Royalty payments are compensation provided to artists, musicians, and creators for the use of their intellectual property by distributors, publishers, or manufacturers. These payments are typically outlined in contracts and must be accurately accounted for to ensure timely and correct payments.

Understanding Royalties

Royalties refer to payments made to individuals who own the intellectual property rights to a particular asset. For instance, a production company may receive royalties for allowing their TV show to be streamed on various platforms.

Steps to Account for Royalty Payments

Establishing Payment Procedures

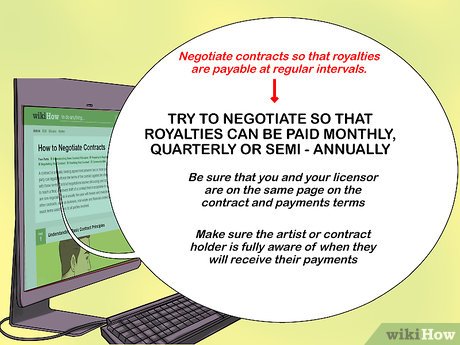

Contract Negotiation: Ensure that royalty agreements stipulate regular payment intervals, such as monthly, quarterly, or semi-annually. Align contract terms with the licensor to avoid discrepancies in payment schedules.

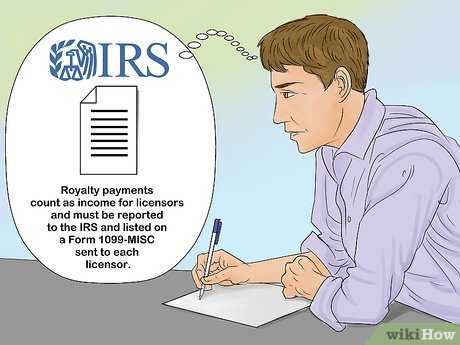

Obtaining Tax Information: Gather tax details for all recipients of royalty payments. This information is necessary for IRS reporting and issuing Form 1099-MISC to each licensor, as royalty payments constitute taxable income.

Choosing Accounting Methods: Determine the appropriate accounting approach based on your company's size:

- Small Businesses: Integrate a royalties section into your accounting software or bookkeeping system. Consider software like Easy Royalties or Metacomet solutions for affordable options tailored to your business.

- Mid-sized Businesses: Engage a specialized royalty accountant to implement a royalty accounting system within your bookkeeping framework.

- Large Enterprises: Establish a dedicated royalty department comprising accountants, IT professionals, and legal experts, especially if your business frequently deals with royalty-based products or operates in industries like software, music, art, or renewable resources. Alternatively, outsource royalty management to an accounting firm.

Recording Transactions

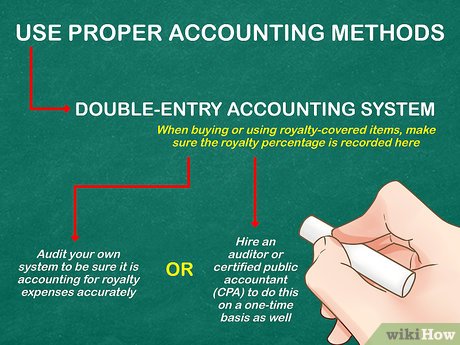

Utilize Appropriate Accounting Methods for Recording Royalties: Ensure that royalties are recorded accurately using double-entry accounting. Regularly audit your accounting system or consider hiring an auditor or CPA for verification.

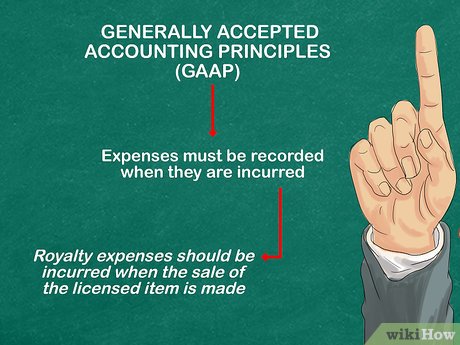

Record Royalty Payments Timely: Adhere to generally accepted accounting principles (GAAP) by recording royalty expenses when they are incurred, typically upon the sale of licensed items.

