What exactly does it mean to invest in yourself? It's far more significant than simply pouring money into lucrative ventures. Investing in yourself involves making deliberate choices to cultivate positive, mindful habits that enhance every aspect of your life, spanning from your financial well-being to your career, health, and relationships. Keep reading, and we'll guide you through actionable steps to kickstart your self-investment journey today!

Key Insights

- Financially invest in yourself by devising and adhering to a budget, including provisions for emergencies and retirement.

- Emotionally invest in yourself by exploring a new creative pursuit, maintaining a journal, and nurturing meaningful connections.

- Physically invest in yourself by prioritizing self-care, adopting a nutritious diet, and engaging in regular exercise.

Action Plan

Establish a financial plan.

Financial plans pave the way for achieving stability. Compile a list of savings objectives, approximate monthly expenses, and post-tax income. Utilize the 70/20/10 principle to construct your plan and allocate funds towards expenses, savings, and investments. Allocate 70% of your earnings for monthly expenses, reserve 20% for savings and investments, and allocate 10% for debt repayment or charitable contributions.

- Consider utilizing a Google or Excel spreadsheet or a mobile financial management application such as Mint and EveryDollar to monitor your expenses and financial plan.

- Monthly expenses encompass essentials like groceries, rent, transportation, utilities, insurance, as well as discretionary spending on dining out, entertainment, and travel.

- Investments and savings may involve stocks, bonds, real estate, initial business capital, or a dedicated fund for future expenditures.

- If burdened by debt, allocate that 10% towards gradual repayment. While contributing to charitable causes is admirable, prioritize your financial stability first. You can extend help once you've achieved a secure financial position.

Build an emergency fund.

An emergency fund acts as a financial safety net during unforeseen circumstances. Whether it's car repairs, medical bills, or unexpected job loss, having an emergency fund alleviates financial strain. Begin by establishing a separate savings account with your bank and gradually deposit a portion of each paycheck to accumulate funds.

- Don't fret if you can't set aside 20% of your earnings for savings each month. Contribute what you can, acknowledging that unexpected expenses are inevitable, and strive to save a minimum of 10% whenever feasible. Every contribution counts!

- Remember: Reserve your emergency fund exclusively for genuine emergencies. Its purpose is to safeguard your financial well-being and provide peace of mind.

- While it may be tempting to allocate a larger portion of your earnings for immediate gratification, establish automatic transfers to your savings account via your bank or employer to remain disciplined.

Create a retirement nest egg.

The earlier you commence saving, the sooner you'll achieve retirement. While many employers offer retirement plans, you can also opt for independent saving. Initiate a retirement savings account distinct from your general savings. Channel your funds into an interest-compounding savings account to expedite the growth of your retirement funds.

- Consider initiating a Roth IRA account, enabling steady contributions to your retirement fund with tax-free withdrawals upon maturity.

- Traditional IRAs allow tax-deductible contributions to a retirement account.

- You may also contribute to an employer-sponsored 401(k) or 403(b) retirement plan, depending on your employer's provisions.

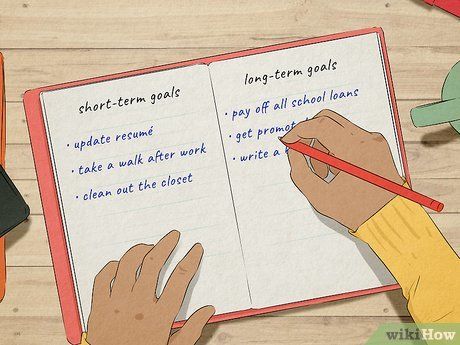

Establish both short-term and long-term objectives.

Precise, attainable objectives serve as catalysts for life transformation. Envision your position in a month, 6 months, a year, or even 5 years. Compile a roster of simple, short-term objectives achievable in the present and another list of long-term objectives to pursue gradually. Upholding commitments boosts self-assurance in your capabilities!

- Short-term goals can be as basic as refining your CV, incorporating a daily walk into your routine, or organizing your wardrobe.

- Long-term goals are usually more intricate, such as clearing all educational debts or ascending to a managerial role within a few years.

- Divide long-term goals into smaller increments. Establishing milestones renders the goal more manageable and allows you to monitor progress at every phase.

