If you suspect receiving an email allegedly from Bank of America that seems suspicious, remain calm. These deceptive emails, known as 'phishing emails,' are distributed to hundreds and thousands of recipients at once, with the intention of deceiving at least a few individuals into falling for the scam. By learning to recognize the indicators of phishing, understanding how to report it, and safeguarding your information, you can shield yourself from identity theft and various types of scams.

Steps

Identifying a Phishing Email

Be vigilant regarding the email address. One of the prevalent tactics employed by email scammers is to utilize an email address that appears official. Given that the bank is purportedly reaching out to you via email, it may seem like a legitimate correspondence. However, these email addresses are often not authentic and merely resemble official addresses. For instance:

- The genuine domain for Bank of America is @bankofamerica.com. If the domain in the email you receive is @bankofamerica.us, or @bankofamerica.net, or any variation thereof, it is likely counterfeit.

Avoid succumbing to urgent appeals. Genuine urgent matters between a bank and its customer are exceedingly rare. Even in such cases, email is the least likely method of contact the bank will utilize.

- If there is a genuine urgent matter, you will be contacted via telephone, postal mail, or it will be publicly announced.

- Be vigilant for poor grammar, spelling, and punctuation. Phishing emails often originate from scammers outside the US, resulting in language errors or adherence to British spelling conventions.

Keep in mind that personal information is the gateway to identity theft. Scammers typically aim to perpetrate some form of identity theft and may request personal information in a phishing email.

- They may request Social Security numbers, credit card details, debit card or ATM card PINs, or Bank of America online login credentials.

- Bank of America will never request any of the aforementioned details via email.

Reporting a Suspicious Email

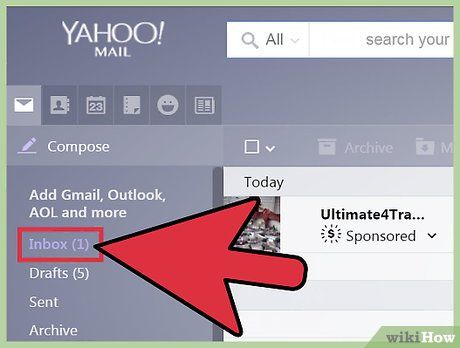

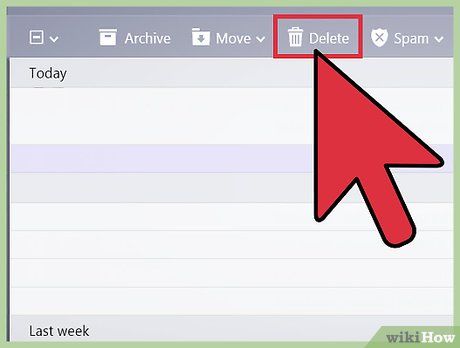

Refrain from deleting the email immediately. Eventually, you'll need to share the email with Bank of America, so retain it in your inbox until then. Additionally, avoid clicking on any links within the suspicious email.

- Scammers can be adept, and if unable to directly obtain your personal information, they may embed malware into email links. This malware, which can be challenging to remove, can record personal information like logins and passwords, facilitating identity theft.

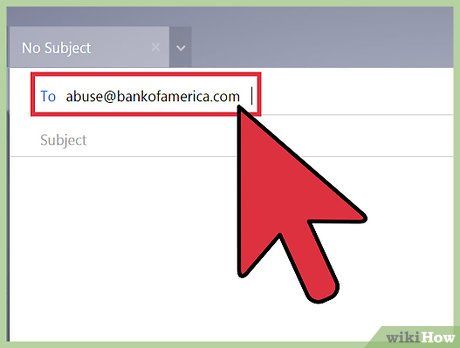

Forward any suspicious emails (including full headers) to abuse@bankofamerica.com. These will be directed to their fraud detection department. They will reach out to you via telephone to verify the legitimacy of the communication. If deemed fraudulent, they will collaborate with law enforcement to trace its origin.

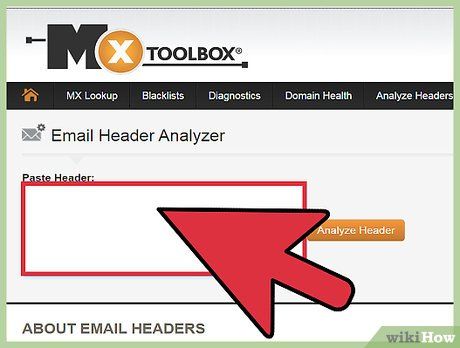

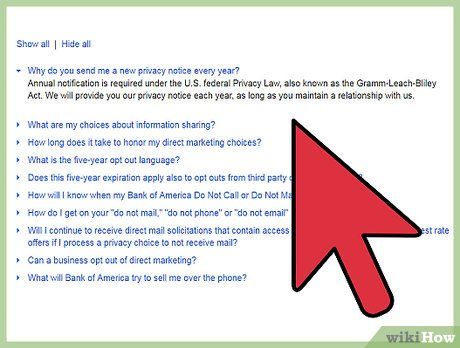

- The email header contains technical details analogous to the TO, FROM, and SUBJECT lines. If you wish to learn how to view the header in your email program, you can do so at https://mxtoolbox.com/Public/Content/EmailHeaders/

Contact Bank of America directly to report the fraudulent activity. Bank of America provides a telephone line specifically for reporting suspicious activity. If you prefer initiating the complaint over the phone, you can call 1-800-432-1000.

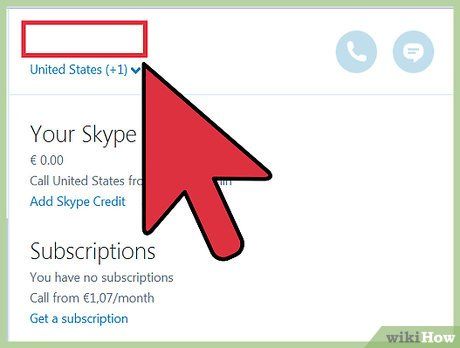

Stay cautious of similar fraudulent schemes. Occasionally, scams of the same nature are executed via text messages and Voice Over Internet Protocol (VoIP) phones. The indicators of such scams, including urgent requests, grammatical errors, and requests for personal information, remain consistent.

- You can report suspected fraud of these types using the same methods. Either email abuse@bankofamerica.com or call 1-800-432-1000.

Safeguarding Your Information

Ensure antivirus software is installed on both your computer and smartphone. Despite our efforts to avoid deception, nobody is infallible. Reliable antivirus and anti-malware software are indispensable.

- Furthermore, many antivirus programs offer free versions. Seek out a well-regarded program with a proven track record. cnet.com is a reputable source for reviews.

Avoid carrying sensitive documents with you. Unless necessary for immediate use, it's prudent to store items like birth certificates and Social Security cards at home in a secure location. Sometimes, all it takes for a scammer to gather more information is a single piece of data.

Safeguard your bank statements. If you receive paper statements by mail, ensure they're stored securely. Before discarding them, consider shredding or destroying them to prevent unauthorized access.

- Consider transitioning to online banking and electronic statements. This eliminates the need for physical documents while maintaining a digital record. Additionally, it familiarizes you with your bank's online procedures, reducing susceptibility to phishing attempts.

Keep personal information separate. Avoid including sensitive details like your account number or driver's license number on personal checks, or your PIN on your debit card. Combining this information makes it easier for scammers. By prioritizing security over convenience, you mitigate the risk of unauthorized access.