This guide is intended for individuals residing in the United States. Legal requirements for Powers of Attorney may differ in other jurisdictions, thus it's essential to familiarize yourself with the laws applicable to your area before drafting or accepting a Power of Attorney if you're not located in the United States.

When granted power of attorney (POA) in the United States, it authorizes you to manage financial accounts and sign legal documents on behalf of another person. POA is granted through a legal document that complies with state laws. Upon its execution, you assume the role of attorney in fact, serving as the individual's representative. Typically, when signing documents in this capacity, you'll first sign the principal's name, followed by your own with the designation 'attorney in fact' or 'power of attorney.'

Steps

Becoming Attorney-in-Fact

- Ensure that the forms or templates comply with your state's legal requirements.

- Review the listed POA duties to ensure comprehensive coverage of your intended actions. If acting as someone else's agent, ensure you're comfortable fulfilling all responsibilities outlined in the document.

- For instance, in numerous states, a basic POA document might not grant the agent authority to act on behalf of the principal in real estate transactions.

- Some POA agreements take effect upon signing, while others are contingent upon specified events. For example, you may have an agreement that activates only when the principal becomes incapacitated or unable to manage their finances.

- In certain states, forms enumerate every possible power an agent may possess under a POA agreement. It is your responsibility to designate the powers granted to the agent under this specific agreement. Failure to specify grants no powers to the agent. Other forms or templates may simply list the powers conferred to the agent.

- Typically, both the principal and the agent must sign the POA document simultaneously. If notarization is required, both parties should appear before the notary together.

- If using a form or template, check for space at the bottom for witness signatures or a notary seal. This will indicate whether notarization is necessary or if additional witnesses are required.

- Organize a file for your personal records containing the POA document and details about the principal's accounts, including financial institution names and account numbers.

- Consult with a lawyer if you believe a petition for conservatorship is necessary. The individual may have already designated a POA through a living will, or there could be other complicating factors.

Guidelines for Acting as Attorney-in-Fact

- Some banks or financial institutions may request to see the original document before allowing you to sign on behalf of the principal.

- Bring a government-issued photo ID to verify your identity as the signer of the POA document. Consider contacting the institution beforehand to inquire about any additional requirements.

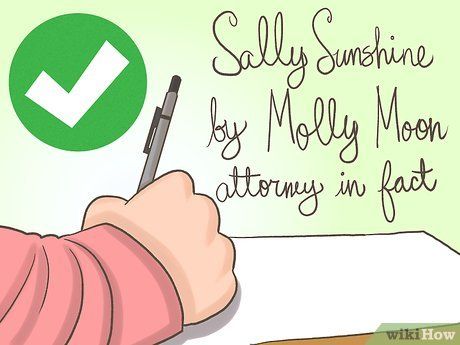

- If the institution does not specify a format, you can use the standard format of the principal's name followed by your name, along with either 'attorney in fact' or 'power of attorney.'

- For instance, if you hold POA for your aunt, Sally S. Sunshine, and her bank account is listed under 'Sally Sunshine,' sign her name accordingly without her middle initial.

- Sign the principal's name just as you would sign your own, using cursive handwriting. Consider printing the name after your signature, but maintain a cursive signature rather than printing.

- For example: 'Sally Sunshine, by Molly Moon.'

- For instance: 'Sally Sunshine, by Molly Moon, attorney in fact.'

- You may also consider using the abbreviation 'POA.' However, avoid using terms like 'attorney' or the abbreviation 'atty.' These imply that you are the individual's legal representative or attorney at law.

- It is important not to sign your name or the principal's name without indicating that you are signing under a power of attorney. Failure to do so can lead to legal repercussions.