A detailed guide on assessing and redeeming electronic and paper savings bonds

Key Points to Note

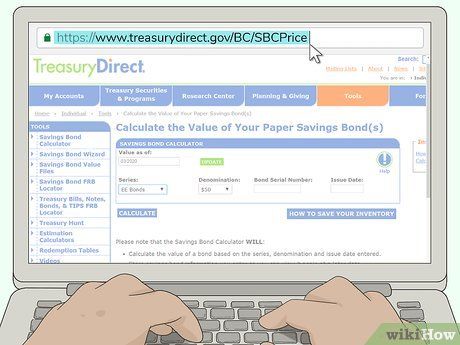

- Utilize the Treasury Direct bond savings calculator to evaluate the worth of paper bonds.

- All electronic bonds are managed on the Treasury Direct platform, the official portal of the US Treasury, where you can find bond values.

- There are two main types of savings bonds: EE bonds with fixed rates and I bonds tied to inflation.

- Bonds continue to accumulate interest until maturity (30 years from issuance), so refrain from selling them prematurely to maximize their value.

Steps to Follow

Paper Bonds

Use the Treasury Direct bond savings calculator. Treasury Direct serves as the official platform for US federal government savings bonds. It’s also where you can purchase new bonds. Utilize the TD calculator to ascertain the current value of your savings bonds.

- Avoid using any other websites to check bond values, as there are fraudulent sites that request unnecessary sensitive information.

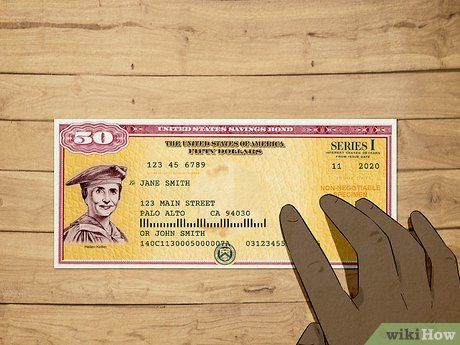

Input the bond’s details for calculation. Choose today’s date, then select the bond type (I bond or EE bond) from the dropdown menu. Pick the denomination ($50, $100, etc.) and enter the bond’s serial number located in the bottom right corner. Finally, input the issuance date (MM/YYYY) found beneath the series in the top right.

- Click “calculate” to determine the bond’s current value as of today.

- Ensure you distinguish the issue date from the print date, which is another date situated in the center of the bond on the right side.

- If checking multiple bond values, create an inventory following Treasury Direct’s guidance here.

Electronic Bonds

Access your Treasury Direct account to view electronic bond values. If you bought electronic bonds through Treasury Direct, you can check their worth there. Log in and choose “Manage Bonds” from the left menu. Your account will display each bond’s value.

- You can trade municipal and corporate bonds with a brokerage account, and treasury bonds (T-notes) via a brokerage, but savings bonds can only be held on Treasury Direct.

- If you’re unable to log in, select “forgot your account number” or “forgot your password” and follow the steps to reset your account.

- If you don’t have a Treasury Direct account, you don’t possess any electronic savings bonds unless they were gifted to you. You’ll receive an email containing a link to your account if the bonds were gifted.

Redeeming Bonds

Visit your bank with an old, matured paper bond to redeem it. Any bank will assist you in redeeming your savings bond. Contact your bank to inquire about the necessary documents. Bring the bond to the bank along with your identification and any other requested paperwork. Present it to the teller for redemption.

- This is suitable for matured bonds that have already reached their maximum interest. If your bond is still maturing, consider holding onto it!

- Alternatively, you can fill out FS Form 1522 and mail the bond to the federal government for redemption. However, visiting a bank is usually quicker and easier.

You have the option to sell electronic bonds early through Treasury Direct. If you wish to redeem your electronic bond before its maturity, navigate to the “current holdings” section and select “Manage Direct.” Follow the provided link to cash out your electronic bond.

- Once electronic bonds mature (30 years after issuance), the funds are automatically deposited into your Treasury Direct account.

- Early redemption of EE or I bonds incurs a forfeiture of 3 months' interest if done before the bonds reach 5 years of age. For instance, if you sell a bond after holding it for 22 months, you will receive interest for only 19 months.

