Discover the myriad advantages of prepaid credit cards, including their seamless integration with ATMs. Mastering the art of using a prepaid credit card at an ATM is crucial for maintaining optimal credit scores and managing debts effectively.

Essential Steps

Withdrawing Cash from an ATM

Visiting a Designated ATM: Utilize your prepaid credit card at ATMs authorized by the issuing bank. Alternatively, choose any ATM displaying network brands matching those on your card. Enter your PIN and finalize the transaction.

- Ensure the network brand on the ATM matches that on your card, e.g., for a Visa prepaid card, seek ATMs accepting Visa or featuring the Visa logo.

- Be mindful of daily withdrawal limits specified in your Cardholder Agreement.

- Using affiliated ATMs minimizes withdrawal fees.

Card Insertion: Insert your card into the ATM and enter your PIN. The machine will display the withdrawal fee, allowing you to proceed or cancel. Choose “checking” as the account type.

- For instance, if you're withdrawing $20 with a $3.50 fee, your total withdrawal will be $23.50.

Beware of Extra Charges: Refrain from using the ATM to check your card balance. Utilize online banking or your card issuer’s app instead. Some cards impose a balance inquiry fee for ATM balance checks.

- In addition to the withdrawal fee from your card issuer, the ATM owner may levy an extra charge.

- If your prepaid card offers in-network ATMs, you can avoid the additional ATM owner fee by using them. Otherwise, you'll incur the fee for using an out-of-network ATM.

Acquiring a Prepaid Card

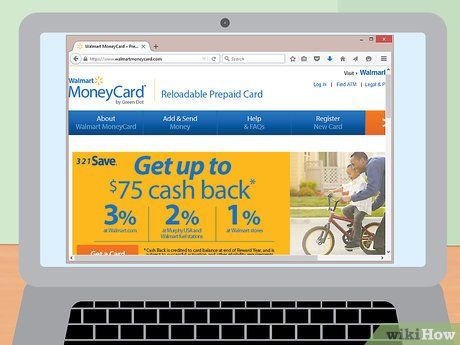

Choosing the Right Card: Research various prepaid cards, considering fees, withdrawal options, and funding methods. Opt for a card that grants access to numerous ATMs with minimal or no withdrawal fees. Avoid frequent charges for ATM usage.

- Notable prepaid debit cards include Walmart MoneyCard, PayPal Prepaid Mastercard, Direct Express, upside Visa, Green Dot, and American Express Serve.

- Avoid NetSpend Fee Advantage Plan, NetSpend Pay-As-you-Go Plan, and AccountNow Gold Visa Prepaid card due to their higher fees.

Card Application: Upon selecting a suitable card, visit the issuer’s website and complete an application. Instant approval is typical. The card will be sent to you via mail. If it doesn't arrive promptly, contact the issuer to ensure correct delivery.

- Activate your new card upon receipt; it remains inactive until activated.

- Follow the activation instructions, usually by calling the number on the card's sticker.

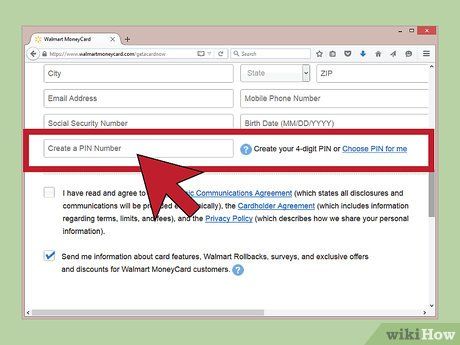

Select a 4-digit PIN: Upon card activation, choose a PIN for ATM usage and added security. Without the PIN, unauthorized use at ATMs is prevented.

- Some cards may prompt for a PIN after the initial transaction, which will be used for future transactions.

- Ensure the PIN is memorable yet not easily guessable, avoiding common sequences like 1234 or 1111 to prevent identity theft.

Adding Funds to Your Card

Opt for direct deposit: Many employers offer direct deposit services, allowing faster access to paychecks. Complete a direct deposit form with your bank and card details provided by your employer.

- Funds are usually available the same day as deposit.

- Verify completion of paperwork with employer and card issuer.

- Direct deposit typically incurs no fees and extends to government benefits and tax refunds.

Deposit cash: Visit a designated location such as MoneyGram or Walmart for cash loading. Complete service forms if required, or hand cash to the cashier for instant loading.

- Cash loading usually incurs a fee, typically between $3 and $5.

- Funds are typically available within minutes of loading.

Deposit checks: Utilize your mobile phone and a compatible app to deposit checks. Capture an image of the check for loading.

- Consult your card issuer for app compatibility.

- Depending on the desired processing speed, fees may apply. Instant availability typically incurs a fee, while waiting a few days may be fee-free.

- Always review associated fees before proceeding with this option.

Useful Tips

- To change your PIN, contact the customer service number on the back of your card.

- A prepaid credit card provides the benefits of a credit card, offering protection against unauthorized use and the flexibility to use it wherever credit cards are accepted. It's particularly beneficial for individuals aiming to establish or rebuild credit.