Equifax, one of the three major credit bureaus, provides contact details for its free annual credit reports. Moreover, contacting Equifax is convenient even without requesting a report. Equifax promptly responds to inquiries, comments, and requests online, over the phone, or through physical mail, ensuring accessibility whenever necessary.

Steps

Acquiring a Credit Report

Visit annualcreditreport.com to obtain your complimentary yearly report online. Were you aware that you are guaranteed one free credit report annually? Under the Federal FACT (Fair and Accurate Credit Transactions) Act, every U.S. consumer is entitled to one free credit report each year from each of the three major credit reporting agencies, including Equifax. To request your free report, click here to visit annualcreditreport.com, then follow these steps:

- Click the 'Request your free credit reports' button.

- On the subsequent page, click the 'Request your credit reports' button.

- Fill out the form with the requested information, clicking 'Next' after each page to proceed.

- Follow the prompts to request your reports. Note that, using this method, you can obtain a report from Equifax, Experian, TransUnion, or all three agencies.

To obtain a credit report via phone, dial 1-877-322-8228. Follow the automated instructions provided to complete your request. Ensure you have necessary personal and financial details on hand.

If you prefer receiving credit reports by mail, fill out the official request form from the Federal Trade Commission (FTC). Print the form, fill in required information, and mail it to the address provided.

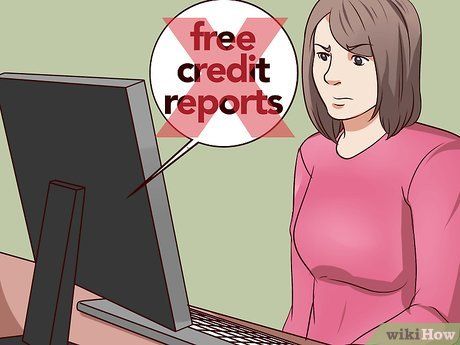

Avoid contacting Equifax directly for credit reports. Equifax, along with Experian and TransUnion, do not process direct requests. Utilize the mentioned methods for obtaining your free credit report.

Be cautious of fraudulent websites. Only use annualcreditreport.com for requesting free credit reports online. Other sites might not be truly free and could potentially compromise your personal information.

Essential Information for Requesting a Credit Report

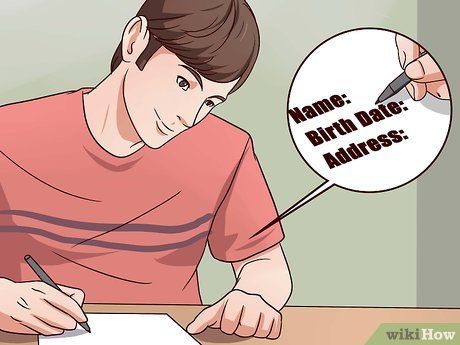

Ensure you have your essential personal details at hand. Regardless of the method you choose to request your credit report, you'll need to provide key information about yourself. This typically includes your:

- Full legal name

- Date of birth

- Current residential address

- If you've moved in the last two years, you'll also need your previous address.

Keep your Social Security number accessible. When requesting a credit report, you'll be asked for your Social Security number (SSN), a crucial piece of private information. This unique number is essential for various financial tasks.

- If you're unsure of your SSN or have lost your card, contact your local SS office for a replacement. You can reach them at 1-800-772-121 or visit ssa.gov. You'll likely need to provide proof of citizenship with a birth certificate or passport.

- When requesting your credit report(s), you may choose to disclose only the last four digits of your SSN.

Be prepared to share limited financial information. Depending on the credit reporting agency, you might need to provide additional financial details to obtain your credit report. Different agencies require different information to compile your report. Knowing this in advance enables you to gather the necessary documents. You may be asked about:

- Mortgage payments

- Student loans

- Car loans

- Credit card payments

Assistance for Personal Account Holders

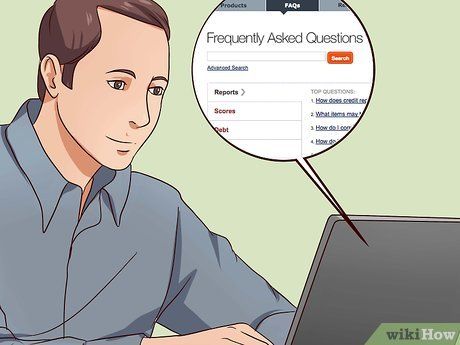

Refer to the FAQ for answers to common queries. Equifax's official FAQ (frequently asked questions) page addresses many common customer inquiries. Personal customers can access it here. The FAQ provides answers to important questions such as:

- 'How does credit reporting function?'

