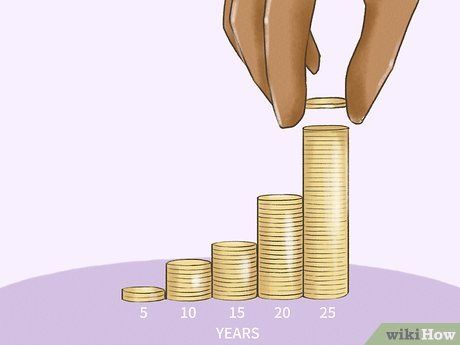

You're never too young to start saving and investing. Those who commence investing early are more likely to develop lifelong habits that pave the way for financial stability. The earlier you begin investing, the greater your wealth accumulation over time. To uncover additional funds for investment, consider launching your own business. With a careful analysis and adjustment of spending habits, everyone can allocate money for investment purposes.

Fundamental Steps

Mastering the Basics

Commence Early

Enhance Savings Regularly

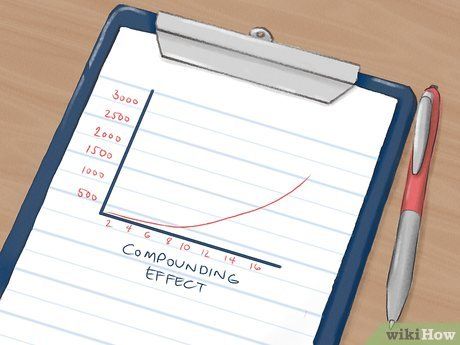

Leverage Compound Interest in Investing

Utilize Dollar Cost Averaging

Harness the Power of Compounding Wealth

Exploring Saving and Investment Opportunities

Utilize Savings Accounts or Certificates of Deposit

Explore Government or Municipal Bonds

Consider Investing in Stocks

Opt for Mutual Fund Investment

Explore Exchange Traded Funds (ETFs) Trading

Utilize Retirement Plans with Employer Match

Explore Alternative Investment Opportunities

Understand Potential Investment Fees

Expanding Your Investable Funds

Explore Entrepreneurship to Boost Investments

Monetize Your Passion

Evaluate Your Spending Habits

Improving Financial Management

Helpful Tips

Consider Using Financial Apps for Savings