- For instance, if your long-term goal is to author a book, begin with the short-term goal of maintaining a daily writing journal or committing to writing 1,000 words daily at a designated time.

Mytour Quiz: Assessing Your Blind Spots

We all possess blind spots, particularly concerning our interactions with others (and ourselves). Unfortunately, objectively identifying our weaknesses can be challenging. Fear not, we're here to assist. Take this quiz to uncover your blind spots and gain invaluable insights.

1 out of 12

Choose a Marine Creature:

Seek out a mentor.

Mentors can assist in acquiring new skills and advancing your career. Define your career aspirations in the long term. Where do you envision yourself, and which skills do you aim to enhance? Identify individuals in those fields whom you admire. Seek out a mentor within your existing circle, such as a supervisor or colleague, or connect with them through industry gatherings and online platforms like LinkedIn.

- Clarify your reasons for seeking their guidance and compile a list of queries or guidance you require. For instance, a mentor can offer constructive feedback on your portfolio or aid in formulating a 5-year career trajectory.

- Promptly request a discussion to solicit career guidance. Prepare a brief introduction; elucidate why you admire their work and why they're the ideal mentor for you.

- Arrange a video conference or meet for coffee if feasible. Interacting in person enables you to establish a personal rapport with them.

Acquire new professional competencies.

Continue self-development post-graduation to enhance your career prospects. Identify a career-related skill you wish to delve into, whether it aligns with your current job or aids in establishing a side venture to supplement income. Enroll in a course, workshop, or conference focused on honing the desired skill. Embrace lifelong learning and consistently cultivate valuable skills!

- For instance, you might opt to explore leadership skills as part of your aspiration to ascend to a managerial role, undertake a marketing course to kickstart your entrepreneurial journey, or learn a new language to thrive in a multilingual workplace.

- Accessing classes and training materials post-college is convenient! Many universities offer complimentary online courses. Alternatively, consider enrolling in a class at your local community college or utilizing online platforms like Skillshare or MasterClass.

- Establish both short-term and long-term objectives. If, for instance, you opt to learn a new language, commence with basic greetings and vocabulary before progressing to more advanced phrases and lexicon.

Embrace a creative pursuit.

Cultivating creativity enhances both enjoyment and professional value. It fosters problem-solving abilities and fosters a receptive mindset toward fresh perspectives. Discover a creative endeavor that ignites your passion. Have you harbored a desire to learn a musical instrument, dance, or perhaps paint? Utilize online tutorials or enroll in a class, allocating dedicated time to unwind and express yourself.

- Pursuing a creative hobby devoid of the pressure to achieve perfection liberates the creative process.

- Your creative pursuit might evolve into a supplementary income stream. Contemplate establishing an online boutique for handmade crafts or accepting commissions if you're an artist.

- The capacity for innovative thinking is invaluable in various occupations. By nurturing it in your personal life, you equip yourself to devise inventive solutions in professional settings as well!

Confront pivotal tasks promptly.

Delaying important tasks only exacerbates stress levels. Initiate chores and projects ahead of schedule, particularly if procrastination has been a recurring issue. Commencing tasks instills a sense of manageability instantly! Break down assignments into smaller segments to expedite completion. This facilitates early task completion rather than last-minute rushes close to deadlines.

- For instance, tackle tax-related obligations promptly upon receipt of information from your employer—rather than awaiting the deadline. This proactive approach instills a sense of relief, eliminating the need for rushed efforts.

Organize and tidy up your surroundings.

Reducing stress is easier when you know where everything is located. Streamline your living space by decluttering and discarding unnecessary items. Establish designated areas for your belongings and implement an efficient system to locate essential documents, such as tax records, birth certificates, and passports. Managing life becomes smoother when you can easily access what you need, when you need it.

- Systematically gather, categorize, and label each document to establish a dependable filing system for your personal records.

- Introduce additional shelves and organizers to minimize clutter and maintain an organized household.

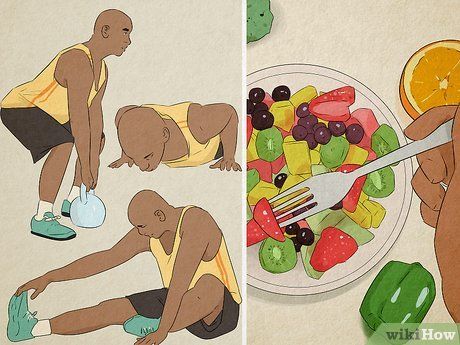

Prioritize your physical well-being.

