Post office savings accounts offer secure banking services in India and Europe. Opening one is a breeze with a valid photo I.D. and proof of address. You can visit your local post office to complete an application and make your initial deposit, or you can download one from the post office’s website.

Steps

Collecting the Necessary Documents

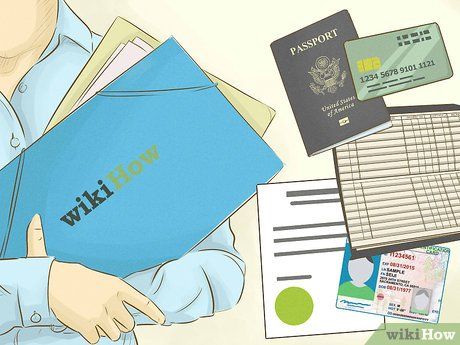

Provide proof of your address at the post office. Bring along at least 1 document demonstrating your address, such as a local authority tax bill for the current council tax year, valid driver's license, recent bank statements, or a mortgage statement. Utility bills like gas, electricity, Internet, and phone bills are also acceptable.

- Another acceptable form of address proof is a letter from a solicitor received within the last 3 months confirming a recent property purchase or land registry confirmation of address. This is applicable to the UK.

Present your identification proof. The post office requires proof of identity, so bring along 1 acceptable document with your legal name from their provided list. Options include a current signed passport, birth certificate, firearms certificate, or an EU National Identity Card with your photo.

- Passports should not be more than 10 years old.

- For the UK, a current driver’s license from the UK, EU, US, Canada, or Australia, not exceeding 10 years old, is acceptable.

- Additionally, for the UK, Benefits Agency correspondence received within the last 13 months is acceptable.

- In India, 2 forms of passport-sized photo I.D. are required.

- Ration cards and a letter issued by the Unique Identification Authority of India are also accepted by Indian post offices.

- If opening a joint account, photos of all account holders must be provided.

Provide proof of identity if you're a senior citizen. India offers a Senior Citizens Savings Scheme (SCSS) for seniors aged 55 and over who have retired. To open an SCSS at the post office, seniors must provide a passport, birth certificate, voter’s I.D., senior citizen card, or PAN.

- Seniors must pay a minimum balance of 1,000 rupees in cash to open a post office savings account.

Applying to Open a Post Office Account

Visit your local post office to obtain an account opening application. Request an account application form from your local post office. Complete the form and ensure you have all necessary documents for proof of address and photo I.D.

- The application form is available on the India Post official website.

- In other countries with a post office savings system, you can obtain the application form from your local post office.

Make your initial deposit when opening an account. Bring a cash deposit when submitting your forms to the post office. For a basic account without checkbooks, an initial deposit of 50 rupees is required and must be paid in cash.

- A maximum deposit of 10,000 rupees is allowed.

- Opening a savings account with a checkbook requires a minimum deposit of 500 rupees.

- Senior citizens opening an SCSS account must make an initial deposit of 1,000 rupees. The SCSS offers senior citizens the opportunity to invest their retirement funds with the security of a government-sponsored savings account. SCSS account holders enjoy returns at a rate of 8.6%.

Select the type of savings account you want on the application. You have the option to choose from various types of accounts such as those with or without a checkbook, basic savings accounts, SCSS, and more. All options are listed on the form for your selection.

List the first names of all applicants for the savings account. A joint account can accommodate up to 3 individuals, so provide your name and the names of the other 2 applicants, if applicable. If you're a minor, include the name of your guardian.

- You can fill out an application on behalf of someone severely ill and unable to do it themselves.

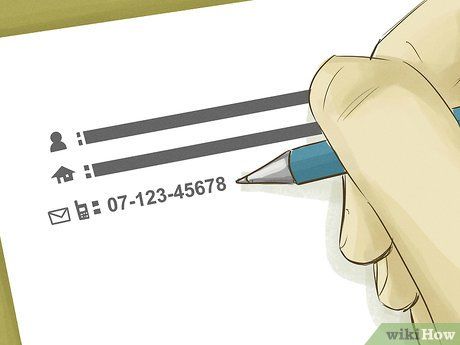

Provide your address and the addresses of other applicants, if applicable. You'll need to include details such as addresses, states, villages, localities, phone numbers, local post offices, and email addresses for each person on the account.

Enter your date of birth on the application. There's a specific section to input your date of birth. If applicable, include the birthdates of any joint holders as well.

Specify who is completing the application. If you're an agent filling out the application on behalf of someone else, indicate this in the provided section. Also, mention whether you're applying jointly with someone else or if the account will be solely yours.

Indicate the documentation you're submitting. On the application, you'll need to specify the types of documents you're providing for proof of address and identity, along with their respective numbers and validity periods.

- For instance, you might mention presenting your passport and utility bill. Include the passport numbers and expiration date on the form.

Enter the deposit amount. Firstly, write the numerical amount on the designated line. Then, spell out the amount in words on the provided line. Also, indicate the mode of deposit.

- For a savings account, the initial deposit must be made in cash.

Nominate the account holders. In the following section, fill in the names of all applicants to nominate them as account holders. This could include yourself, joint holders, or someone for whom you're completing the application.

Sign the form and submit it to the clerk. The clerk will process the account upon receiving the initial deposit. You will also receive a debit card upon making the first minimum deposit.

Tips

- Organize all your documents in a folder along with your cash deposit when visiting the post office to open your savings account.

- Determine whether you prefer a savings account with or without a checkbook, as they have different minimum deposit requirements.

- Do not make unnecessary payments. Only deposit the required minimum balance for the account.