Essential Steps to Preserve Your Funds, Safeguard Your Identity, and Locate Your Wallet

Picture this: You're ready to pay for your morning brew, but your wallet is nowhere to be found. Panic sets in. Is it lost? Stolen? Or simply forgotten at home? If you've experienced the sinking feeling of a missing wallet, you know the urgency to protect your money and identity. While losing your wallet is distressing, swift action can mitigate the impact. This guide outlines the necessary steps to freeze and replace your cards, safeguard your identity, and increase the chances of finding your misplaced wallet. Take a breath—there's a solution!

Key Insights

- Immediately notify your bank and credit card companies to freeze or replace your cards. Also, inform the DMV, insurer, and other relevant entities to replace additional cards.

- Initiate fraud alerts with major credit bureaus such as Experian, TransUnion, or Equifax to prevent identity theft.

- Stay composed and conduct a thorough search in probable locations like pockets, jackets, or your home. If unsuccessful by day's end, consider your wallet compromised.

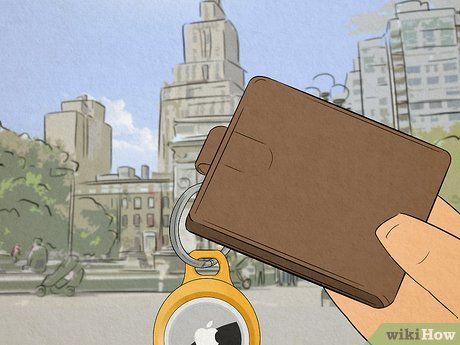

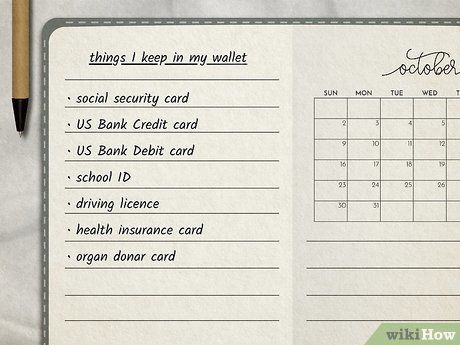

- Maintain a detailed list and copies of wallet contents for reference. Consider investing in a wallet tracker for added security.

Action Plan

Quest for Your Missing Wallet

Begin with the Usual Suspects. After a moment of tranquility, scour the spots where your wallet typically resides. Probe your pant and jacket pockets, and inspect the interiors of recently utilized purses. Extend your search to nearby locales, such as beneath your bedside table or amidst the cushions of your sofa where you previously perched.

Reenact Your Last Known Movements. Physically retrace your path within your abode or locale, or mentally traverse your journey through the city if your wallet strayed further. Summon forth the sensations and musings from that moment to invoke your contextual memory.

- Recall every intricate detail to immerse yourself in the same mental state as when you last possessed your wallet.

- Eventually, a recollection may spark, illuminating the path to your missing item.

Contact or Visit Recent Haunts. Reach out to establishments you frequented where your wallet may have been deployed. Inquire about any misplaced wallets in their possession or whether a benevolent soul turned it in.

- Consider alternative spots where you might have removed it from your pocket, such as showcasing your new license photo to a friend.

Maintain Composure and Avert Panic over Your Absent Wallet. Employ relaxation techniques, like deep breathing exercises, to compose yourself and sharpen your focus. This counteracts the frenetic 'fight or flight' response triggered by sudden stressors.

- In a state of panic, crucial details may slip your mind or vital clues may evade your notice, hindering the recovery of your wallet.

Explore Unlikely Hideaways. Delve into bustling zones of your home or workplace, such as corridors or verandas, and inspect overlooked receptacles where your wallet may have inadvertently found refuge. Probe areas near entrances, lavatories, the culinary space, or any locale where interruptions may have occurred during wallet usage.

- Gradually expand your search perimeter from customary locales. If merely misplaced, it shouldn't stray far from its habitual abodes.

Presume Theft if Recovery Eludes You. Given the jeopardy to your identity and financial data, swift action is imperative. Within a day's span, annul and renew your cards to thwart fraudulent exploits. Forewarn your card providers to preempt unauthorized expenditures. Federal statutes shield you from liability for post-reporting fraudulent charges.

Securing Your Financial Integrity

Vigilance Against Online Fraud. Immediately scrutinize your card statements via web browsers, mobile apps, or direct communication with your financial institutions. Scrutinize transactions post the anticipated wallet misplacement or theft. Unfamiliar charges suggest theft, prompting swift recourse.

