Making cash deposits is often straightforward: visit your bank, complete a deposit slip, and inform the teller of your intentions. Ensure the slip is filled correctly to avoid errors. Depositing cash online requires additional steps, such as opening an account at a traditional bank and using electronic transfers or money orders.

Steps to Follow

Completing a Deposit Slip

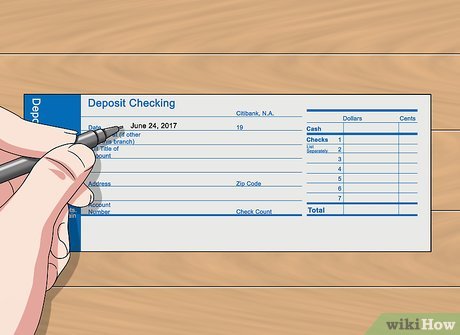

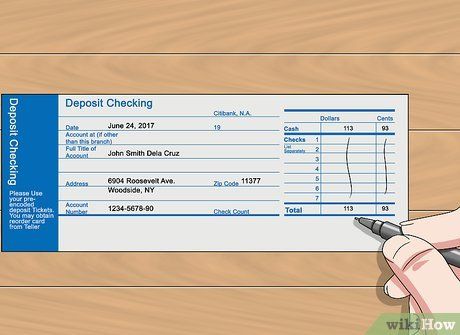

Verify the preprinted details. Many details, such as your name, address, and account number, are already provided on the slip. Double-check their accuracy before proceeding with the deposit. If any information is missing or incorrect, contact your bank for assistance. If deposit slips weren't provided initially, inquire at the bank for unnumbered slips to manually enter your account number.

Note down the date on the slip. Make sure to write the date of your deposit on the space provided on the left side of the slip. This helps ensure a smooth transaction and avoids confusion.

Specify the amount of cash you're depositing. Find the line designated for cash deposits, usually the first line on the right side of the slip marked with a small black triangle and the word 'CASH.' Total the cash amount and write it on this line. If depositing checks too, list their totals on subsequent lines.

Calculate the total deposit. After completing the slip, add up the amounts of cash and checks. Write the total at the bottom of the slip. For example, if you deposited $50 and $100 in cash along with two checks, the total would be $200.

Depositing Cash in an Online Bank

Opt for an online bank with physical locations. Some online banks have physical branches where you can deposit cash in person. If there's a nearby location, the deposit process is similar to that of a traditional bank.

Opt for a money order. Money orders function like checks but are backed by public or private services such as Western Union or the Indian Postal Service. Visit a money order service, purchase a money order, and then follow your bank's instructions to deposit it.

Transfer funds online. If you have accounts with both an online bank and a traditional bank, deposit cash at your local branch of the traditional bank and then transfer the funds electronically to your online bank. The method may vary depending on your banks.

Utilize wire transfer services. Wire transfer services allow electronic money transfers between accounts and are offered by most major traditional banks. To deposit cash into your online account, deposit the cash at your traditional bank and request a wire transfer.

Depositing Cash in Other Ways

Load cash onto a reloadable prepaid debit card. Instead of depositing cash directly into a bank, purchase a reloadable prepaid debit card. These cards function like regular debit or credit cards and can be loaded with cash for use in making purchases.

Use an ATM to deposit cash. Automated teller machines (ATMs) allow you to access your bank account and sometimes accept cash deposits even when the bank is closed. Ensure you use a bank with access to a large ATM network, as not all ATMs accept cash deposits.

Avoid sending cash by mail. While some banks accept check deposits by mail, it's risky to send cash through the postal service. Instead, consider converting your cash to a money order, as the risk of money getting lost in the mail is significant.