Surviving in today's costly world can feel like an uphill battle! It appears that nearly every expense is higher than it ought to be, leaving your hard-earned paycheck dwindling rapidly. If you're eager to uncover methods to stretch your funds, you've landed on the right article. By trimming unnecessary expenses and seeking out more economical alternatives, you can amass significant savings in various aspects of your life. Whether you're contemplating a complete lifestyle overhaul or simply seeking minor adjustments, embracing frugality will bring long-term benefits to both you and your financial future.

Essential Steps

Thrifty Eating Habits

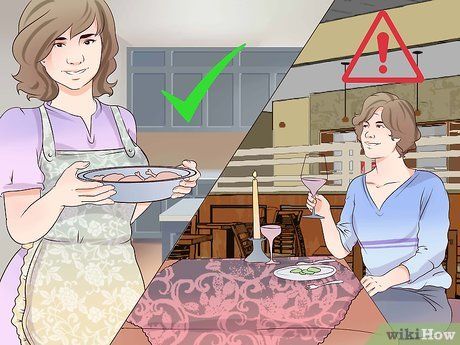

- Stock up on basic ingredients rather than relying on ready-made meals. By investing in a sack of uncooked rice, for instance, you can yield a significantly larger quantity of food for a fraction of the cost compared to buying pre-cooked rice packets.

- Consider portion control to save money, particularly if you're accustomed to sizable servings. Reserve a portion of your meal for later consumption, and consider freezing leftovers if immediate consumption isn't anticipated.

- Experiment with diverse flavors and seasonings to elevate your dishes. Transform a plain fish fillet or chicken breast into a culinary delight with the addition of an inventive sauce or spice blend. Explore unfamiliar spices or condiments from diverse cultural cuisines, such as those found in Asian, African, or local farmers' markets.

- Avoid shopping on an empty stomach.

- If you plan weekly meals, use them to formulate your shopping list and adhere to it throughout the week.

- Utilize Coupons. Save money by seeking out store or product coupons and planning meals around them. For example, if there's a great deal on meatballs, consider making meatball subs. If you have a coupon for bread, try making bread pudding or French toast.

- Review the menu beforehand to avoid surprises with prices.

- Take home leftovers to stretch one meal into two.

- Explore restaurant specials, such as free or discounted kids' meals or daily promotions. Some establishments offer discounts for specific groups like police officers, seniors, or active military personnel.

- Beverages, especially alcoholic ones, often contribute significantly to the total bill. By cutting back on drinks and opting for water, you can save substantially on your dining expenses.

- Ensure you're meeting nutritional requirements by supplementing appropriately to prevent deficiency diseases.

- Consider sharing a membership with a friend to split the membership fee, making it more economical.

- Alternatively, you can establish a food co-op with nearby families to pool resources and buy in bulk, resulting in significant savings. Explore resources on starting a food co-op for detailed guidance.

Trimming Housing Expenses

- If feasible, inquire about paying the full year's rent upfront, as landlords may offer a discount equivalent to one or two months' rent.

- Explore purchasing bank-owned properties, often auctioned below market value due to foreclosure.

- Consider refinancing your mortgage after several years to secure a better interest rate, thereby reducing monthly payments while maintaining the original payoff timeline.

- Explore micro-housing options, which despite limited space, offer more affordable living arrangements. Companies like Tumbleweed in the U.S. provide options with low initial payments and manageable monthly installments.

- For example, in Manhattan, NY, individuals can apply for affordable or middle-income housing programs, although waitlists may be involved.

Trimming Utility Costs

- Utilize an HDMI cord to connect your computer to the TV for multimedia streaming.

- For sports enthusiasts, consider streaming services like NBA's 'League Pass' or NFL's 'Game Pass' as cable alternatives for live sports coverage.

- Simple measures like hanging thick curtains, caulking window gaps, and using a blanket to block drafts beneath doors can enhance heat retention and save on heating costs.

- Investing in energy-efficient upgrades for furnaces, heaters, appliances, windows, doors, and insulation may entail initial expenses but yields long-term savings.