- Promptly alert your credit card issuer upon detecting any fraudulent activity to mitigate losses.

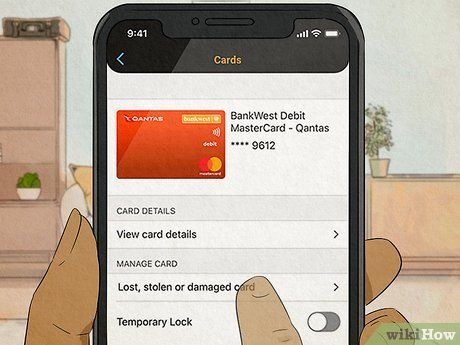

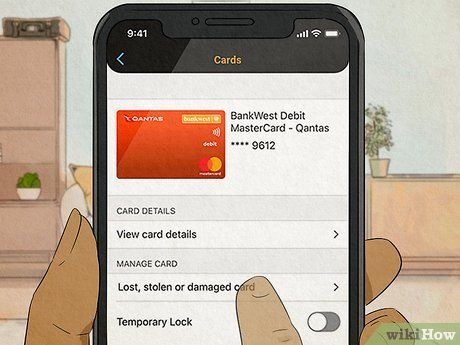

Immediate Card Freeze Protocol. Promptly notify your bank to suspend missing debit or ATM cards and checks. This affords a grace period for wallet retrieval if confident in its misplacement. Upon recovery, request card reactivation; else, initiate card cancellation and reissuance.

- Utilize mobile banking to manage card status and transactions seamlessly.

- Update automated payments with new card details post-receipt to avert service disruption.

- Patronize passport as identification for interim cash withdrawals in the absence of replacement cards.

- Some branches facilitate instant card issuance—verify local branch services beforehand.

Report Missing Cards Instead of Cancelling. Inform your card provider of the disappearance and request replacements to retain your account details. Swift action is key; utilize your mobile banking app to report immediately.

- Key contact numbers include:

-

Mastercard: 1-800-627-8372 (US) or 1-636-722-7111 (Global)

-

Visa: 1-800-8472-911 (US) or 1-303-967-1096 (Global, collect call)

-

Amex: 1-800-528-4800

-

Discover: 1-800-347-2683

- Federal law shields you from liability post-reporting.

- Report within 2 days: liable for up to $50. 3-60 days: up to $500. After 60 days: full liability.

Activate Credit Line Fraud Alerts. If your wallet contained your SS card, contact credit bureaus—

Experian,

Equifax, or

TransUnion. Notify any one to activate alerts; they’ll inform the others accordingly.

- Review complimentary credit reports post-request for any anomalies or suspicious activity.

- Fraud alerts prompt lenders to exercise caution with credit applications under your name.

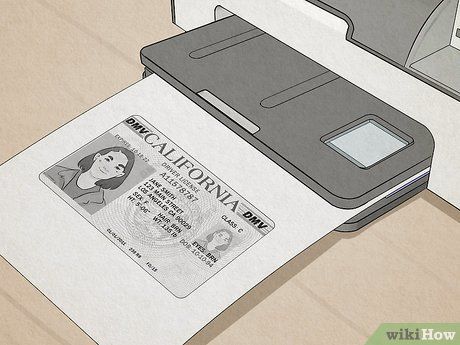

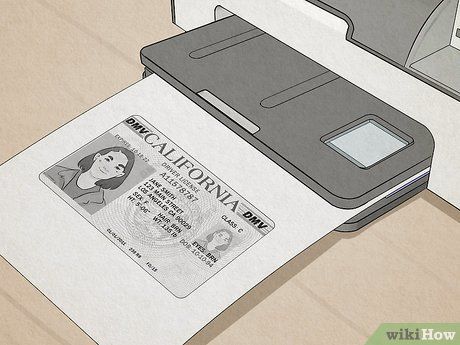

Replace Driver's License or ID. Alert the nearest DMV office of your lost or stolen ID. Follow state-specific instructions for renewal.

- Online renewal is an option; expect a temporary ID until the new one arrives by mail.

- Your new ID retains the old number. Request a change if fraud is suspected.

- A nominal fee usually applies for reissuance.

- Vehicle registration replacement may be necessary.

Request Health Insurance Card Replacement. Notify your insurer; safeguard against unauthorized use. Inquire about altering account details on the new card.