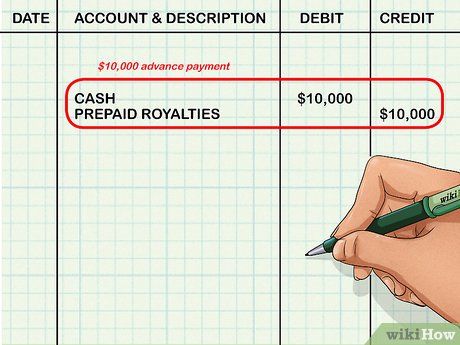

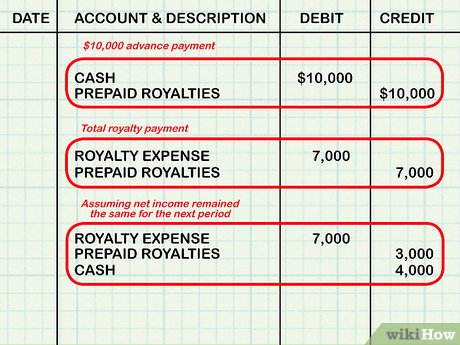

Handle Advance Payments: Account for advance payments by debiting prepaid royalties and crediting the cash account. These payments represent royalties paid in advance for future intellectual property delivery.

Manage Regular Payments: For contracts requiring regular payments based on net income, deduct payments from the prepaid royalty account until depleted. Subsequently, record payments as royalty expenses and reduce the cash account accordingly.

Address Stepped Royalty Agreements: Handle stepped royalty agreements by debiting royalty expenses and crediting accrued royalties in the ledger, especially if payments are made at the period's end.

Minimizing Risks

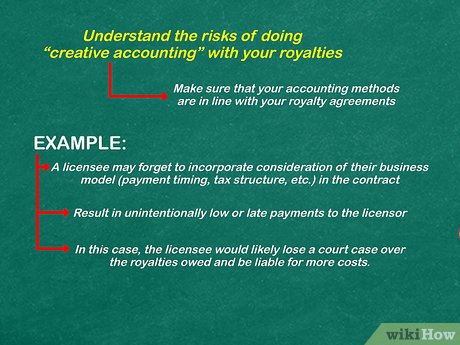

Recognize the Risks of Engaging in 'Creative Accounting' with Your Royalties: Understand the potential consequences of deviating from standard accounting practices in managing royalties. Ensure alignment between your accounting methods and the terms outlined in your royalty agreements to mitigate the risk of legal disputes and additional expenses in the future.

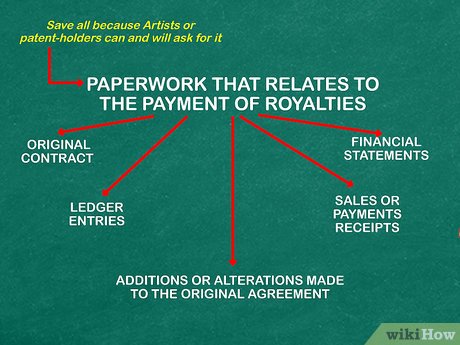

Maintain Comprehensive Documentation Related to Royalty Payments: Retain all relevant paperwork associated with royalty payments, including the original contract, ledger entries, financial statements, sales receipts, and any modifications to the agreement. This documentation serves as evidence of sales, usage, and payments, which may be requested by artists or patent holders.

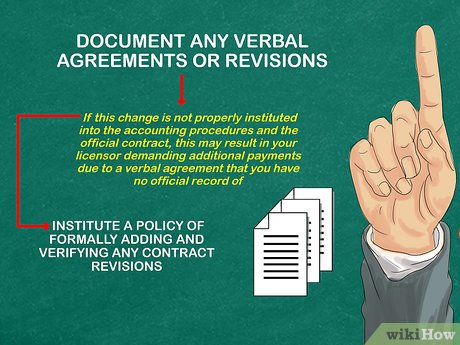

Formally Record Verbal Agreements or Amendments: Document any verbal agreements or contract revisions to ensure clarity and avoid misunderstandings. Properly incorporate changes into official accounting procedures and contract documentation to prevent disputes over unrecorded agreements that could lead to additional payment demands from licensors.

Opt for Check Payments to Provide Payment Verification: Issue checks whenever feasible to maintain a detailed payment trail. Unlike electronic payments, paper checks offer a comprehensive record of transactions, facilitating easier reconciliation of accounts and providing tangible proof of payment.

Useful Tips

-

This article provides insights into the royalty accounting process for licensees who distribute intellectual property under agreements with creators, known as licensors. Licensors should report royalty income as regular income on IRS Form 1040, possibly requiring completion of Schedule E. Seek advice from a tax professional for further guidance.

-

While there's no standard percentage for royalty payments to licensors, they typically range between 1 and 30 percent of gross sales. Negotiating the actual royalty rate with your licensor is essential, so be ready to justify your proposed rate with comparable contracts or industry benchmarks.

Important Warnings

- This article serves as a reference and does not substitute professional legal advice. Consult with a royalties accountant or intellectual property attorney before finalizing your royalty agreements.