If you've managed to save even a small sum, channeling it into investments can foster its growth. In fact, with effective investment strategies, you could potentially rely on the earnings and interest from your investments as a sustainable income source. Begin with safer investment options like bonds, mutual funds, and retirement accounts, especially as you familiarize yourself with the market dynamics. As your capital grows, consider venturing into riskier investments such as real estate or commodities, which offer higher potential returns.

Key Steps

Commence with Secure Investments

- Accessibility to your funds is generally maintained, although the bank may impose limitations on withdrawal amounts and frequency. A money market account isn't intended for emergency funds.

- If you have an existing banking relationship, it might be advantageous to open a money market account there. However, it's prudent to explore other options to secure the best interest rates and minimum deposit requirements that suit your financial objectives and constraints.

- Several credit card companies, including Capital One and Discover, provide online platforms for initiating money market accounts.

- Starting with small amounts, even $20 or $30 a month, is feasible through these direct plans. Visit https://www.directinvesting.com/search/no_fees_list.cfm for a list of companies offering fee-free direct investing.

- Investing in familiar companies makes research easier. Recognize when the company performs well and understand favorable trends.

- You may purchase shares directly from the fund in some instances. Otherwise, a broker or financial advisor can assist in acquiring mutual fund shares.

- As a beginner, mutual funds offer an affordable means of diversifying your portfolio. Access mutual fund shares at a fraction of the cost compared to owning a portion of all assets in the fund.

- Many employers match 401(k) contributions, maximizing benefits. Aim to contribute at least the matched amount to avoid missing out on employer contributions.

- A traditional IRA allows tax-free contributions up to $5,500 annually, with taxes paid upon withdrawal during retirement. Alternatively, Roth IRAs tax contributions but offer tax-free withdrawals in retirement.

- All IRAs leverage compound interest, generating significant growth over time. For instance, a $5,000 contribution to a Roth IRA at age 20 can yield $160,000 by age 65 with an 8% return.

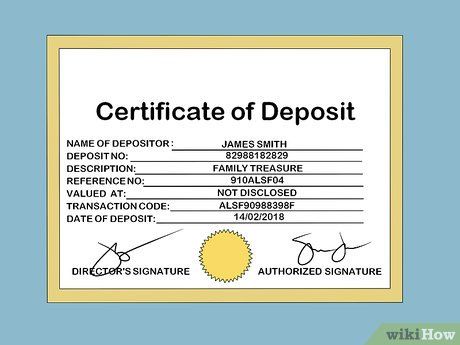

- For instance, if Bella Bakery issues a 5-year $10,000 bond with a 3% coupon rate, Ivan Investor receives $300 every six months for five years before reclaiming his $10,000.

- Bonds typically require a minimum investment, often $1,000, making them accessible with slightly larger investments.

- Series I Savings Bonds combine interest with inflation protection, obtainable directly from the government online. When interest rates are low, they may outperform money market accounts or CDs while mitigating inflation risks.

- Precious metal prices tend to increase during periods of uncertainty, influenced by geopolitical events and instability. Conversely, the stock market tends to react negatively to uncertainty and instability, potentially leading to downturns.

- Unlike other assets, precious metals are not subject to taxation and can be stored and traded relatively easily. However, expect to incur expenses for secure storage if you opt to purchase physical gold and silver.

Embracing Higher Risks

- Passive investment poses lower risk and may serve as a suitable entry point into real estate investment. Investing in real estate investment trusts (REITs), resembling mutual funds for real property, is a popular option. REIT shares are purchasable through brokerage firms.

- Successful currency trading necessitates a deep understanding of geopolitical trends and events. Prepare to stay informed by closely monitoring international news for potential opportunities.

- It's advisable to concentrate on one or two currencies to thoroughly research the respective economies and stay abreast of developments.

- To trade options, establish a brokerage account, either online or through a traditional broker. The brokerage firm will impose trading restrictions based on your investment experience and account balance.

- Passive investors, focused on long-term goals like retirement or funding their children's education, typically don't utilize hedging. However, for those making aggressive or risky investment decisions, hedging serves as insurance, reducing the impact of losses, especially from short-term market fluctuations.

- For more aggressive, short-term investment approaches, consulting a financial planner or advisor is vital. They assist in designing a hedging strategy and ensuring the majority of your portfolio remains protected.

- Commodities include hard commodities like precious metals and soft commodities such as wheat, sugar, or coffee. Investment options include physically buying the commodity, purchasing shares in a commodity company, or acquiring futures contracts.

- Alternatively, passive investment in commodities is achievable through investment funds, including exchange-traded funds (ETFs) holding shares in commodity companies or tracking a commodity index.

Preparing for Success

- Maintain your emergency fund in a savings account to earn interest, distinct from your primary checking account. Obtain a dedicated debit card for quick access to emergency funds.

- Avoid investing funds needed for imminent emergencies.

- For instance, if you invest $4,000 while carrying $4,000 in credit card debt at 14 percent interest, even with a 12 percent investment return, you'll only earn $480. However, with $560 in interest charges, you're still at a loss despite sound investment strategies.

- Distinctions exist among debts; prioritizing repayment of high-interest debts like credit cards is prudent. Mortgage or student loan debts, typically featuring lower interest rates, may be managed differently, potentially offering tax deductions on interest payments.

- Establish short-, medium-, and long-term objectives. Determine the required funds for each and the timeframe for achieving them.

- Aligning goals aids in selecting suitable investment avenues. Accounts like a 401k penalize early withdrawals, making them unsuitable for short-term goals due to restricted access.

- Even if you opt not to retain a long-term relationship, advisors can equip you with essential tools for initiating your investment journey.

- Present your goal list for discussion. Advisors can offer options to efficiently achieve your objectives.

Insightful Video

Key Pointers

-

The cardinal investment principle is to 'buy low and sell high.' Ideally, investments are made when prices are low and demand is minimal, allowing profit as values rise.

-

Avoid viewing the stock market as a shortcut to quick gains, despite short-term goals. Emphasize long-term investments over short-term speculation.

-

Investment isn't confined to retirement; it should extend beyond. Continuing investment post-retirement is advisable.

Important Notes

- Investments carry inherent risks, and there's always a possibility of loss. Exercise caution, and invest only funds that you can tolerate losing in case the investment doesn't yield the expected returns.