- Practice efficient appliance use, such as avoiding leaving refrigerator doors open and running full loads in dishwashers and laundry machines.

- Transitioning to energy-efficient appliances can further diminish long-term costs.

- Explore strategies for reducing electricity expenses for additional insights.

- Conserve energy by utilizing only one electronic device at a time and avoiding leaving idle devices powered on.

- Transitioning to renewable energy enables uninterrupted power supply, even during outages.

- Despite minimal sunlight, regions like Germany harness solar power effectively.

- Installing solar panels typically costs around $10,000 for an average American home, with options for bank financing and tax incentives.

- Explore options for selling excess electricity back to the grid, though viability depends on long-term cost savings.

- Alternatively, consider switching to alternative energy providers for potential cost savings, applicable in deregulated markets.

Enjoying Affordable Entertainment

- Check with your city's recreation department for information on events such as movie screenings, music festivals, yoga classes, and art exhibits. Many museums also offer free admission on select days.

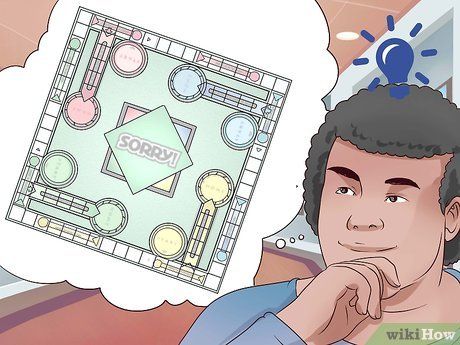

- Explore a mix of classic and contemporary games like Life, Monopoly, Apples to Apples, and Settlers of Catan. Games like Cards Against Humanity offer free downloadable versions for home play, providing entertaining options without breaking the bank.

- Start with accessible classics like Harry Potter and Game of Thrones if you're reacquainting yourself with literature.

- Access free reading materials by obtaining a library card or exploring online platforms for e-books and used bookstores for inexpensive options.

- Many public domain titles are available for free online or downloadable to e-readers.

- Opt for budget-friendly accommodations like hostels, Airbnb rooms, or campgrounds.

- Plan your itinerary in advance to avail discounts on tours and enhance trip enjoyment.

- Travel during off-peak seasons to capitalize on cheaper flight fares. Research and book tickets at least six weeks ahead to secure favorable deals.

Implementing Lifestyle Changes

- Keep an eye out for special discounts and promotions at thrift stores, maximizing savings on desired items.

- Before finalizing a purchase, conduct thorough online research to ensure you're securing the best deal available.

- Utilize public transportation, although it may extend travel time, you can utilize this time for activities like reading, checking emails, or making phone calls. A monthly bus pass often costs less than a tank of gas, not to mention other car-related expenses.

- Consider biking or a combination of biking and public transit. Many buses and trains accommodate bicycles, enabling a quicker commute while promoting physical activity and saving on fuel costs.

- Explore options like electric cars or downsizing to a smaller vehicle, or purchasing with cash, all of which can yield substantial savings.

Analyzing Spending Patterns

- Utilize features provided by credit card companies and online banks to summarize spending patterns.

- Maintain meticulous records of expenses, including both debit and credit transactions, to accurately track spending habits.

- Include retirement savings in your budget, starting with a modest percentage and gradually increasing it over time. Prioritize building an emergency fund equivalent to six months' living expenses.

- Experts suggest allocating less than 30% of income to housing costs. Adjust your budget to reflect your actual spending habits.

- If housing expenses are high, consider relocating to a more affordable area or refinancing a mortgage for better terms. Explore cost-saving measures for food, such as cooking at home and using budget-friendly ingredients.

- Utilize financial management apps like Quicken, Mint, or PocketGuard for effective expense tracking.

Useful Advice

-

Implementing the advice provided may require significant lifestyle adjustments. Sacrifices made today can lead to future financial stability and freedom.

-

Prioritize self-care while adopting frugal living practices. Never compromise essential needs for the sake of saving money.