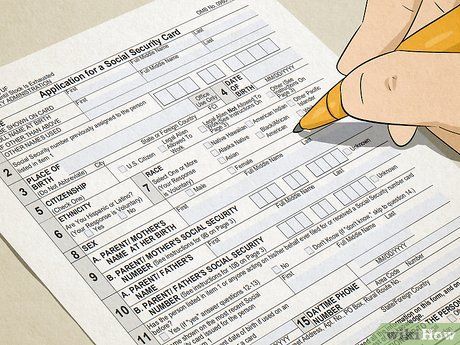

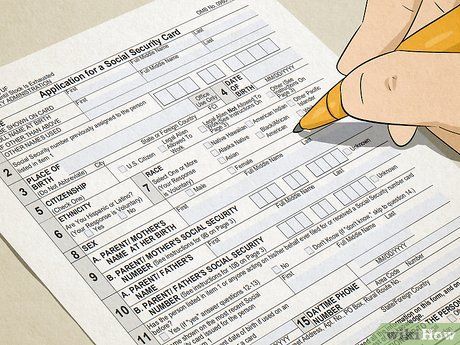

Secure a Replacement Social Security Card. Contact the

Social Security Administration to initiate replacement procedures.

- Provide birth certificate and ID proofs for verification.

- Replacement is free; however, application process varies.

Upgrade Home Security if House Key is Missing. Engage a locksmith or

DIY lock replacement to avert potential break-ins. Criminals might exploit address details from your ID found in the wallet to access your residence.

- Criminals could duplicate your key, even if they return the wallet with the original.

Notify Authorities for Lost Wallet to Document Theft. Lodge a report at the nearest police station to establish theft evidence. Retain a copy for personal records, guarding against identity theft attempts.

- Provide details on loss circumstances, contents, wallet description, and potential suspects.

Fortifying Against Future Incidents

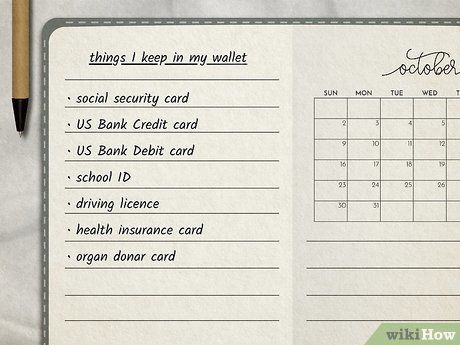

Maintain Card Copies for Emergency. Duplicate card fronts and backs for secure storage at home or in a safe deposit. Include vital documents like SS card, passport, and birth certificate.

- Record customer service numbers and account details for prompt identity verification.

- Essential data is often retrievable from online or mobile banking platforms.

- Avoid carrying SS card in the wallet; limit contents to ID, cards, and insurance.

Document Wallet Contents for Efficiency. Enumerate all items—cards, IDs, checks—prioritizing replacements. Initiate replacements for critical items like cards and IDs promptly upon misplacement.

- Focus on urgent replacements such as cards and IDs, expediting the process.

Include Contact Info for Lost Wallet Recovery. Enhance the chances of wallet return by leaving your email or phone details inside. Omit your home address to foil potential burglars (though likely on your ID). If abroad, jot down info in the local language for easy communication.

- Abroad? Pen down details in the local tongue for swift communication.

Establish a Home for Your Wallet. Foster consistency by habitually placing your wallet in a designated spot upon arrival. This practice averts domestic misplacement and subsequent frantic searches elsewhere.

- Mindful storage during activities ensures safekeeping (e.g., glove compartment during outings).

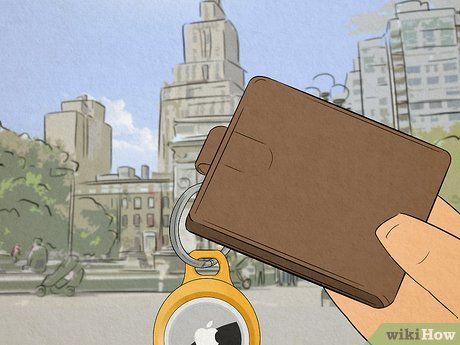

Invest in Wallet Tracking Technology. Procure a Bluetooth- or RF-based tracker to swiftly locate misplaced wallets. These devices, often accompanied by mobile apps, offer real-time tracking and alerts for effortless retrieval.

- Tracker costs range from $25 to $70, a prudent alternative to card replacement hassles.

Useful Pointers

-

Consider enrolling in an identity theft protection plan for added security. Monthly fees typically range from $15 to $17.

-

Divide cash between wallet and a money clip or secure location to mitigate loss risk.

-

Regularly check pockets or purses throughout the day to safeguard against wallet loss. Early detection increases recovery odds.

Important Reminders