- EE and I bonds must be held for at least 1 year before they can be redeemed.

Is Early Redemption Advisable?

No, unless you have an immediate need for the funds. Savings bonds represent a stable investment, and if your bonds are still maturing, it's wise to retain them to benefit from the accrued interest. The interest on savings bonds compounds, resulting in exponential growth as it's added to your principal amount. Consequently, the final years of a bond’s term are typically the most lucrative!

- If you lack a compelling reason to redeem your bonds early, it's advisable to wait until they reach maturity.

Indeed, if you require immediate funds. Upon selling your bond, you'll receive its face value along with accrued interest. Even if the bond is less than 5 years old, forfeiting 3 months of interest is a small trade-off. Selling a bond early is often preferable to incurring debt or assuming other financial risks, so feel free to proceed with the sale if necessary.

- If you're torn between using savings or selling a bond, compare the interest rates. Sell the bond if your savings account offers a higher rate, or dip into savings if the bond's rate is superior.

Savings Bond Varieties

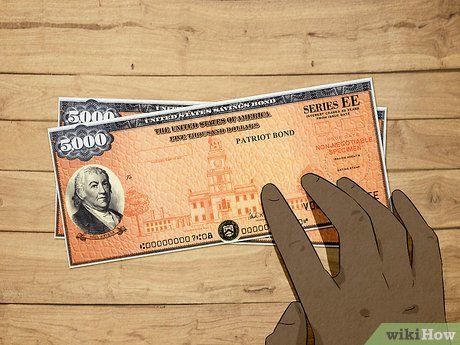

EE Bonds (Also Known as 'Patriot Bonds') EE Bonds aim to double their face value over 20 years, continuing to accrue interest for another 10 years thereafter. These bonds pay monthly interest and compound it semiannually, featuring a fixed interest rate determined by the purchase date.

- The 'face value' denotes the bond's original purchase price.

- Interest rates for EE Bonds vary based on the purchase date. All EE Bonds mature 30 years from the issuance date.

- Patriot Bonds are essentially identical to EE Bonds, with the term used from 2001 to 2011.

- An individual can buy up to $10,000 worth of EE Bonds annually.

I Bonds I Bonds serve to safeguard your funds against inflation, which erodes the purchasing power of currency. Similar to EE Bonds, I Bonds accrue monthly interest that compounds semiannually. However, the interest rate for I Bonds adjusts every six months according to inflation rates.

- For instance, as of October 2022, the interest rate for I Bonds stands at 9.62%. If inflation decreases in the subsequent six months, the rate will decline; conversely, it will rise if inflation increases.

- All I Bonds reach full maturity 30 years after issuance.

- Similar to EE Bonds, individuals can purchase up to $10,000 worth of I Bonds annually.

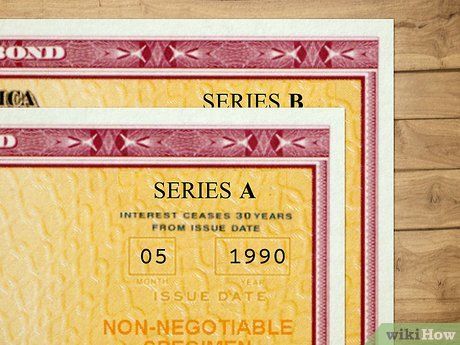

Discontinued Paper Bonds Although the government currently offers only EE and I Bonds, you might possess a paper bond with a different designation. Bonds labeled A through K have reached full maturity and no longer earn interest.

- HH Bonds constitute an exception. While unavailable for purchase, the last series of HH Bonds matures in 2024. These bonds are akin to EE Bonds but yield a fixed interest rate of 1.5%.

- The government ceased issuing paper bonds in 2011.

Calculator and Terminology Guide

Example of Savings Bonds Value Calculator

Example of Savings Bonds Value Calculator Example Glossary for Evaluating Savings Bonds Value

Example Glossary for Evaluating Savings Bonds ValuePointers

-

Remember, a bond's value is influenced by its interest rate, which in turn is affected by market demand.