- 'How do I rectify or dispute inaccuracies in my credit file?'

- 'How can I obtain a complimentary copy of my credit file?'

- ...and more.

Access Online Account Assistance for login support. If you've forgotten your username or password, you can recover them here.

- To retrieve your login details, you'll need to verify basic personal information along with your SSN.

Utilize online tools for routine tasks. Equifax offers a range of essential account functions through its online platform. Find specific links below:

Reach Equifax by phone. Equifax provides various helplines for different inquiries and concerns. Refer below for details:

- Call 1-866-640-2273 for general customer service.

- Call 1-888-766-0008 to set up a fraud alert.

- Dial 1-800-685-1111 to request special reports by phone. This number links to Equifax's automated ordering system. Note: Do not use this number for your free annual credit report; use the number provided above.

- For disputing sections of your credit report, refer to the report for the correct contact number. You'll need the confirmation number from your Equifax credit report.

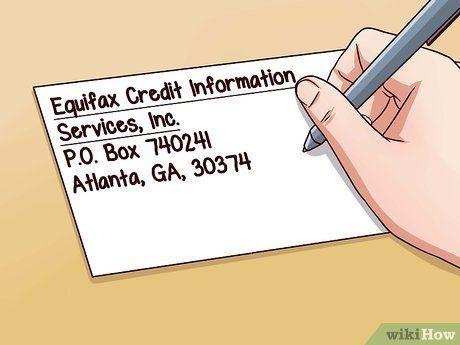

Mail queries to P.O. Box 740241, Atlanta, GA, 30374. If time permits, Equifax accepts most inquiries via mail. Include copies of relevant documents and allow ample time for a response.

- For optimal processing, address your letter to 'Equifax Credit Information Services, Inc.' as follows:

- Equifax Credit Information Services, Inc.

- P.O. Box 740241

- Atlanta, GA, 30374

Support for Business Accounts

Refer to the business FAQ page for solutions to common queries. Before reaching out to Equifax, it's wise to check if your question is already addressed online. Equifax's Business Customer Support FAQ page covers many common issues, including:

- How to update company information via fax (Use 770-740-5223)

- How to cancel your account (Use this form)

- How to verify your account balance (Call 800-685-5000)

- ...and more.

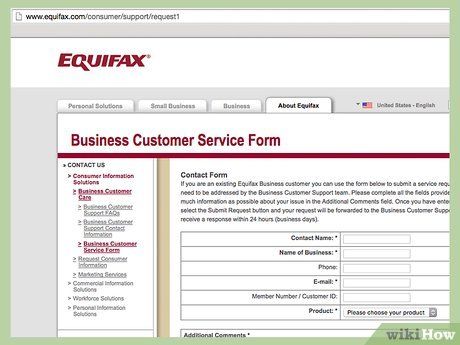

Complete a web-based 'Service Request' form. If you're experiencing issues with your Equifax business account, a convenient way to reach customer service is by submitting a service request through the official contact form. Provide the necessary information and describe your problem in the 'Additional Comments' section.

- Expect a response within one business day.

Contact Equifax Business Support via email. Equifax offers specific email addresses for different types of customer service inquiries. See below for details:

- For support regarding eID Verifier, InterConnect, Decision Power, or eID Compare, email ETSupport@equifax.com.

- For support with Prospect Select, Equifax List Select, ReadiScreen, TPA Lite, or MarketReveal, email emshelpdesk@equifax.com.

Reach Equifax Business Support via phone. Different types of requests require different phone numbers. Refer below for details:

- To inquire about becoming an Equifax business customer, call 1-888-202-4025.

- For existing business customers, contact Equifax business customer support at 1-800-685-5000.

- For Market Reveal or TPA Lite support, dial 1-800-865-5000.

- To reach support for InterConnect, eID Verifier, eID Compare, and Decision Power, call 1-877-420-7345.

- For information about Equifax Mortgage services, call 1-866-746-3780.

Helpful Advice

-

If your credit history is brief or has intermittent gaps (e.g., due to self-employment), you might need extra documentation (such as SS card copies, birth certificate, passport, etc.)

-

Feel free to contact Equifax even if you're unsure of the department — their staff should be able to redirect you to the appropriate contact.

-

To unsubscribe from Equifax mailing lists, dial 1-888-567-8688.