Family members often serve as a reliable resource for unforeseen financial needs. Although asking can be uncomfortable, honesty regarding your financial situation can facilitate the conversation. Sit down for a sincere discussion with your family regarding the required amount and repayment plan. Document the agreement to ensure mutual comfort and understanding.

Steps

Preparing to Seek Financial Assistance from Family

Assess your financial standing before approaching family members for assistance. Take a moment to evaluate your spending habits and monthly expenses. Identify areas where you can reduce costs and explore opportunities to increase income. Establish a personal budget to maintain financial discipline.

- Having a comprehensive understanding of your financial situation will strengthen your case when discussing with your family.

- For instance, if excessive spending on dining out is apparent, commit to preparing meals at home using affordable ingredients.

Seek financial assistance from trusted individuals. Typically, individuals turn to family members, notably parents, as their first choice for financial support. Establishing a solid relationship built on trust and open communication is crucial between you and the family member you approach. Requesting a loan from a distant cousin may not be appropriate unless a similar level of trust exists.

- Trust is key in securing a loan from someone you know well.

- While written communication or phone calls are options, face-to-face discussions are generally more effective.

Avoid seeking financial assistance from individuals facing financial instability. Consider the financial situation of the person you intend to ask for a loan. Requesting money from someone who is financially insecure, unemployed, or burdened with significant medical expenses may appear disrespectful. Refrain from adding pressure to someone already experiencing financial strain.

- While your closest friend may be your most trusted confidant, avoid seeking loans from them if they are also struggling financially.

Establishing Loan Terms

Clearly communicate the purpose of the loan. Initiate a serious conversation to explain why you require financial assistance. Transparency strengthens trust and communication, even if your family members are hesitant to lend money.

- For instance, you might say, “I had to make a significant payment toward my student loan, leaving me short on rent for this month.”

Specify the exact amount you require. It is helpful to provide documentation of the expense, such as a bill or rental agreement if available. Requesting more than necessary is inappropriate, and needing a second loan due to inadequate borrowing portrays irresponsibility.

- For example, you could say, “I would like to borrow $20 to attend the concert this weekend.”

Develop a detailed spending plan for significant loans. When seeking substantial funds to cover various expenses or a business venture, outline how the money will be allocated. Providing a clear and concise plan demonstrates your responsibility and ensures your personal finances are well-organized.

- For instance, the budget might allocate $200 for the electric bill, $100 for groceries, and $50 for transportation.

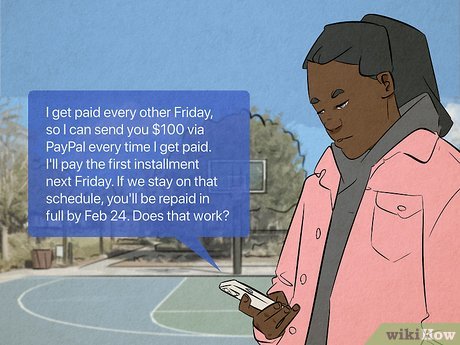

Clarify the repayment timeframe. Evaluate your personal or business budget to determine a suitable repayment period. This depends on the loan amount and your monthly financial capacity. Adjust your budget to cut expenses and expedite debt repayment.

- For example, a small loan for dinner may be repaid within a week, while a substantial business loan could take months or even years.

- Regardless of the loan size or your relationship with the lender, treat borrowing money as a business transaction.

Negotiate a repayment schedule. Discuss the frequency of repayments, especially for larger loans that cannot be repaid all at once. Collaborate with your family to establish a minimum repayment amount per month or other agreed-upon intervals.

- Having a repayment plan in place ensures accountability and prevents oversight in your budgeting.

- Consider alternative forms of repayment, such as completing household chores, as part of your agreement with family members.

Suggest offering nominal interest. Recognize the risk the lender is taking by loaning the money instead of investing it elsewhere. Calculate a modest interest rate, such as 1-2%, and incorporate it into your monthly payments.

- Adding interest is a gesture of gratitude towards your family member's support.

Establish repercussions for delayed payments. Determine consequences for missed payments in collaboration with your family. These consequences could range from gentle reminders to additional charges in the subsequent payment. Choose incentives that motivate you to adhere to the repayment schedule.

- For instance, you might agree to perform a favor or task for your family, such as babysitting a sibling, as a consequence for late payment.

- Implementing consequences demonstrates your commitment to the loan agreement and encourages open communication about a challenging subject.

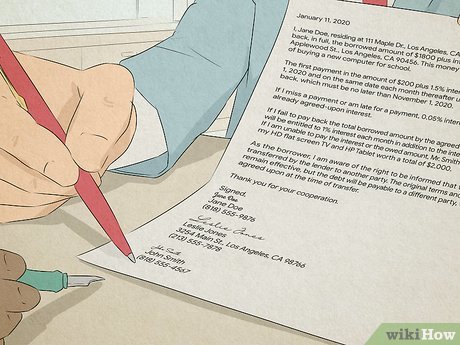

Formalize the agreement with a promissory note. Access sample templates online and print them out. Record the terms discussed with your family, then have everyone sign the document. This transforms your request into a tangible, legally binding contract.

- A physical document helps instill confidence and prevents potential misunderstandings in the future.

Maintain open communication with your family throughout the repayment process. Keep in touch with your family members, updating them on your progress periodically. If you encounter any difficulties repaying the loan, be transparent about it. You may explore options such as deferring a payment or renegotiating the repayment terms.

Facilitating Dialogue

Useful Tips

-

Explore alternative avenues for securing funds, such as obtaining a line of credit, applying for a personal loan, selling items, or taking up odd jobs in your neighborhood.

-

Refrain from haggling with your family members. When requesting their financial assistance, it's essential to abide by their terms and conditions.

-

Unless explicitly stated as a gift, treat the money received from family as a loan to be repaid.

Important Considerations

- Discussing finances can strain relationships. Be prepared for potential challenges in your interpersonal dynamics if you're not transparent about your financial situation.