as pending litigation or potential payments within the next operating cycle.

- Subtract liabilities from assets, then divide by the total common shares to determine NAV per share.

- For instance, if a company has $120 million in assets, $100 million in liabilities, and 10 million common shares, the calculation yields a NAV per share of $2.

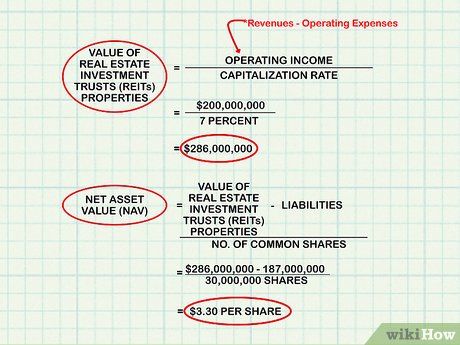

Analyze the performance of real estate investment trusts (REITs). REITs are companies holding income-generating real estate assets or mortgages, offering investors stock shares. While the book value assesses the properties' worth, calculating the net asset value (NAV) better mirrors REIT share market value.

- Commence with property appraisal, using methods like dividing property operating income (revenue minus expenses) by the capitalization rate (expected property return based on income).

- For instance, if an REIT's total operating income is $200 million and the average capitalization rate is 7 percent, property value would be $286 million ($200 million / 7 percent = $286 million).

- After determining property value, deduct liabilities like mortgage debt to obtain NAV. For example, if total liabilities are $187 million, NAV would be $286 million - $187 million = $99 million.

- Divide NAV by common shares. If there are 30 million shares, NAV per share equals $99 million / 30 million = $3.30.

- Theoretically, REIT share prices should align closely with NAV per share.

Evaluate the performance of variable universal life insurance policies. Similar to mutual funds, variable universal life insurance policies accumulate cash value through investments in various separate accounts. As these policies are sold as ownership units to policyholders, assessing policy value involves calculating NAV per unit, akin to mutual funds.

- The process for determining the investment value of variable insurance policies mirrors that of mutual funds.