A risk management policy serves as a valuable tool to recognize, mitigate, and forestall potential risks. Mastering the art of crafting a risk management policy constitutes a fundamental aspect of shaping your organization's strategic goals. Let's guide you through the process of drafting a comprehensive risk management plan to safeguard your business.

Steps

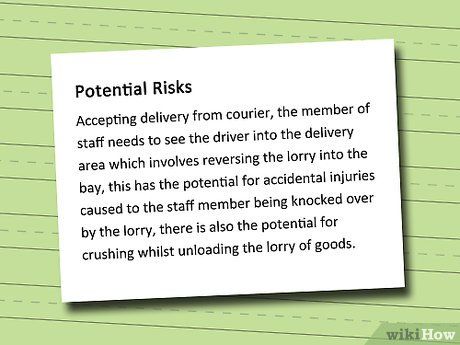

Identify the potential risks inherent in your work environment, considering all stakeholders.

- Examine the various aspects of your operations, including strategic goals, day-to-day activities, financial management, technological endeavors, and regulatory compliance.

- Compile a comprehensive list of potential risks and analyze them individually, categorizing them based on their nature and impact.

Analyze each identified risk thoroughly.

- Detail how these risks might manifest, strategies for prevention, additional precautionary measures, and methods for ongoing evaluation and assessment.

Review past incidents your organization faced and evaluate their management.

- Examine historical records to gauge incident frequency, assess management strategies' effectiveness, and pinpoint areas for improvement.

Assess the likelihood of each risk recurring based on organizational history, industry best practices, and peer insights.

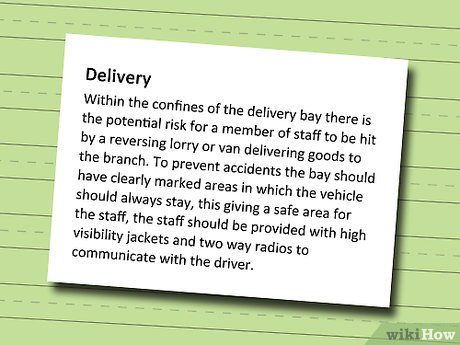

Create action plans for identified risks, prioritizing those with higher recurrence likelihood.

- Detail step-by-step procedures for risk avoidance, mitigation strategies, incident handling protocols, and documentation processes.

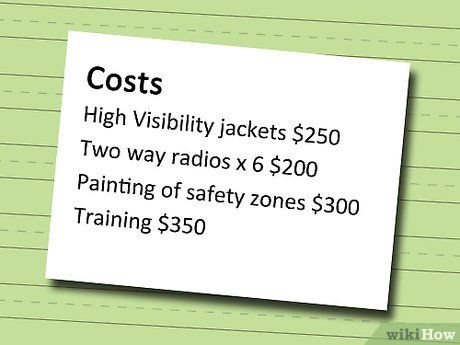

Estimate the costs associated with implementing risk management policy recommendations. Present this information to internal stakeholders during policy proposal stages.

Compile reports for both internal and external stakeholders, outlining auditing procedures to review and assess policy adherence.

- Internal stakeholders require details on major risks, accountability structures, monitoring processes. External stakeholders should understand the organization's risk management culture and policy framework.

Implement a data tracking system to log all risk management data, ensuring staff are trained in its use.

- Developing a post-incident risk assessment form can aid in evaluating necessary precautions. This facilitates immediate data recording post-incident and ensures consistency across assessments.

Establish a routine monitoring process to assess all risks and evaluate the effectiveness of treatment plans.

Review the risk management policy every six months to gauge effectiveness through incident occurrence rate comparisons. Adjust the plan as needed.

- Risk management should be an ongoing process, seamlessly integrated into organizational culture.

Recommendations

-

Assign a dedicated department or individual responsible for assessing and monitoring identified risks to enhance accountability.

-

Ensure risk mitigation plans adhere to legal requirements and regulatory standards applicable to your industry.

-

Involve all staff in developing the risk management plan; frontline employees often possess valuable insights. Alternatively, designate a risk management officer responsible for policy development and evaluation.

Cautionary Notes

- Ensure that the writing process remains collaborative and avoids blame or finger-pointing. Emphasize its positive, preventive nature rather than punitive actions based on past occurrences.

- Upon identifying organizational risks, review insurance coverage levels in consultation with relevant stakeholders. Adjust coverage as necessary to align with the risk management policy.

- Identifying risks entails managerial responsibilities. After identification, managers must provide training, equipment, and oversight to empower staff in risk avoidance.