Maintain a balanced diet, quality sleep, and regular exercise to keep your body vitalized. Strategize your meals and monitor your dietary intake to ensure nutritional adequacy. Engage in walks or gym sessions to invigorate your body and maintain physical activity. Aim for a minimum of 8 hours of sleep to enhance immune function and cognitive performance. A state of good physical health fosters confidence and readiness to tackle life's challenges.

- Adopt a nutritious diet by incorporating a variety of complex carbohydrates, vegetables, fruits, proteins, and ample water into your meals.

- Establish an exercise regimen tailored to your preferences, whether it involves swimming, hiking, dancing, or weightlifting. Enjoying your chosen activity facilitates consistency!

- The benefits extend beyond the physical realm; poor physical health can exacerbate mental health issues like depression or anxiety. Prioritizing physical well-being leads to reduced fatigue and enhanced concentration.

- Reader Poll: According to a survey of 240 Mytour readers, 60% emphasized exercise and physical activity as the most fulfilling and effective form of self-care. [Participate in Poll]

Nurture self-wellness.

Make your mental well-being a priority to prevent burnout and maintain a positive outlook. Your mental state impacts your job performance; the better you feel, the more you can accomplish! Take breaks when needed, and be forgiving towards yourself for mistakes. Incorporate enjoyable activities into your daily routine, such as meditation, yoga, walks, or indulging in a warm bath.

- Recognize that progress requires time. Instead of dwelling on negative thoughts when feeling off track, reassure yourself by saying, 'It's okay,' and focus on the brighter side. You'll reach your goals eventually!

- Consider seeking guidance from a therapist to manage stress and understand your emotions better. Therapy benefits everyone, not just those facing challenges. Platforms like BetterHelp offer easy access to therapy services.

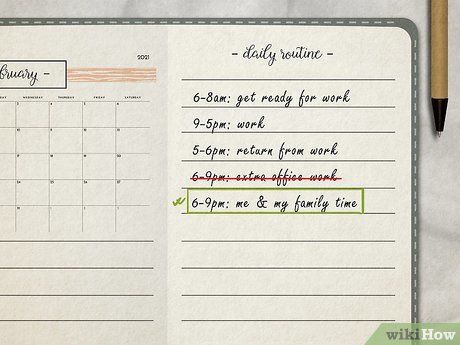

Establish personal boundaries.

Creating boundaries between work and personal life grants you more relaxation time and opportunities for enjoyment. Structure your workday and set a definitive end time for work. Once that time arrives, disconnect from work-related matters and embrace your personal time. Sacrificing downtime and sleep for late-night work sessions only heightens stress and compromises work quality. You deserve dedicated time for yourself!

- Whether you're a freelancer or follow a traditional 9 to 5 schedule, resist the temptation to carry work burdens into your personal life and avoid late-night work sessions, even during busy periods.

Journal regularly.

Journaling serves as a valuable tool for self-reflection and cultivating daily gratitude. Maintain a regular journaling practice to record your aspirations, commemorate achievements, and express gratitude for even the smallest blessings in life. Reflecting on gratitude enables you to appreciate the positive aspects of your current circumstances.

- Ensure to update your journal with fresh goals each time you achieve one, fostering ongoing motivation and progress.

- Utilize your journal to tackle undesirable habits by outlining your intentions and devising actionable steps for change. Track your progress and celebrate milestones along the way.

- There's no right or wrong way to express gratitude in your journal. Whether acknowledging supportive relationships or the simple joys of everyday life, there's ample room for appreciation.

Cultivate your interpersonal connections.

Strong friendships and professional relationships enhance life satisfaction. They provide encouragement and support along your journey of self-improvement! Sustaining healthy relationships relies on consistent communication. Take the initiative to reach out first, express your thoughts, and dedicate time to shared activities or interests. Show reciprocal support to nurture these bonds.

- Isolation exacerbates self-doubt and hinders social engagement. Building a reliable support network is crucial for navigating challenging times.

- Friends and family can also serve as allies in maintaining positive habits. Whether it's a gentle reminder to take a daily stroll or joining you on the journey, their encouragement reinforces your commitment.